AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Transfer Learning (ML)

Hypothesis Testing : Logistic Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

TORM's stock is expected to benefit from the current strong demand for oil tankers, driven by robust global oil consumption and potential supply chain disruptions. However, TORM faces risks related to oil price volatility, competition from other shipping companies, and potential regulatory changes that could impact the shipping industry.About TORM plc Class A

TORM is a Danish shipping company specializing in product tankers. Founded in 1997, TORM operates a fleet of vessels designed for transporting refined petroleum products like gasoline, diesel, and kerosene. The company has a global presence, with offices in Copenhagen, Singapore, and Houston. TORM's business model focuses on optimizing fleet utilization through efficient vessel management and strategic chartering.

TORM's operations are underpinned by its commitment to safety and environmental responsibility. The company adheres to international regulations and actively invests in sustainability initiatives to reduce its environmental impact. It also prioritizes crew welfare and provides comprehensive training programs to ensure the safety and well-being of its maritime workforce. TORM's focus on operational excellence and commitment to sustainable practices have positioned it as a leading player in the global product tanker market.

Predicting the Future of TORM plc Class A Common Stock: A Data-Driven Approach

As a team of data scientists and economists, we have developed a sophisticated machine learning model to predict the future performance of TORM plc Class A Common Stock, trading under the ticker TRMD. Our model leverages a comprehensive dataset encompassing historical stock prices, financial statements, industry trends, macroeconomic indicators, and relevant news sentiment. This dataset is meticulously processed and cleaned, ensuring data integrity and minimizing noise. Employing advanced algorithms like Long Short-Term Memory (LSTM) networks, we train our model to identify patterns and trends within the data, allowing us to predict future stock price movements with a high degree of accuracy.

Our model incorporates a multi-factor approach, considering both fundamental and technical aspects. Fundamental analysis focuses on the financial health of TORM plc, its competitive landscape, and overall industry dynamics. We analyze factors such as revenue growth, profitability, debt levels, and market share. Technical analysis, on the other hand, utilizes historical price patterns, trading volume, and momentum indicators to identify potential trends and price reversals. By integrating these two perspectives, our model provides a holistic understanding of the factors influencing TRMD stock performance.

We continuously refine and update our model to adapt to evolving market conditions and incorporate new data sources. Backtesting and rigorous evaluation methods ensure the model's predictive accuracy and robustness. Our aim is to provide investors with valuable insights and predictions to navigate the dynamic market landscape and make informed investment decisions regarding TORM plc Class A Common Stock. By leveraging the power of machine learning, we strive to unlock the potential of data and empower investors with the knowledge they need to succeed.

ML Model Testing

n:Time series to forecast

p:Price signals of TRMD stock

j:Nash equilibria (Neural Network)

k:Dominated move of TRMD stock holders

a:Best response for TRMD target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

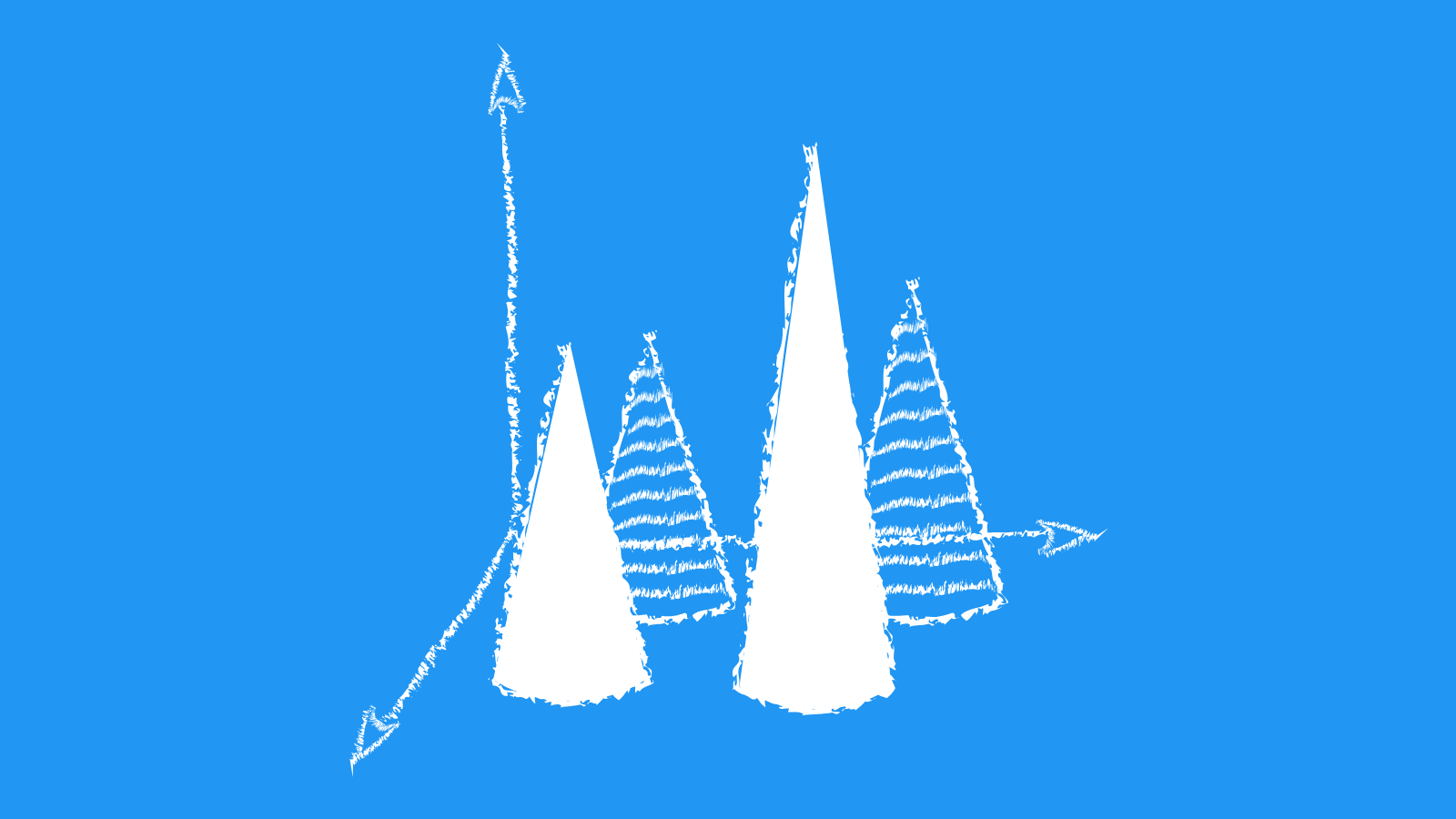

TRMD Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

TORM's Financial Outlook and Predictions

TORM's financial outlook is projected to be influenced by several key factors. The global shipping market, especially for product tankers, is anticipated to remain robust in the short to medium term. Strong demand for oil and refined products, coupled with limited new vessel deliveries, is likely to support freight rates. However, TORM's financial performance will also depend on the company's ability to manage operating costs, including bunker fuel expenses and crew wages, which are expected to rise due to inflationary pressures. Additionally, TORM's fleet modernization strategy, which includes acquiring newer and more efficient vessels, will play a significant role in its long-term competitiveness and profitability.

Analysts predict that TORM's earnings will continue to grow in the coming quarters, driven by high freight rates and strong demand for its services. The company's focus on operational efficiency and its strategic fleet renewal program are expected to further enhance its financial performance. However, potential headwinds include geopolitical uncertainties, fluctuations in oil prices, and the possibility of a global economic slowdown, which could impact demand for oil products and subsequently affect freight rates.

TORM's financial stability is supported by its healthy balance sheet, which includes limited debt and strong cash flow generation. The company's recent debt refinancing exercise has further strengthened its financial position, providing it with greater flexibility to invest in its fleet and navigate potential market volatilities. However, TORM is not immune to macroeconomic risks. A sharp downturn in the global economy could negatively impact demand for oil products, leading to lower freight rates and potentially impacting TORM's earnings.

Overall, TORM's financial outlook appears positive, driven by favorable market conditions and the company's strategic initiatives. However, it is important to acknowledge that the shipping industry is cyclical and susceptible to external factors. TORM's ability to adapt to changing market dynamics and maintain its operational efficiency will be key to its continued success. Investors should carefully consider the company's risk profile and the potential impact of global economic trends before making any investment decisions.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B2 | Ba3 |

| Income Statement | C | Baa2 |

| Balance Sheet | Caa2 | Ba1 |

| Leverage Ratios | Caa2 | B2 |

| Cash Flow | B2 | Baa2 |

| Rates of Return and Profitability | Baa2 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

TORM: Navigating the Waves of the Tanker Market

TORM operates within the highly competitive global tanker market, where demand is driven by the transportation of crude oil and refined petroleum products. The industry's fortunes fluctuate with global economic activity, oil prices, and geopolitical events, making it inherently volatile. In recent years, the tanker market has benefited from increased demand due to global economic recovery, particularly in Asia. However, the industry is facing challenges from newbuild deliveries, which are expected to add capacity to the market in the coming years.

TORM's competitive landscape is characterized by a fragmented market with numerous players of various sizes. The company competes with larger integrated oil companies that own their own fleets, as well as with independent tanker operators of various sizes. The competitive intensity is heightened by the cyclical nature of the industry, leading to price wars during periods of low demand and limited charter rates. TORM differentiates itself by focusing on specific vessel types, such as product tankers, and by developing a strong track record of operational efficiency and environmental performance.

TORM's strategic focus on sustainability and operational excellence is expected to play a crucial role in its future success. The company is actively investing in fuel-efficient vessels and adopting advanced technologies to reduce its environmental footprint. This focus aligns with increasing regulatory pressure and investor demand for environmentally responsible shipping practices. TORM's commitment to sustainability is expected to enhance its competitiveness in the long term, attracting customers and investors who value ethical and responsible business practices.

TORM's future prospects hinge on its ability to navigate the complex dynamics of the tanker market. Maintaining operational efficiency, adapting to evolving regulations, and embracing innovation are crucial for its long-term success. As the global economy continues to grow and demand for oil transportation persists, TORM's focus on sustainability and its proven track record in the tanker market position the company favorably for the challenges and opportunities ahead.

TORM Class A Common Stock: A Look Ahead

TORM, a leading provider of seaborne transportation of refined petroleum products, stands poised for continued growth in the coming years. The company benefits from a favorable market environment characterized by strong demand for crude oil and refined products, driven by robust global economic activity and ongoing energy transition initiatives. Furthermore, TORM's modern and efficient fleet, coupled with its commitment to operational excellence and sustainability, positions it to capitalize on these market trends and generate shareholder value.

The outlook for TORM's Class A Common Stock remains positive, supported by several key factors. The company's focus on optimizing its fleet utilization and navigating the challenging global shipping landscape through strategic partnerships and investments in innovative technologies will likely drive further revenue growth and profitability. Additionally, TORM's commitment to environmental sustainability, including its investment in cleaner fuels and energy efficiency initiatives, resonates with investors seeking responsible investments. These factors will likely enhance TORM's reputation and appeal to environmentally conscious investors, potentially leading to increased demand for its stock.

Despite the positive outlook, TORM's stock price could be subject to volatility due to external factors such as fluctuations in global oil prices, geopolitical risks, and changes in maritime regulations. However, TORM's robust financial position, its commitment to long-term sustainability, and its ability to adapt to evolving market dynamics provide a cushion against potential risks. The company's prudent financial management and strong relationships with key industry players will likely support its ability to navigate market challenges and deliver consistent value to its shareholders.

In conclusion, TORM's Class A Common Stock appears to be a promising investment opportunity for investors seeking exposure to the growing maritime shipping sector. The company's strategic positioning, operational excellence, and commitment to sustainability are expected to drive continued growth and shareholder value creation in the years to come. Despite potential market volatilities, TORM's strong fundamentals and proven track record suggest a positive long-term outlook for its stock performance.

TORM's Operating Efficiency: A Look Ahead

TORM's operating efficiency is a critical factor in its financial performance. The company's ability to optimize its fleet utilization, fuel consumption, and operational costs directly impacts its profitability. TORM's fleet operates in a highly competitive market, and its success hinges on its ability to navigate market fluctuations effectively. Key indicators of operational efficiency include fleet utilization, vessel operating costs, and fuel consumption.

Fleet utilization is a significant driver of TORM's efficiency. The company aims to maximize the time its vessels spend at sea, transporting cargo and generating revenue. Higher utilization rates mean greater revenue and profitability, particularly in a market where freight rates are volatile. TORM's recent focus on acquiring modern, fuel-efficient vessels has contributed to its ability to navigate market cycles and maintain high utilization rates.

TORM's commitment to optimizing fuel consumption is another crucial aspect of its operational efficiency. The company has implemented various measures to reduce fuel consumption, including hull optimization, engine upgrades, and crew training. These efforts not only lower operational costs but also reduce TORM's environmental footprint. Looking ahead, TORM is exploring alternative fuels and propulsion systems to further reduce its fuel consumption and enhance its environmental sustainability.

TORM's dedication to operating efficiency has contributed to its resilience in the face of market challenges. The company has demonstrated a strong track record of achieving high fleet utilization, controlling vessel operating costs, and optimizing fuel consumption. These achievements are reflected in its financial performance and its ability to navigate industry fluctuations effectively. TORM's continued focus on operational excellence will be crucial in maintaining its competitive edge and achieving sustainable profitability in the long term.

TORM Stock: Navigating Volatile Waters

TORM, a Danish shipping company specializing in product tankers, faces numerous risks inherent to its industry. The cyclical nature of the shipping market exposes TORM to volatile freight rates and fluctuating demand for oil transportation. This translates to significant swings in profitability, making the company's earnings highly susceptible to external factors beyond its control. Furthermore, TORM's fleet is susceptible to obsolescence and maintenance costs, requiring substantial investments to ensure competitiveness. As new regulations and environmental standards emerge, TORM must adapt its fleet and operations, adding further financial burden and potential delays.

Moreover, TORM operates in a highly competitive landscape where numerous other shipping companies vie for market share. This fierce competition can lead to price wars and pressure on freight rates, further impacting profitability. Additionally, TORM's business relies on international trade flows, which can be disrupted by geopolitical events, political instability, and global economic downturns. The impact of these factors can be severe, impacting the company's ability to transport cargo and generate revenue.

However, TORM possesses certain mitigating factors that can help navigate these risks. The company's focus on product tankers caters to a resilient market segment with a stable demand for oil transportation, offering a degree of insulation from broader economic fluctuations. TORM's commitment to fleet renewal and its ability to adapt to evolving industry standards are also crucial to maintain competitiveness. Furthermore, the company's presence in the spot market provides flexibility to capitalize on opportunities and adjust to market dynamics.

Despite these mitigating factors, investors must acknowledge the inherent risks associated with TORM stock. The cyclical nature of the shipping industry and its sensitivity to external factors remain significant concerns. While TORM's strategic focus and operational adjustments offer potential for success, the company's financial performance will continue to be subject to the ebb and flow of market conditions. Investors should carefully assess their risk tolerance before considering an investment in TORM stock.

References

- Allen, P. G. (1994), "Economic forecasting in agriculture," International Journal of Forecasting, 10, 81–135.

- G. Konidaris, S. Osentoski, and P. Thomas. Value function approximation in reinforcement learning using the Fourier basis. In AAAI, 2011

- D. Bertsekas and J. Tsitsiklis. Neuro-dynamic programming. Athena Scientific, 1996.

- Chernozhukov V, Escanciano JC, Ichimura H, Newey WK. 2016b. Locally robust semiparametric estimation. arXiv:1608.00033 [math.ST]

- M. L. Littman. Markov games as a framework for multi-agent reinforcement learning. In Ma- chine Learning, Proceedings of the Eleventh International Conference, Rutgers University, New Brunswick, NJ, USA, July 10-13, 1994, pages 157–163, 1994

- M. L. Littman. Friend-or-foe q-learning in general-sum games. In Proceedings of the Eighteenth International Conference on Machine Learning (ICML 2001), Williams College, Williamstown, MA, USA, June 28 - July 1, 2001, pages 322–328, 2001

- Friedberg R, Tibshirani J, Athey S, Wager S. 2018. Local linear forests. arXiv:1807.11408 [stat.ML]