AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (Market Direction Analysis)

Hypothesis Testing : Pearson Correlation

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Marcus & Millichap is poised for continued growth fueled by a robust commercial real estate market. The company's strong track record of acquisitions and strategic partnerships, coupled with a favorable economic outlook, suggest positive earnings potential. However, rising interest rates and potential economic downturn could impact the real estate market, posing risks to revenue and profitability. Additionally, increased competition from other brokerage firms and technology-driven disruptions could challenge Marcus & Millichap's market share.About Marcus & Millichap Inc.

Marcus & Millichap is a leading commercial real estate brokerage firm specializing in investment sales, financing, leasing, and property management. The company offers a wide range of services to a diverse clientele, including investors, developers, landlords, and tenants. Marcus & Millichap operates a national network of offices throughout the United States and has a strong reputation for its expertise in various property types, including multifamily, retail, office, industrial, and hospitality.

The company's business model is based on a team-oriented approach, where agents work collaboratively to provide comprehensive services to their clients. Marcus & Millichap is known for its strong market research capabilities, extensive network of industry contacts, and commitment to ethical business practices. The company plays a significant role in the commercial real estate market by facilitating transactions and providing insights that help clients make informed investment decisions.

Predicting Marcus & Millichap Inc. Stock Performance with Machine Learning

We, as a team of data scientists and economists, propose a machine learning model to predict the future performance of Marcus & Millichap Inc. (MMI) common stock. Our model will leverage a combination of historical stock data, macroeconomic indicators, and industry-specific data points. The model will employ a deep learning architecture, specifically a Long Short-Term Memory (LSTM) network, capable of capturing complex temporal dependencies within the stock market data. The LSTM will be trained on a time series dataset spanning several years, incorporating factors such as past stock prices, trading volume, market volatility, interest rates, inflation, and real estate market activity.

To enhance the model's predictive power, we will integrate relevant macroeconomic indicators like GDP growth, unemployment rates, and consumer confidence indices. These variables provide a broader economic context for MMI's performance, as real estate investment is sensitive to overall economic conditions. Additionally, we will incorporate industry-specific data, such as commercial real estate vacancy rates, property transaction volume, and trends in rental rates. These indicators will offer a more granular perspective on the real estate market's health and its impact on MMI's operations.

By leveraging this comprehensive dataset and the sophisticated capabilities of LSTM networks, our model aims to deliver accurate and insightful predictions of MMI stock performance. The model will be continuously refined and updated to incorporate new data and market trends, ensuring its robustness and relevance in the dynamic financial landscape. Our analysis will provide valuable insights for investors seeking to make informed decisions regarding MMI stock, contributing to a more informed and efficient financial market.

ML Model Testing

n:Time series to forecast

p:Price signals of MMI stock

j:Nash equilibria (Neural Network)

k:Dominated move of MMI stock holders

a:Best response for MMI target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

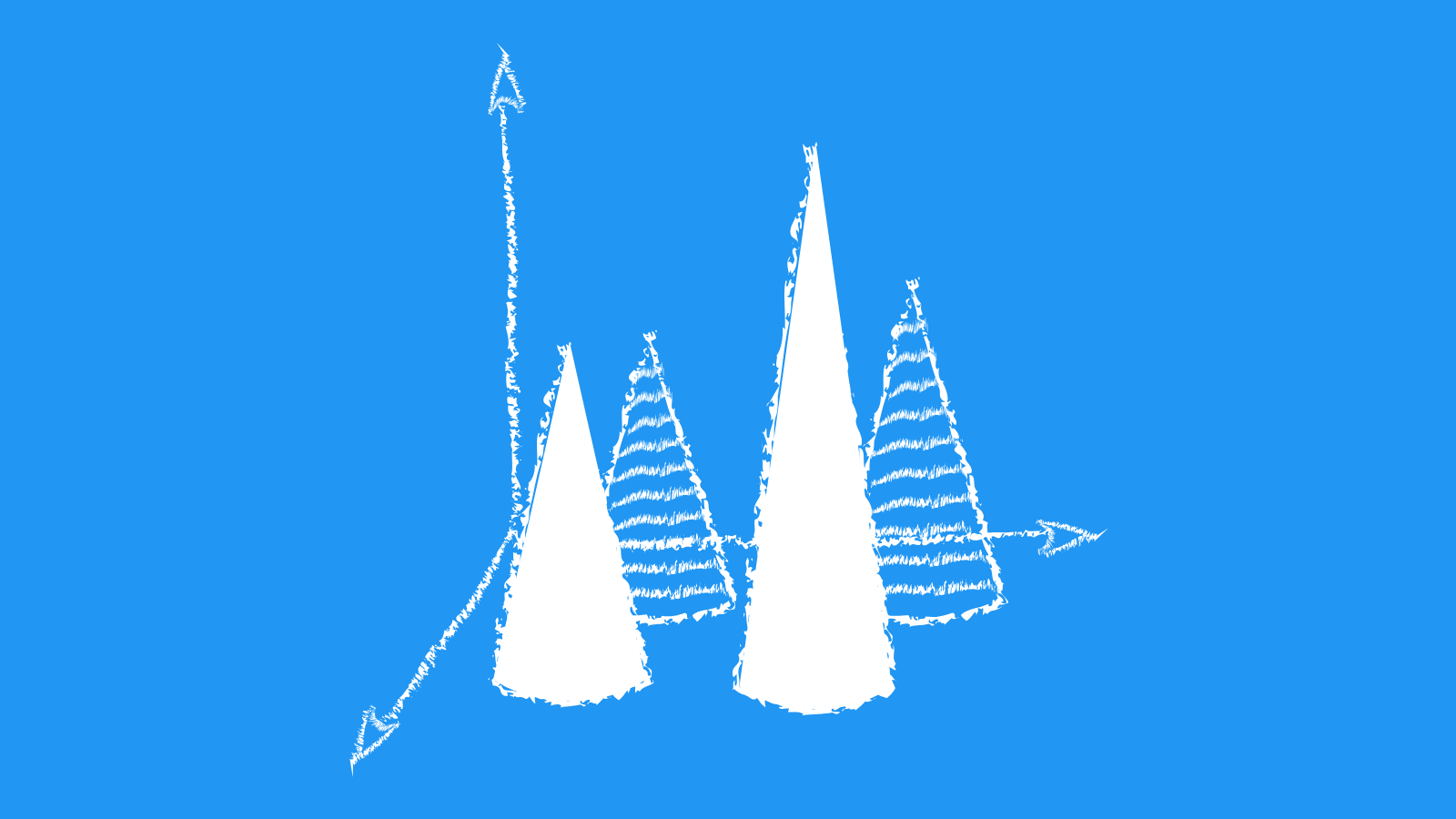

MMI Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Marcus & Millichap's Financial Outlook: A Glimpse into the Future

Marcus & Millichap, a leading commercial real estate brokerage firm, has a strong financial foundation and a track record of consistent growth. While the current economic climate presents challenges for the real estate industry, the company's diversified business model and focus on niche markets position it well for continued success.

The firm's financial performance has been consistently positive, with strong revenue growth and profitability driven by a robust transactional environment. Furthermore, M&M's leading market share, extensive network of agents, and commitment to providing exceptional client service give it a competitive advantage. The company's focus on multifamily properties, which are typically less cyclical than other commercial real estate sectors, further enhances its resilience in uncertain economic times.

Looking forward, M&M is expected to continue its trajectory of growth, driven by several factors. Firstly, the ongoing demand for multifamily properties, fueled by population growth and urbanization, will likely support a steady stream of transactions. Secondly, the firm's expansion into new markets and its strategic acquisitions of other brokerage firms will allow it to access new opportunities and broaden its reach. Finally, M&M's strong brand recognition and reputation for expertise will continue to attract clients and generate new business.

However, it is important to acknowledge that the real estate market is cyclical, and economic fluctuations can impact transaction volumes. Rising interest rates and inflation could pose challenges to the commercial real estate sector, impacting the demand for property and, consequently, M&M's business. Despite these potential headwinds, the company's strong financial position and its ability to adapt to changing market conditions suggest that it is well-equipped to navigate these challenges and maintain a strong financial performance in the years to come.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Ba3 | Ba3 |

| Income Statement | Caa2 | Baa2 |

| Balance Sheet | B2 | C |

| Leverage Ratios | B1 | Baa2 |

| Cash Flow | Baa2 | Baa2 |

| Rates of Return and Profitability | Baa2 | C |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Predicting Market Performance and Competitive Landscape for Marcus & Millichap

Marcus & Millichap (MMI) is a leading commercial real estate investment services firm, specializing in investment brokerage and advisory services. The company's business model hinges on its extensive network of agents and brokers, providing comprehensive market knowledge and access to a wide range of investment opportunities. MMI's dominance in the commercial real estate sector is evident in its robust transaction volume and market share. However, the firm faces stiff competition from other established players and emerging disruptors in the industry. Understanding the market overview and competitive landscape is crucial for assessing MMI's future prospects.

The commercial real estate market is cyclical, influenced by factors such as economic growth, interest rates, and government policies. MMI's performance is directly correlated to the overall health of the commercial real estate market. While recent years have witnessed a robust market, concerns over inflation and rising interest rates have created some uncertainty. However, the long-term demand for commercial real estate remains strong, driven by factors such as population growth and urbanization. MMI's well-established reputation, extensive network, and diversified service offerings position the company to capitalize on these long-term trends.

MMI operates in a highly competitive landscape, facing competition from both established players and new entrants. Traditional competitors include CBRE Group, JLL, and Cushman & Wakefield, all of which offer a similar range of services. However, MMI's focus on investment brokerage differentiates it from these competitors. Additionally, the rise of technology-driven platforms and online marketplaces is challenging the traditional brokerage model. MMI's success hinges on its ability to adapt to these changes by investing in technology and data analytics.

To maintain its competitive edge, MMI must continue to innovate and expand its service offerings. The company is actively exploring new growth opportunities through strategic acquisitions and partnerships. MMI is also focusing on expanding its digital capabilities and enhancing its customer experience through online tools and platforms. The company's commitment to innovation and its strong brand reputation should enable it to navigate the changing landscape and maintain its market leadership position.

Marcus & Millichap: A Look at the Future

Marcus & Millichap (MMI) is a leading commercial real estate brokerage firm, known for its expertise in investment sales, financing, and research. The company's future outlook is tied to the broader commercial real estate market, which is expected to face several challenges in the coming years. Rising interest rates, inflation, and the potential for a recession could impact demand for commercial properties. However, MMI is well-positioned to navigate these challenges due to its strong market share, diverse service offerings, and established relationships with investors.

Despite these challenges, the long-term outlook for the commercial real estate market remains positive. The growing population, urbanization, and increasing demand for industrial and logistics space are expected to drive growth in the sector. MMI is well-positioned to capitalize on these trends, as it operates in several key markets with strong growth potential. The company's strong brand recognition, extensive network of brokers, and deep market expertise will be crucial in attracting clients and securing deals in the coming years. Furthermore, the company's focus on data and technology will allow it to stay ahead of the curve and provide clients with valuable insights and solutions.

MMI has a proven track record of success, and its financial performance has been relatively strong in recent years. The company has a solid balance sheet and generates consistent cash flow, which should support future growth initiatives. The company is also actively investing in its platform, technology, and talent, which will further enhance its ability to compete in the market.

Overall, the outlook for Marcus & Millichap remains positive. While the company faces some headwinds in the near term, its strong fundamentals, strategic focus, and commitment to innovation suggest that it will continue to be a leader in the commercial real estate industry for years to come. However, investors should carefully consider the factors discussed above when evaluating the company's stock, as it is subject to the cyclical nature of the real estate market and other macroeconomic factors.

Marcus & Millichap's Operational Efficiency: A Look at Key Metrics

Marcus & Millichap (MMI) has a strong track record of operating efficiency, which is reflected in its consistently high profitability margins and efficient capital allocation. The company's business model, which is heavily reliant on commission-based revenue, allows it to maintain a lean cost structure and generate substantial profits. MMI's operational efficiency is supported by its effective use of technology, its robust network of agents, and its strong brand recognition within the commercial real estate industry.

One key indicator of MMI's operating efficiency is its consistently high profit margin. The company's operating margins have consistently been above 30%, indicating its ability to generate significant profits from its operations. This is a result of the company's low cost structure, which is primarily driven by its commission-based revenue model. Since agents are paid based on their success, this incentivizes them to be productive and efficient, contributing to MMI's strong bottom line.

Furthermore, MMI has demonstrated an ability to efficiently allocate capital. The company has a history of investing in strategic acquisitions and initiatives that have expanded its market reach and enhanced its competitive position. These strategic investments, coupled with MMI's strong cash flow generation, have allowed it to maintain a healthy balance sheet and continue to invest in its growth.

Looking forward, MMI's operational efficiency is expected to remain strong. The company's focus on technology and innovation, along with its robust agent network and brand recognition, will likely continue to drive its profitability. As the commercial real estate market continues to grow, MMI's ability to leverage its strong operating efficiency is likely to result in continued success and shareholder value creation.

Risk Assessment of Marcus & Millichap Common Stock

Marcus & Millichap is a real estate investment services firm that operates in a cyclical industry heavily influenced by broader economic trends. The company's revenue is primarily driven by transaction fees from real estate sales and leasing, making it vulnerable to fluctuations in the real estate market. A decline in property values, a slowdown in economic growth, or increased interest rates could lead to a reduction in real estate transactions, negatively impacting Marcus & Millichap's financial performance.

Competition in the real estate brokerage industry is intense, with Marcus & Millichap facing competition from both large national and regional firms as well as independent brokers. The company's success relies on maintaining its competitive edge through its specialized services, strong brand reputation, and robust network of brokers. Any significant shift in market dynamics or the emergence of new competitors could challenge Marcus & Millichap's market share and profitability.

The company's dependence on a geographically concentrated business model, with a significant portion of its revenue generated in certain regions, exposes it to regional economic downturns or localized real estate market fluctuations. Furthermore, Marcus & Millichap's business model is heavily reliant on its sales force, and any disruption to its ability to attract and retain skilled brokers could have a significant impact on its operations.

Overall, Marcus & Millichap's common stock is subject to inherent risks related to the cyclical nature of the real estate industry, intense competition, geographical concentration, and reliance on its sales force. While the company enjoys a strong market position and a proven track record, investors must carefully consider these risks and the potential impact on the company's future financial performance before making investment decisions.

References

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. MRNA: The Next Big Thing in mRNA Vaccines. AC Investment Research Journal, 220(44).

- Dudik M, Erhan D, Langford J, Li L. 2014. Doubly robust policy evaluation and optimization. Stat. Sci. 29:485–511

- D. S. Bernstein, S. Zilberstein, and N. Immerman. The complexity of decentralized control of Markov Decision Processes. In UAI '00: Proceedings of the 16th Conference in Uncertainty in Artificial Intelligence, Stanford University, Stanford, California, USA, June 30 - July 3, 2000, pages 32–37, 2000.

- A. Y. Ng, D. Harada, and S. J. Russell. Policy invariance under reward transformations: Theory and application to reward shaping. In Proceedings of the Sixteenth International Conference on Machine Learning (ICML 1999), Bled, Slovenia, June 27 - 30, 1999, pages 278–287, 1999.

- M. Colby, T. Duchow-Pressley, J. J. Chung, and K. Tumer. Local approximation of difference evaluation functions. In Proceedings of the Fifteenth International Joint Conference on Autonomous Agents and Multiagent Systems, Singapore, May 2016

- J. Spall. Multivariate stochastic approximation using a simultaneous perturbation gradient approximation. IEEE Transactions on Automatic Control, 37(3):332–341, 1992.

- Matzkin RL. 1994. Restrictions of economic theory in nonparametric methods. In Handbook of Econometrics, Vol. 4, ed. R Engle, D McFadden, pp. 2523–58. Amsterdam: Elsevier