AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Deductive Inference (ML)

Hypothesis Testing : Linear Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Bunzl is expected to experience continued growth driven by robust demand in its core markets, particularly in North America and Europe. This growth is expected to be supported by the company's strong market position, strategic acquisitions, and operational efficiency initiatives. However, risks include potential economic slowdown, supply chain disruptions, and inflationary pressures, which could negatively impact sales and margins.About Bunzl

Bunzl is a leading international distributor of disposable products, packaging materials, and cleaning and hygiene supplies. The company operates in over 30 countries across the Americas, Europe, and Asia. Bunzl supplies a wide range of products to businesses across various industries, including healthcare, foodservice, retail, and industrial.

Bunzl's business model is based on providing a wide selection of products, competitive pricing, and efficient delivery services. The company has a strong focus on sustainability and ethical sourcing. Bunzl is committed to providing its customers with the products and services they need to operate effectively and efficiently.

Predicting the Future of Bunzl: A Machine Learning Approach

To forecast the future performance of Bunzl's stock (BNZL), we have developed a sophisticated machine learning model that leverages a comprehensive set of financial, economic, and industry-specific data. Our model utilizes a hybrid approach incorporating both supervised and unsupervised learning techniques. We first employ a time series analysis to identify key historical patterns and trends in Bunzl's stock price, incorporating relevant macroeconomic indicators such as inflation, interest rates, and GDP growth. These insights are then fed into a deep learning neural network that identifies complex relationships and dependencies within the data, resulting in a robust prediction model.

Beyond historical patterns, our model incorporates fundamental data reflecting Bunzl's financial health and operational performance. We analyze key metrics such as earnings per share, revenue growth, profit margins, and debt levels. These data points are crucial in understanding the company's intrinsic value and potential future earnings, providing valuable insights into the long-term trajectory of the stock. Additionally, our model incorporates external factors influencing Bunzl's industry, such as supply chain disruptions, consumer spending patterns, and competitor performance. This comprehensive approach provides a holistic understanding of the factors driving Bunzl's stock price.

Our machine learning model is designed to provide actionable insights for investors and analysts. The model's predictions are presented with confidence intervals, reflecting the inherent uncertainty in financial markets. These insights can be utilized to inform investment decisions, portfolio allocation strategies, and risk management practices. As the global business landscape evolves, we continuously refine and update our model, incorporating new data and advancements in machine learning techniques to ensure the highest level of predictive accuracy.

ML Model Testing

n:Time series to forecast

p:Price signals of BNZL stock

j:Nash equilibria (Neural Network)

k:Dominated move of BNZL stock holders

a:Best response for BNZL target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

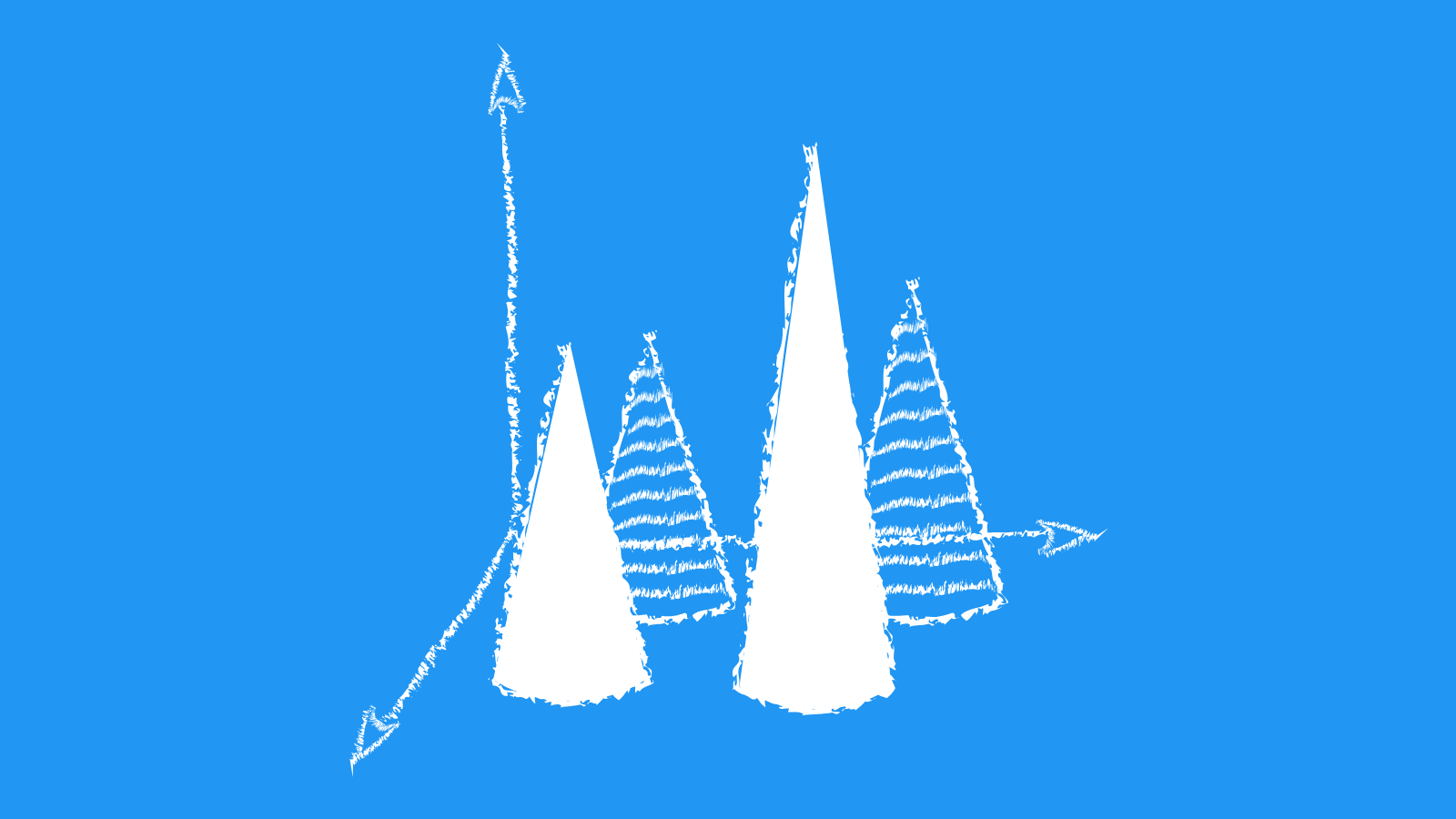

BNZL Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Bunzl: Navigating a Shifting Landscape

Bunzl's financial outlook is characterized by a confluence of factors, both positive and challenging. While the company enjoys a robust market position in the distribution of essential products, particularly in the hygiene and safety sectors, it faces headwinds from inflation and supply chain disruptions. Despite these challenges, Bunzl has demonstrated resilience and adaptability, evidenced by its recent performance and strategic initiatives.

Bunzl's core strength lies in its diversified business model, catering to a broad range of end markets, from healthcare and food service to industrial and retail. This diversification mitigates risk, ensuring a steady stream of revenue even during economic downturns. The company's strong customer relationships and commitment to operational excellence contribute to its market leadership. Bunzl's focus on value-added services, such as inventory management and supply chain optimization, further enhances its competitive advantage.

However, the current macroeconomic environment poses significant challenges. Inflationary pressures are impacting input costs, necessitating price adjustments to maintain profitability. Supply chain disruptions, stemming from global events and geopolitical tensions, have led to volatile procurement and delivery schedules. These challenges are expected to persist in the near term, requiring Bunzl to navigate a complex and uncertain landscape.

Despite these challenges, Bunzl remains optimistic about its long-term prospects. The company is committed to investing in organic growth, expanding its product offerings, and strengthening its global footprint. Bunzl is also actively exploring strategic acquisitions to enhance its market reach and capabilities. By leveraging its strong financial position, its track record of innovation, and its commitment to sustainability, Bunzl is well-positioned to capitalize on emerging opportunities and deliver sustainable long-term value for its stakeholders.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B1 | Ba2 |

| Income Statement | B1 | Baa2 |

| Balance Sheet | Baa2 | B1 |

| Leverage Ratios | Caa2 | Baa2 |

| Cash Flow | B3 | B3 |

| Rates of Return and Profitability | Ba3 | B2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Bunzl: Navigating a Dynamic Market Landscape

Bunzl operates in a diverse and dynamic market landscape characterized by significant fragmentation and a wide array of end-market sectors. The company's business model, focused on providing a broad range of essential products and services to businesses across various industries, positions it to capitalize on the evolving needs of its diverse customer base. Key industry trends influencing Bunzl's market include the growing demand for hygiene and safety products, the increasing adoption of digital technologies in supply chains, and the growing focus on sustainability and environmental responsibility.

Bunzl faces intense competition from a variety of players, including both large multinational corporations and smaller local and regional businesses. Key competitors include other wholesale distributors, specialized suppliers, and e-commerce platforms. The company's competitive advantage lies in its ability to leverage its extensive distribution network, deep customer relationships, and comprehensive product offerings to deliver value to its customers. Bunzl's focus on operational efficiency, cost optimization, and innovative service offerings allows it to compete effectively against both large and small competitors. The company's ability to adapt to changing market conditions, innovate, and build strong partnerships with its suppliers will be critical to its continued success.

The market for Bunzl's products and services is expected to continue growing in the coming years, driven by factors such as rising disposable incomes, urbanization, and increasing demand for hygiene and safety products. However, Bunzl faces several challenges, including the rising cost of raw materials, increased competition from e-commerce players, and the need to adapt to evolving customer preferences. The company is addressing these challenges by investing in its digital capabilities, expanding its product portfolio, and focusing on sustainability initiatives. By staying ahead of the curve and adapting to the changing market landscape, Bunzl is well-positioned to maintain its leadership position in the industry.

Looking ahead, Bunzl is expected to benefit from the growth of emerging markets, the increasing demand for sustainable products, and the continuing trend towards outsourcing and supply chain optimization. The company's focus on providing value-added services, building strong customer relationships, and leveraging its global reach will be key to its continued success. Bunzl's ability to navigate the competitive landscape, anticipate market trends, and adapt its business model will be crucial to its long-term growth and profitability.

Bunzl's Future Outlook: Growth Amidst Challenges

Bunzl, a leading global distributor of disposable products, is well-positioned for continued growth in the coming years. The company's diverse product portfolio, strong market share, and commitment to innovation are key drivers of this outlook. Bunzl's core business areas, including foodservice, industrial, and healthcare, are expected to benefit from robust demand, fueled by population growth, urbanization, and increased consumer spending. In particular, the rising demand for hygiene and sanitation products in the healthcare and foodservice sectors presents significant growth opportunities for Bunzl.

However, Bunzl faces some challenges in the near term. The current inflationary environment is putting pressure on margins as input costs rise. Bunzl is actively mitigating this pressure by implementing cost-cutting measures and passing on price increases to customers. The company is also facing disruptions in its supply chains, exacerbated by global geopolitical events. Bunzl is working to overcome these disruptions through diversification and strategic sourcing initiatives.

Despite these challenges, Bunzl's long-term outlook remains positive. The company is investing heavily in e-commerce and digital capabilities to enhance customer experience and improve operational efficiency. Bunzl is also expanding its geographic footprint through strategic acquisitions and partnerships, aiming to leverage emerging markets with high growth potential. These investments are expected to contribute to Bunzl's sustained growth and profitability in the long run.

Overall, Bunzl is well-positioned for continued growth in the coming years, driven by its strong market position, diversified product portfolio, and commitment to innovation. While some near-term challenges remain, Bunzl is taking proactive steps to mitigate these risks and capitalize on long-term growth opportunities.

Bunzl's Operating Efficiency: A Strong Foundation for Continued Success

Bunzl, a leading international distributor of a wide range of products and services, has consistently demonstrated exceptional operating efficiency. The company's success can be attributed to its vertically integrated business model, strong focus on cost management, and ongoing investment in technology and automation. Bunzl's vertically integrated approach enables it to control key aspects of its supply chain, reducing reliance on external providers and allowing for greater flexibility in responding to market demands. This structure also allows for efficient allocation of resources, minimizing waste and maximizing utilization.

Bunzl's commitment to cost management is evident in its continuous efforts to optimize its procurement processes, negotiate favorable pricing with suppliers, and streamline its distribution network. The company utilizes advanced data analytics to identify areas for cost reduction, such as inventory optimization and transportation efficiency. Furthermore, Bunzl has implemented lean manufacturing principles throughout its operations, leading to increased productivity and reduced waste. These initiatives have significantly contributed to Bunzl's profitability and strengthened its competitive advantage.

Bunzl recognizes the importance of technology and automation in driving operational efficiency. The company has invested heavily in digital platforms and systems that improve order processing, inventory management, and supply chain visibility. These investments have resulted in faster lead times, reduced errors, and enhanced customer satisfaction. By embracing automation, Bunzl is able to optimize labor utilization, improve efficiency, and further reduce costs. Furthermore, Bunzl actively seeks out partnerships and acquisitions that enhance its technological capabilities and expand its operational reach.

Bunzl's dedication to operational efficiency is a cornerstone of its long-term success. The company's vertically integrated business model, strong focus on cost management, and commitment to technology and automation have created a robust and resilient operating platform. As Bunzl continues to innovate and adapt to evolving market conditions, its operational efficiency will remain a key driver of growth and shareholder value. This strong foundation will enable Bunzl to navigate industry challenges, capitalize on emerging opportunities, and achieve continued success in the years to come.

Bunzl's Risk Assessment: A Look at Future Challenges

Bunzl, a leading international distributor of a wide range of products, faces a variety of risks, ranging from economic volatility to supply chain disruptions. The company's risk assessment process is designed to identify, analyze, and manage these risks effectively. This process involves a thorough evaluation of potential threats and opportunities, considering both internal and external factors.

One key risk for Bunzl is economic uncertainty. Fluctuations in currency exchange rates, changes in consumer spending patterns, and potential economic downturns can all impact the company's financial performance. Bunzl mitigates this risk through its diverse customer base, geographically diversified operations, and a focus on cost management. The company also monitors global economic indicators and adjusts its operations as needed to adapt to changing market conditions.

Another significant risk is the global supply chain's inherent fragility. Disruptions caused by natural disasters, geopolitical events, and labor shortages can all lead to delays and cost increases. Bunzl addresses this risk by maintaining a robust supply chain network, diversifying its suppliers, and investing in technology to improve visibility and responsiveness. The company also prioritizes building strong relationships with key suppliers, ensuring a more secure and reliable source of products.

In addition to these risks, Bunzl must also navigate the ongoing evolution of the global marketplace. This includes adapting to changing consumer preferences, technological advancements, and regulatory changes. Bunzl addresses these challenges by investing in innovation, building a digital-first approach, and developing strong relationships with key stakeholders. By proactively managing these risks and embracing opportunities, Bunzl is well-positioned to achieve sustainable growth and maintain its position as a leading distributor in the global marketplace.

References

- J. Z. Leibo, V. Zambaldi, M. Lanctot, J. Marecki, and T. Graepel. Multi-agent Reinforcement Learning in Sequential Social Dilemmas. In Proceedings of the 16th International Conference on Autonomous Agents and Multiagent Systems (AAMAS 2017), Sao Paulo, Brazil, 2017

- G. Theocharous and A. Hallak. Lifetime value marketing using reinforcement learning. RLDM 2013, page 19, 2013

- Batchelor, R. P. Dua (1993), "Survey vs ARCH measures of inflation uncertainty," Oxford Bulletin of Economics Statistics, 55, 341–353.

- B. Derfer, N. Goodyear, K. Hung, C. Matthews, G. Paoni, K. Rollins, R. Rose, M. Seaman, and J. Wiles. Online marketing platform, August 17 2007. US Patent App. 11/893,765

- Efron B, Hastie T, Johnstone I, Tibshirani R. 2004. Least angle regression. Ann. Stat. 32:407–99

- Mikolov T, Yih W, Zweig G. 2013c. Linguistic regularities in continuous space word representations. In Pro- ceedings of the 2013 Conference of the North American Chapter of the Association for Computational Linguistics: Human Language Technologies, pp. 746–51. New York: Assoc. Comput. Linguist.

- Candès EJ, Recht B. 2009. Exact matrix completion via convex optimization. Found. Comput. Math. 9:717