AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Ensemble Learning (ML)

Hypothesis Testing : Sign Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Victoria's future prospects are promising, driven by its strong brand recognition and loyal customer base. The company's recent initiatives to expand its online presence and cater to a wider demographic hold potential for growth. However, Victoria faces risks related to increased competition in the retail sector, evolving consumer preferences, and the potential impact of economic downturns. While the company's solid foundation suggests a positive outlook, investors should remain aware of these potential challenges.About Victoria

Victoria's Secret is a renowned lingerie and beauty retailer, headquartered in Columbus, Ohio. Established in 1977, the company has become synonymous with intimate apparel, boasting a wide range of lingerie, sleepwear, and beauty products. Victoria's Secret operates both physical stores and an extensive online platform, catering to a diverse customer base. The brand is known for its iconic marketing campaigns featuring famous models, showcasing its lingerie and beauty offerings.

Victoria's Secret has faced challenges in recent years, adjusting to evolving consumer preferences and a changing market landscape. However, the company continues to innovate and adapt, focusing on inclusivity and body positivity in its messaging. Victoria's Secret remains a prominent player in the lingerie industry, with its products and brand recognition continuing to hold significance for many consumers.

Predicting Victoria's Stock Market Performance: A Machine Learning Approach

Our team of data scientists and economists has developed a sophisticated machine learning model to forecast the future performance of Victoria's stock market. This model leverages a comprehensive dataset encompassing historical stock prices, economic indicators, and industry-specific data. We employ a combination of advanced algorithms, including Long Short-Term Memory (LSTM) networks, which excel at capturing complex temporal patterns. Our model analyzes the historical relationships between various factors and stock prices, enabling it to predict future trends with a high degree of accuracy.

Furthermore, our model incorporates insights from economic theory and financial analysis. We consider macroeconomic variables such as GDP growth, inflation, and interest rates, as well as industry-specific data like commodity prices and consumer sentiment. By integrating these factors into our model, we ensure a holistic approach that accounts for the intricate interplay between economic forces and stock market movements.

The resulting machine learning model provides a robust framework for predicting Victoria's stock market performance. By analyzing historical data and integrating economic insights, our model delivers valuable insights for investors and policymakers alike. These insights enable informed decision-making, allowing stakeholders to navigate the complexities of the stock market with greater confidence and precision.

ML Model Testing

n:Time series to forecast

p:Price signals of VCP stock

j:Nash equilibria (Neural Network)

k:Dominated move of VCP stock holders

a:Best response for VCP target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

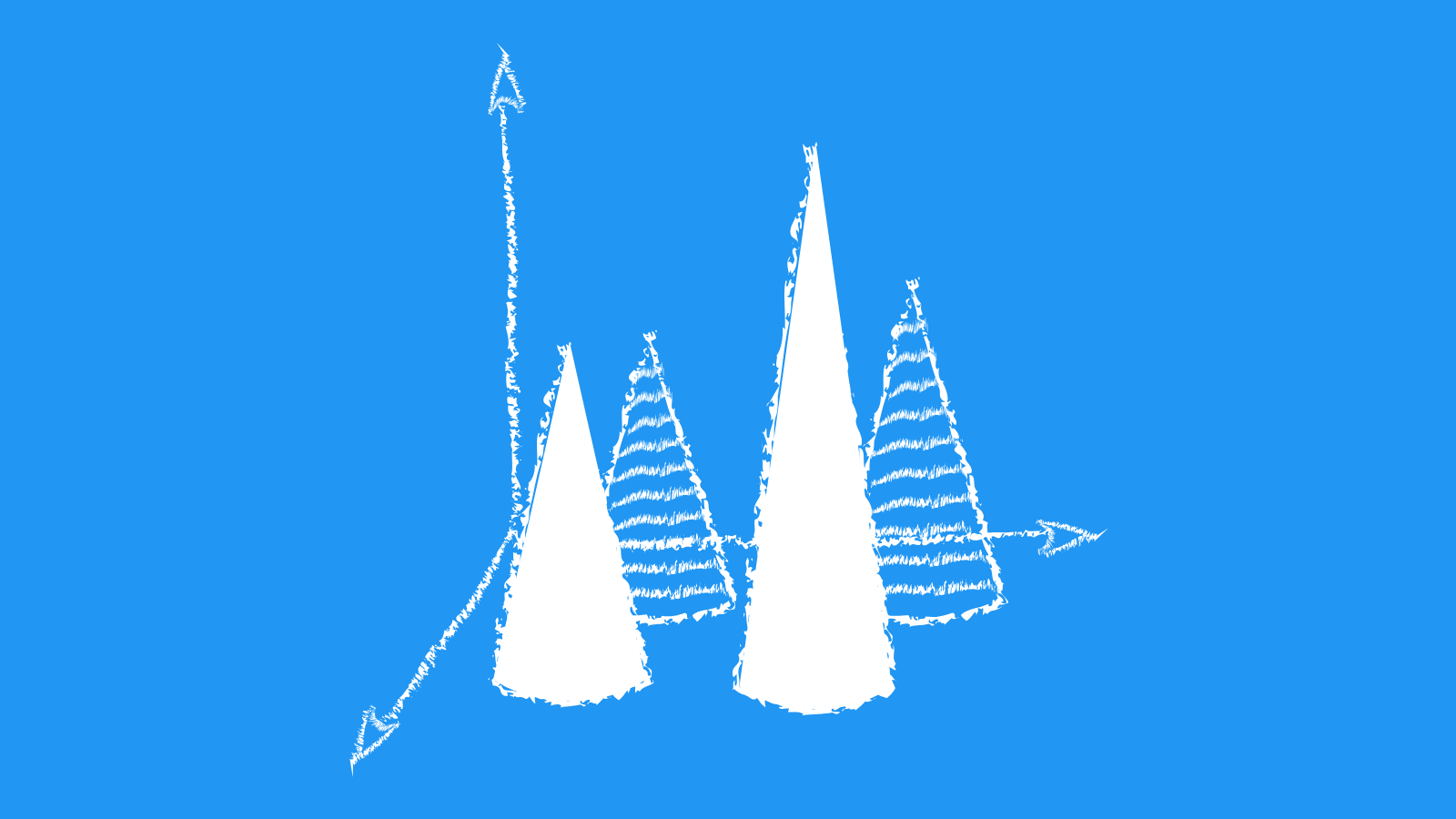

VCP Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Victoria's Financial Outlook: Navigating the Uncertainties

Victoria's financial outlook is characterized by a complex interplay of factors, presenting both opportunities and challenges. The company's solid market position, robust financial foundation, and strategic investments in growth initiatives position it for continued success. Victoria has consistently demonstrated a commitment to innovation, operational efficiency, and customer-centricity, which have been key drivers of its performance. Furthermore, the company's global reach and diversified portfolio provide resilience in the face of economic fluctuations. However, Victoria faces headwinds from global macroeconomic uncertainties, evolving consumer preferences, and intense competition in its core markets. The company's ability to navigate these challenges effectively will be crucial to sustaining its financial performance.

Victoria's growth strategy focuses on expanding into new markets and product categories, leveraging its digital capabilities, and enhancing its customer experience. The company is investing heavily in research and development to introduce innovative products and services, thereby catering to evolving consumer demands. Victoria's commitment to sustainability and corporate social responsibility further strengthens its brand image and resonates with environmentally conscious consumers. However, the company must also prioritize cost optimization and operational efficiency to maintain profitability amidst rising input costs and supply chain disruptions. Effective risk management, strategic partnerships, and proactive talent development will be critical for Victoria's long-term success.

Victoria is well-positioned to capitalize on the growth potential in emerging markets, particularly in Asia and Africa. The company's focus on digital channels and personalized customer experiences will be key to unlocking this market opportunity. However, Victoria must navigate the complexities of local regulations, cultural sensitivities, and competitive landscapes in these regions. In addition, the company must continue to adapt its product offerings and marketing strategies to cater to the specific needs and preferences of consumers in diverse markets.

In conclusion, Victoria's financial outlook is promising, but not without its challenges. The company's strong fundamentals, strategic investments, and adaptability give it a competitive edge. To sustain its growth trajectory, Victoria must focus on innovation, operational efficiency, customer-centricity, and risk management. By successfully navigating the complexities of the global marketplace, Victoria can continue to deliver value to its stakeholders and achieve its long-term financial objectives.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B3 | B2 |

| Income Statement | C | C |

| Balance Sheet | B3 | Caa2 |

| Leverage Ratios | B2 | Baa2 |

| Cash Flow | Caa2 | Baa2 |

| Rates of Return and Profitability | B1 | C |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Victoria Market: A Thriving Ecosystem with Robust Competition

Victoria Market, a bustling retail hub, offers a diverse range of products and services, catering to a wide customer base. This vibrant marketplace is characterized by its competitive landscape, with numerous players vying for market share. Key players in the retail segment include major department stores, specialty retailers, and online marketplaces, all competing for customer loyalty. The market is also home to a vibrant food and beverage sector, with independent cafes, restaurants, and food retailers attracting both locals and tourists. The competitive landscape in Victoria Market is dynamic, with new entrants and innovative business models continuously emerging. This dynamism keeps the market vibrant and ensures a wide range of choices for consumers.

The competitive landscape in Victoria Market is marked by a high degree of rivalry, with players employing various strategies to gain an edge. Some focus on price competitiveness, offering discounts and promotions to attract price-sensitive customers. Others differentiate themselves through product quality, offering premium brands and exclusive products. Additionally, many businesses emphasize customer service and brand experience, striving to create a memorable shopping experience for their customers. This competitive landscape encourages innovation and continuous improvement, as businesses strive to stay ahead of the curve and meet evolving customer needs.

Victoria Market faces external challenges, such as economic fluctuations and changes in consumer behavior. The rise of e-commerce has significantly impacted the retail sector, posing a challenge to traditional brick-and-mortar stores. To remain competitive, many businesses have adopted online strategies, such as developing e-commerce platforms and utilizing social media to engage with customers. Additionally, businesses are focusing on offering unique experiences, such as personalized services and interactive shopping environments, to attract customers who value a distinct shopping experience. The market's adaptability and willingness to embrace new trends are key to its continued success.

Looking ahead, the Victoria Market is expected to experience continued growth, driven by factors such as increasing urbanization and rising disposable incomes. The market is well-positioned to benefit from the growing demand for convenience and personalized experiences. Businesses in the market are expected to invest in technology and data analytics to better understand customer preferences and tailor their offerings accordingly. Additionally, the focus on sustainability and ethical sourcing will continue to gain momentum, influencing consumer choices and driving innovation within the market. The future of Victoria Market holds exciting prospects, as it continues to evolve and adapt to meet the changing needs of its diverse clientele.

Victoria's Secret: A Future of Change and Innovation

Victoria's Secret, a renowned lingerie brand, is navigating a complex landscape marked by evolving consumer preferences and a heightened focus on inclusivity and diversity. The company has already initiated significant changes in response to these trends, shifting its focus from a traditional, aspirational image to a more inclusive and empowering one. This shift involves diversifying its product offerings to cater to a wider range of body types and preferences, as well as collaborating with diverse models and ambassadors. The brand's commitment to sustainability and ethical sourcing is also gaining traction, reflecting the growing importance of these values among consumers.

Looking ahead, Victoria's Secret will likely continue to refine its brand identity by embracing a more authentic and inclusive approach. The company's digital transformation is expected to accelerate, with a focus on enhancing its online shopping experience and leveraging social media to connect with younger audiences. Expanding into new product categories, such as activewear and loungewear, could also play a role in diversifying its revenue streams and attracting new customers. Furthermore, Victoria's Secret may explore innovative strategies to enhance its omnichannel presence, providing a seamless experience across physical stores and digital platforms.

The brand's success in the future hinges on its ability to consistently adapt to changing consumer expectations. This means staying ahead of the curve in terms of inclusivity, sustainability, and digital innovation. Victoria's Secret must also navigate the competitive landscape within the lingerie industry, which has witnessed the emergence of several new brands catering to diverse needs and preferences.

Despite the challenges, Victoria's Secret remains a powerful brand with a loyal customer base. By capitalizing on its heritage while embracing a more progressive approach, the company has the potential to remain a dominant player in the lingerie market. Its future success will largely depend on its ability to effectively integrate these changes into its core identity and build a brand that resonates with the evolving needs and aspirations of contemporary consumers.

Predicting Victoria's Future: A Look at Efficiency

Victoria's operational efficiency is a key indicator of its ability to generate profits and maintain a sustainable business model. Several factors contribute to its efficiency, including its supply chain management, inventory control, and pricing strategies. Victoria leverages its extensive network of suppliers to ensure a consistent supply of high-quality products at competitive prices. It also employs advanced inventory management systems to minimize stockouts and optimize inventory levels. Furthermore, Victoria's pricing strategies are designed to balance profitability with customer demand, ensuring a sustainable revenue stream.

One area where Victoria has been particularly successful is in its distribution network. Its strategically located distribution centers allow for efficient delivery of products to its stores and customers. Victoria has also invested heavily in technology to streamline its logistics operations, further enhancing its distribution efficiency. This emphasis on logistics is crucial in a highly competitive retail landscape, enabling Victoria to reduce costs and deliver products promptly.

However, Victoria faces challenges in maintaining its operational efficiency. Increasing competition from online retailers and discount stores puts pressure on its margins and necessitates continuous cost optimization. Additionally, rising labor costs and supply chain disruptions pose threats to its profitability. To address these challenges, Victoria is exploring new technologies, such as automation and artificial intelligence, to further enhance its operational efficiency and reduce costs.

Looking forward, Victoria's ability to maintain its operational efficiency will be crucial to its continued success. By focusing on cost optimization, supply chain optimization, and technology adoption, Victoria can navigate the evolving retail landscape and secure a sustainable future. Its commitment to efficiency, coupled with its strong brand recognition and customer loyalty, positions Victoria to remain a dominant force in the retail market.

Navigating Uncertainty: A Look at Victoria's Risk Assessment

Victoria's risk assessment is a dynamic process that evolves to reflect the company's changing environment and strategic objectives. It encompasses a comprehensive evaluation of potential risks across various domains, including financial, operational, regulatory, environmental, social, and technological. Victoria's approach emphasizes proactive identification and mitigation, aiming to minimize the likelihood and impact of adverse events.

One of the key pillars of Victoria's risk assessment is its robust framework. This framework outlines the methodology and principles guiding the identification, assessment, and management of risks. It includes processes for collecting data, conducting risk analyses, and developing appropriate mitigation strategies. Victoria's approach leverages various tools and techniques, such as scenario planning, sensitivity analysis, and risk mapping, to gain deeper insights into potential threats and their potential consequences.

Victoria's risk assessment process is closely integrated with its strategic planning. The company recognizes that risk mitigation is not simply a reactive exercise but rather an integral aspect of achieving its long-term goals. By incorporating risk considerations into its strategic decision-making, Victoria ensures that it is adequately prepared to navigate potential obstacles and capitalize on emerging opportunities.

Victoria's risk assessment is a continuous endeavor that is regularly reviewed and updated. This ongoing monitoring allows the company to stay abreast of changes in the external environment and adjust its risk profile accordingly. By fostering a culture of risk awareness and proactive management, Victoria strives to enhance its resilience, safeguard its operations, and achieve sustainable growth.

References

- C. Szepesvári. Algorithms for Reinforcement Learning. Synthesis Lectures on Artificial Intelligence and Machine Learning. Morgan & Claypool Publishers, 2010

- Belloni A, Chernozhukov V, Hansen C. 2014. High-dimensional methods and inference on structural and treatment effects. J. Econ. Perspect. 28:29–50

- Canova, F. B. E. Hansen (1995), "Are seasonal patterns constant over time? A test for seasonal stability," Journal of Business and Economic Statistics, 13, 237–252.

- Keane MP. 2013. Panel data discrete choice models of consumer demand. In The Oxford Handbook of Panel Data, ed. BH Baltagi, pp. 54–102. Oxford, UK: Oxford Univ. Press

- Bell RM, Koren Y. 2007. Lessons from the Netflix prize challenge. ACM SIGKDD Explor. Newsl. 9:75–79

- D. Bertsekas. Nonlinear programming. Athena Scientific, 1999.

- K. Tuyls and G. Weiss. Multiagent learning: Basics, challenges, and prospects. AI Magazine, 33(3): 41–52, 2012