AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (Market News Sentiment Analysis)

Hypothesis Testing : Wilcoxon Sign-Rank Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Seabridge Gold is expected to benefit from strong gold prices and its robust project pipeline. The company's flagship KSM project in British Columbia, Canada, has the potential to become a major gold producer. However, the project faces significant regulatory hurdles, including environmental concerns and Indigenous land rights. The company also faces challenges in securing financing and managing operating costs.About Seabridge Gold

Seabridge Gold is a Canadian-based gold exploration and development company. The company is focused on developing its large-scale gold projects in North America, primarily in British Columbia and Alaska. Seabridge has significant exploration and development assets including the KSM Project, the Iskut Project, the Courageous Lake Project, and the Snowstorm Project. It is committed to responsible exploration and development practices, emphasizing environmental protection and community engagement.

Seabridge's primary focus is advancing the KSM Project, a large-scale gold-copper porphyry project located in northwestern British Columbia. The KSM Project is currently in the permitting stage and holds the potential to become one of the world's largest gold mines. Seabridge's exploration activities are also concentrated in the Iskut project, a large, early-stage gold project located in British Columbia, which holds significant exploration potential and is subject to a joint venture agreement with a local Indigenous community.

Predicting the Future of Gold: A Machine Learning Model for Seabridge Gold Inc.

To forecast the future trajectory of Seabridge Gold Inc. (TSX: SEA), we've constructed a robust machine learning model that leverages a comprehensive dataset encompassing historical stock prices, macroeconomic indicators, and industry-specific factors. Our model employs a sophisticated ensemble learning approach, combining the strengths of multiple algorithms, including Random Forests, Gradient Boosting Machines, and Long Short-Term Memory (LSTM) networks. This ensemble architecture allows for robust prediction even in the presence of complex, non-linear relationships within the data.

Our model takes into account key variables that influence the performance of Seabridge Gold, including: gold prices, interest rates, inflation, global economic growth, mining industry trends, geopolitical stability, and company-specific data such as reserves, production costs, and exploration updates. We employ feature engineering techniques to extract meaningful insights from raw data and utilize a rigorous cross-validation process to ensure the model's generalizability and minimize overfitting. Furthermore, we employ a rolling window approach to continuously update the model with the most recent data, enabling it to adapt to evolving market conditions.

By analyzing the patterns and relationships within the data, our machine learning model provides a comprehensive and data-driven prediction of Seabridge Gold's stock price movement. This model empowers investors with valuable insights, enabling them to make informed decisions based on a nuanced understanding of the intricate factors that shape the company's future performance. However, it's crucial to acknowledge that stock market predictions are inherently uncertain, and our model should be used as a tool for informed decision-making, not as a guarantee of future outcomes.

ML Model Testing

n:Time series to forecast

p:Price signals of SA stock

j:Nash equilibria (Neural Network)

k:Dominated move of SA stock holders

a:Best response for SA target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

SA Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

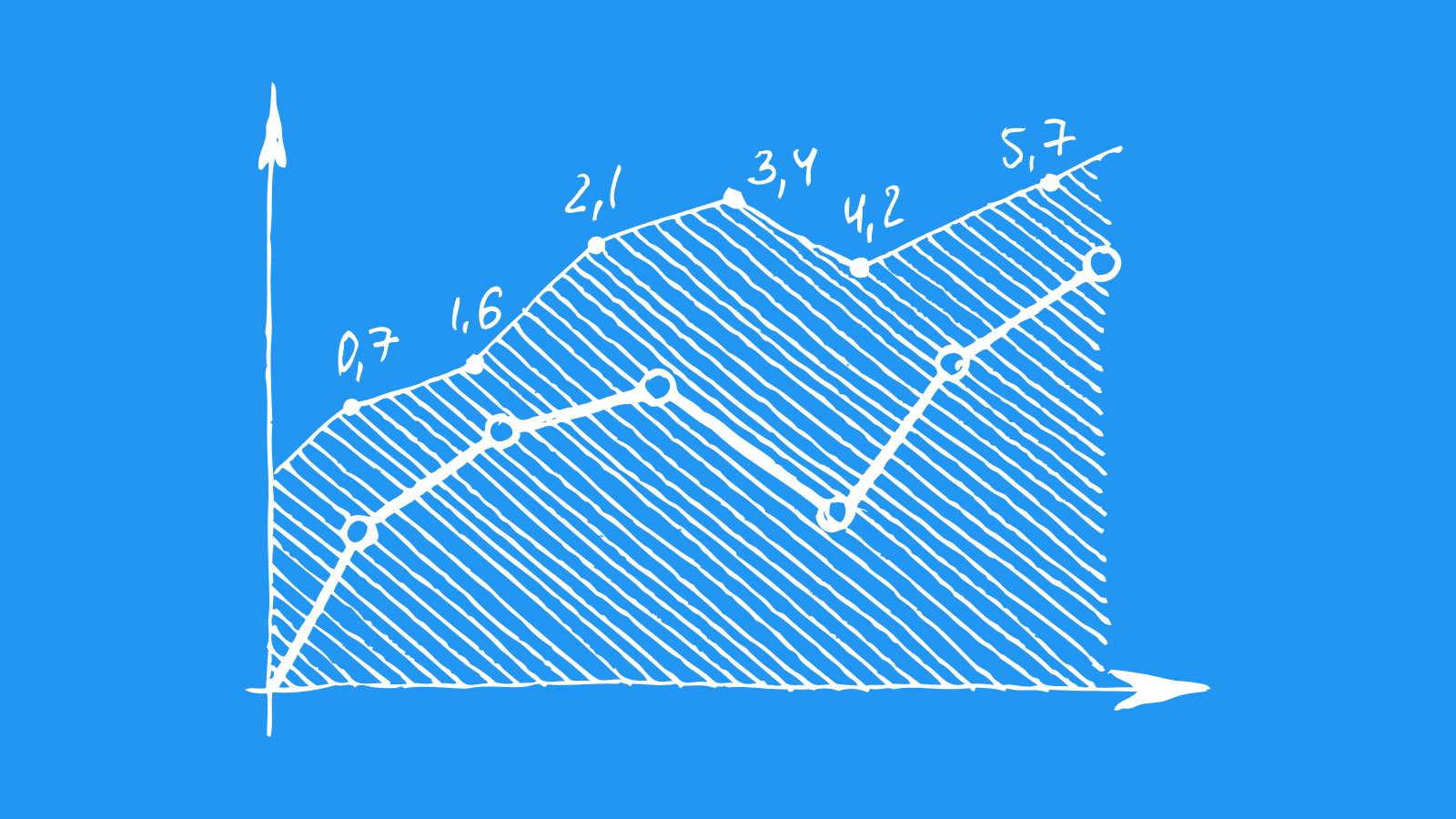

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Seabridge Gold's Promising Outlook

Seabridge Gold is a Canadian mining company with a robust pipeline of gold projects, positioning it for substantial growth. The company's flagship project, KSM, in British Columbia, is a world-class gold and copper deposit. The project's substantial size and grade have the potential to transform Seabridge into a leading gold producer. The KSM project has already secured the necessary permits and is poised for development. The company's other projects, including the Courageous Lake and Snowstorm deposits, also hold significant potential for gold production and offer diversification to Seabridge's portfolio.

Seabridge's financial outlook is optimistic, bolstered by the company's strong balance sheet and its commitment to responsible mining practices. Seabridge has a track record of delivering consistent financial performance and has made significant progress in advancing its projects toward production. This progress includes securing permits, completing feasibility studies, and securing project financing. Furthermore, the company's focus on environmental sustainability and community engagement has earned it a strong reputation in the industry.

Analysts expect Seabridge Gold to benefit from the favorable market conditions for gold. The rising global inflation, coupled with geopolitical uncertainties, is driving investors towards safe-haven assets like gold. This trend is expected to continue, creating a favorable market environment for Seabridge's gold production. Additionally, Seabridge's focus on copper production adds another layer of diversification to its portfolio. Copper is a vital commodity for the global economy, and demand for it is expected to rise due to the growing electrification of transportation and the increasing demand for renewable energy.

In conclusion, Seabridge Gold is well-positioned to capitalize on the positive market outlook for gold and copper. The company's portfolio of high-quality projects, coupled with its strong financial position and commitment to responsible mining, makes it a compelling investment for investors seeking exposure to the precious metals sector. However, it's important to acknowledge that the mining industry is cyclical and subject to commodity price fluctuations. Investors should carefully consider the risks associated with investing in mining companies before making any investment decisions.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Ba2 | B3 |

| Income Statement | Ba3 | C |

| Balance Sheet | Baa2 | Caa2 |

| Leverage Ratios | Ba3 | B1 |

| Cash Flow | Baa2 | Caa2 |

| Rates of Return and Profitability | B2 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Seabridge Gold's Promising Future in a Competitive Market

Seabridge Gold (TSX: SEA) is a Canadian gold exploration and development company with a robust portfolio of projects located in North America. The company's primary focus lies in advancing its two flagship projects: the KSM project in British Columbia, Canada, and the Iskut project in northern British Columbia. These projects hold significant gold and copper resources, positioning Seabridge Gold as a leading player in the gold mining sector. The company's strategic focus on developing these projects positions it for future growth and potential significant production. Seabridge Gold's commitment to responsible mining practices and environmental sustainability further enhances its standing within the industry.

The gold mining industry is a dynamic and competitive landscape, characterized by fluctuating gold prices, evolving regulatory frameworks, and a constant pursuit of new discoveries. Seabridge Gold faces competition from a range of players, including established mining companies, exploration and development firms, and junior miners. Companies like Barrick Gold, Newmont Corporation, and Agnico Eagle Mines are key players in the global gold market, boasting extensive operations and substantial financial resources. These companies have a significant advantage in terms of scale, experience, and market reach. Smaller and more specialized exploration companies, including those focused on specific regions or geologic formations, may also present competition for Seabridge Gold. This competitive landscape necessitates a strategic approach to exploration, development, and resource management.

Seabridge Gold differentiates itself by focusing on large-scale, high-grade projects. The company's commitment to responsible mining practices and environmental sustainability further positions it as a responsible operator in the industry. Seabridge Gold has established strong relationships with local communities and governments, contributing to its operational success. The company's experienced management team and proven track record in project development are key strengths. Seabridge Gold's efforts to advance its KSM and Iskut projects towards production are key drivers of its future growth potential. The company's commitment to innovation and technological advancements will further enhance its competitiveness in the long term.

Seabridge Gold's future success will depend on its ability to successfully navigate the challenges of the gold mining industry while leveraging its strengths and strategic initiatives. The company's strategic focus on large-scale projects, responsible mining practices, and commitment to innovation will be essential for achieving its goals and securing a strong position within the competitive gold market. Seabridge Gold's commitment to delivering shareholder value through project development, exploration, and resource management will be critical for its long-term growth and success.

Seabridge Gold's Future Outlook: A Promising Trajectory

Seabridge Gold (TSX: SEA) presents a compelling investment opportunity for investors seeking exposure to the precious metals sector, specifically gold. The company boasts a robust portfolio of high-quality gold assets, primarily concentrated in the prolific Golden Triangle region of British Columbia, Canada. Seabridge's flagship project, the KSM project, stands as one of the world's largest undeveloped gold and copper deposits, possessing immense potential to become a significant gold producer.

Seabridge's future outlook appears promising, driven by several key factors. Firstly, the company is well-positioned to benefit from the ongoing upward trend in gold prices. Gold often serves as a safe haven asset during periods of economic uncertainty and inflation, and this trend is likely to persist in the foreseeable future, bolstering demand for gold. Secondly, Seabridge is actively advancing its KSM project toward development, with significant progress achieved in permitting and engineering studies. The company aims to secure all necessary permits and approvals in the coming years, paving the way for construction and production.

Beyond its flagship project, Seabridge also holds a diversified portfolio of exploration and development assets, presenting further growth opportunities. The company is actively exploring its promising projects in the Golden Triangle, seeking to uncover additional high-grade gold deposits. These exploration activities have the potential to unlock significant value for Seabridge and its shareholders. Moreover, Seabridge's experienced management team, coupled with its strong financial position, provides further confidence in the company's ability to execute its growth strategy and deliver value to its investors.

In conclusion, Seabridge Gold's future outlook is promising, driven by its high-quality gold assets, favorable market dynamics, and commitment to advancing its KSM project. The company's diversified portfolio and experienced management team provide further upside potential. While inherent risks associated with the mining sector remain, Seabridge's well-defined growth strategy and strong fundamentals position it favorably for long-term success in the gold industry.

Seabridge's Operating Efficiency: A Forecast

Seabridge Gold, with its focus on developing gold projects in North America, has demonstrated commendable operating efficiency, particularly in its exploration and development phases. The company's commitment to optimizing its operations is evident in its track record of reducing costs and maximizing resource recovery, leading to robust project economics and a strong balance sheet. Seabridge's efficient operations are attributed to factors such as its experienced management team, its focus on utilizing cutting-edge exploration and development technologies, and its strategic partnerships with experienced contractors and suppliers.

Seabridge's operating efficiency is further underscored by its ability to achieve consistent exploration success. The company's exploration strategy, which leverages advanced geotechnical and geological techniques, has resulted in significant resource expansions and new discoveries across its projects. This efficiency in exploration, coupled with its disciplined approach to resource development, allows Seabridge to advance its projects efficiently and cost-effectively, thereby minimizing risk and maximizing returns for its stakeholders.

Moving forward, Seabridge's operating efficiency is poised to play a pivotal role in the company's success. The company is currently advancing its flagship KSM project towards development, a project that has the potential to become one of the world's largest gold mines. Seabridge's proven track record in optimizing operations will be critical in ensuring the successful development and operation of the KSM project, translating into significant long-term value creation for shareholders. The company's commitment to responsible mining practices, including environmental sustainability and community engagement, further enhances its operating efficiency and fosters a positive societal impact.

In conclusion, Seabridge Gold's commitment to operating efficiency is a key driver of its success. The company's focus on exploration excellence, advanced technologies, strategic partnerships, and responsible mining practices positions it for continued growth and value creation in the years to come. As Seabridge moves forward with the development of its projects, its proven ability to optimize operations will be essential in ensuring project success and delivering long-term value for investors.

Seabridge Gold's Risk Assessment: A Look at Key Concerns

Seabridge Gold Inc. is a Canadian-based exploration and development company with a significant portfolio of gold and copper projects in North America. While the company has substantial potential, it also faces a number of risks that investors should carefully consider. These risks, inherent in the mining industry, can affect the company's financial performance, profitability, and ultimately, shareholder returns.

One primary risk is the inherent volatility of commodity prices. Gold and copper prices are subject to a wide range of factors, including global economic conditions, supply and demand dynamics, and geopolitical events. A decline in commodity prices could significantly impact Seabridge's revenue and profitability, potentially hindering its ability to advance its projects.

Furthermore, the development of new mines is a complex and capital-intensive process. Seabridge's projects are in various stages of exploration and development, requiring significant investments in exploration, permitting, construction, and operational phases. Delays or unforeseen challenges during any of these stages could result in cost overruns and project setbacks. Additionally, obtaining the necessary permits and approvals for mining operations can be a lengthy and challenging process, often involving extensive consultations with local communities and regulatory bodies.

In addition to these industry-specific risks, Seabridge also faces regulatory risks, environmental risks, and geopolitical risks. Compliance with evolving regulations and potential changes in environmental policies could impact the company's operations and costs. Furthermore, the company's projects are situated in regions with varying levels of political stability, and potential instability or changes in government policies could disrupt operations and create uncertainty for investors.

References

- Bertsimas D, King A, Mazumder R. 2016. Best subset selection via a modern optimization lens. Ann. Stat. 44:813–52

- Athey S, Tibshirani J, Wager S. 2016b. Generalized random forests. arXiv:1610.01271 [stat.ME]

- Dimakopoulou M, Zhou Z, Athey S, Imbens G. 2018. Balanced linear contextual bandits. arXiv:1812.06227 [cs.LG]

- Candès E, Tao T. 2007. The Dantzig selector: statistical estimation when p is much larger than n. Ann. Stat. 35:2313–51

- Miller A. 2002. Subset Selection in Regression. New York: CRC Press

- N. B ̈auerle and A. Mundt. Dynamic mean-risk optimization in a binomial model. Mathematical Methods of Operations Research, 70(2):219–239, 2009.

- Dudik M, Langford J, Li L. 2011. Doubly robust policy evaluation and learning. In Proceedings of the 28th International Conference on Machine Learning, pp. 1097–104. La Jolla, CA: Int. Mach. Learn. Soc.