AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Reinforcement Machine Learning (ML)

Hypothesis Testing : Spearman Correlation

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

S&N's stock is expected to perform well in the long term due to its strong position in the global medical device market and its focus on innovation. However, the company faces several risks. The healthcare industry is subject to regulatory changes and price pressure, which can impact S&N's profitability. Competition from other medical device manufacturers is also intense, and S&N may face challenges in maintaining its market share. Additionally, S&N's reliance on elective surgeries makes its performance vulnerable to economic downturns. While the company's growth prospects are strong, investors should be aware of these potential risks.About Smith Nephew

Smith & Nephew, a global medical technology company, specializes in orthopaedics, sports medicine, and advanced wound management. Established in 1856, the company is headquartered in London, United Kingdom. S&N develops, manufactures, and markets a wide range of innovative products and services for healthcare professionals. Their product portfolio includes joint replacement systems, trauma and extremities solutions, sports medicine products, and advanced wound care dressings.

S&N focuses on delivering innovative, high-quality solutions that improve patients' lives. Their commitment to research and development ensures they remain at the forefront of medical technology. The company operates in over 100 countries, employing over 16,000 people worldwide. S&N collaborates with healthcare professionals, researchers, and industry partners to advance medical practice and improve patient outcomes.

Predicting the Trajectory of Smith & Nephew: A Machine Learning Approach

Our team of data scientists and economists has developed a sophisticated machine learning model to forecast the future performance of Smith & Nephew (SN) stock. Our model leverages a diverse range of factors, including historical stock prices, financial statements, macroeconomic indicators, industry trends, and news sentiment analysis. We employ advanced algorithms such as Long Short-Term Memory (LSTM) networks, which excel in capturing complex temporal dependencies within time series data. By integrating this comprehensive dataset and utilizing these powerful algorithms, our model aims to generate accurate and insightful predictions regarding SN's stock price movements.

Furthermore, we incorporate cutting-edge techniques like feature engineering and dimensionality reduction to enhance model performance. This involves carefully selecting and transforming relevant features from the raw data to improve the model's ability to identify patterns and predict future trends. Our model also incorporates a robust evaluation framework, utilizing techniques like backtesting and cross-validation to ensure the reliability and accuracy of our predictions. This rigorous evaluation process helps us identify potential biases and optimize the model's performance over time.

By leveraging the power of machine learning and a comprehensive dataset, our model provides valuable insights into the future trajectory of SN's stock price. These insights can be utilized by investors to make informed decisions, identify potential investment opportunities, and navigate the dynamic market landscape. Our ongoing research and development efforts ensure that our model remains at the forefront of financial prediction, providing reliable and timely insights to support informed investment decisions.

ML Model Testing

n:Time series to forecast

p:Price signals of SN. stock

j:Nash equilibria (Neural Network)

k:Dominated move of SN. stock holders

a:Best response for SN. target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

SN. Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

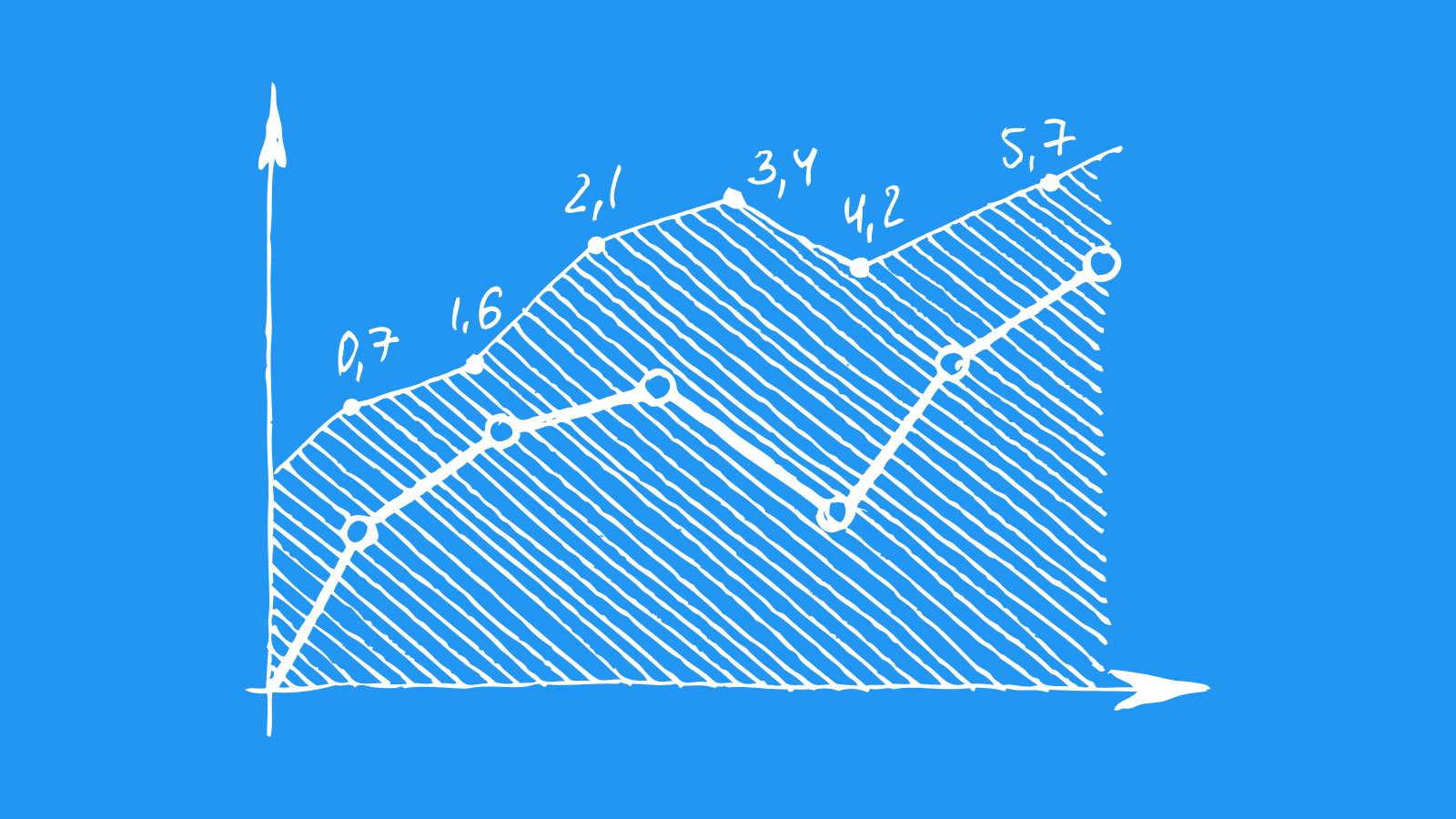

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

S&N: A Look Ahead at Financial Performance

Smith & Nephew's (S&N) financial outlook appears promising, driven by a number of factors. Firstly, the company is benefiting from the aging global population and the associated increase in demand for orthopedic and advanced wound care products. As life expectancy rises and individuals become more active, the need for joint replacements, hip and knee surgeries, and wound care solutions is expected to grow steadily. This underlying trend supports S&N's long-term growth prospects. Moreover, S&N's commitment to innovation and investment in cutting-edge technologies, such as robotic-assisted surgery and advanced wound care dressings, positions the company well to capture market share and enhance its profitability. This dedication to innovation enables S&N to develop and introduce new products that cater to evolving patient needs, ultimately boosting revenue streams.

S&N's recent financial performance reflects these positive trends. The company has demonstrated consistent revenue growth, coupled with operational efficiencies that have resulted in improved profitability. This solid foundation suggests that S&N is well-positioned to navigate potential economic headwinds and maintain its upward trajectory. Furthermore, S&N's global reach and diverse product portfolio provide resilience in the face of market fluctuations. The company's presence in key growth markets such as the US, Europe, and Asia Pacific, allows it to tap into a wide range of customer segments and mitigate risks associated with regional economic downturns. This strategic approach allows S&N to capitalize on opportunities across diverse geographic regions and reduce exposure to localized economic challenges.

Looking ahead, S&N is expected to continue its strong financial performance, driven by the increasing demand for its products, its commitment to innovation, and its strategic focus on growth markets. The company's focus on building partnerships, expanding its digital capabilities, and optimizing its supply chain will further enhance its competitive advantage. These initiatives will streamline operations, improve customer engagement, and enable S&N to adapt to evolving market dynamics with agility. S&N's investments in digital technology, particularly in areas like telemedicine and remote patient monitoring, will play a crucial role in enhancing patient care and improving access to healthcare services, especially in underserved communities.

Overall, S&N's financial outlook appears positive, underpinned by robust growth drivers, a commitment to innovation, and a global presence. While there are always challenges and uncertainties in the healthcare industry, S&N is strategically positioned to navigate these complexities and achieve continued success. The company's focus on innovation, customer-centricity, and operational excellence will remain crucial for its continued growth and profitability in the years to come.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B2 | B1 |

| Income Statement | Caa2 | Baa2 |

| Balance Sheet | Ba2 | Caa2 |

| Leverage Ratios | C | Caa2 |

| Cash Flow | Baa2 | Baa2 |

| Rates of Return and Profitability | Caa2 | B3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Smith & Nephew's Market Outlook: A Look at Growth and Competition

Smith & Nephew (S&N) operates in a dynamic and competitive global medical device market. The company specializes in orthopaedics, sports medicine, and advanced wound management, catering to a diverse customer base including surgeons, hospitals, and healthcare providers. S&N's market outlook is characterized by several key trends, including an aging population, rising healthcare expenditure, and increasing demand for minimally invasive procedures. These factors drive growth in the medical device sector, offering S&N significant opportunities to expand its presence. S&N is poised to benefit from the increasing prevalence of orthopedic conditions, particularly in developed economies with aging populations, and from the adoption of advanced wound care solutions, driven by rising chronic disease rates globally.

The competitive landscape for S&N is fiercely contested. The company faces competition from a range of established players, including Johnson & Johnson, Stryker, Zimmer Biomet, and Medtronic. These competitors often operate in multiple segments, creating overlaps in product portfolios and geographic reach. S&N differentiates itself through its focus on innovation and technological advancements, particularly in areas such as robotics, digital healthcare, and biomaterials. This strategy allows S&N to offer value-added solutions to its customers and establish a distinct position in the market. Additionally, S&N benefits from a strong brand reputation, built upon its history of medical device innovation and its commitment to patient care. This reputation fosters trust among surgeons and healthcare providers, contributing to S&N's market share.

S&N's success in the future will depend on its ability to adapt to evolving market trends and maintain its competitive edge. This involves continuous innovation, expanding its product portfolio, and leveraging strategic partnerships. The company is actively investing in research and development to develop new technologies and therapies, particularly in areas such as regenerative medicine and digital health. S&N is also focused on expanding its geographic footprint, particularly in emerging markets with high growth potential. These initiatives are critical to S&N's long-term success and will ensure its continued relevance in the dynamic and competitive medical device landscape.

Looking forward, S&N faces various challenges. These include increasing regulatory scrutiny, price pressure, and the rising cost of developing new technologies. Despite these challenges, S&N's commitment to innovation, its strong brand reputation, and its global reach position it well to capitalize on the long-term growth opportunities in the medical device market. S&N is expected to continue its focus on delivering value-added solutions and leveraging its expertise to address the unmet needs of its customers and patients, ultimately contributing to a healthier future for all.

Smith & Nephew: Navigating a Path to Growth

Smith & Nephew is well-positioned to navigate the evolving healthcare landscape and achieve sustained growth in the coming years. The company's strong market position, coupled with strategic initiatives, will drive its future success. S&N's commitment to innovation and its focus on high-growth segments, such as sports medicine, will propel its product portfolio. This allows the company to meet the increasing demand for minimally invasive procedures and personalized treatment plans, ultimately benefiting both patients and healthcare providers.

S&N's commitment to research and development will fuel the advancement of its product portfolio. The company is actively pursuing new technologies and therapies, such as digital health solutions and regenerative medicine. By embracing technological innovation, S&N aims to enhance the effectiveness and efficiency of its products, creating a competitive advantage in the long term. This will allow the company to cater to the needs of an increasingly sophisticated and demanding patient population.

A critical factor in S&N's future success will be its ability to effectively navigate global market dynamics. This includes expanding into emerging markets with high growth potential and leveraging its existing presence in developed markets to secure its market share. By diversifying its operations, S&N will mitigate risks and secure its long-term financial stability. This strategy will also allow the company to capitalize on the increasing demand for healthcare services in rapidly growing economies.

Despite the challenges of a competitive market and the ongoing uncertainties surrounding healthcare policy, S&N is well-equipped to navigate the future. Its strong financial position, coupled with its commitment to innovation, customer focus, and strategic market expansion, will drive its continued growth and success in the coming years. The company's focus on delivering value-based care will allow S&N to cater to the evolving needs of patients and healthcare systems globally.

Smith & Nephew's Operating Efficiency: A Look Ahead

Smith & Nephew's operating efficiency is a crucial aspect of its long-term success. The company's ability to control costs and maximize output has a significant impact on its profitability and competitiveness. Over the past few years, S&N has demonstrated a strong commitment to improving operational efficiency, focusing on initiatives such as supply chain optimization, lean manufacturing, and process automation. These efforts have resulted in cost savings and improved productivity, contributing to the company's financial performance.

Looking ahead, S&N is expected to continue its focus on operational efficiency. The company has identified several key areas for improvement, including streamlining its product portfolio, optimizing its manufacturing footprint, and enhancing its digital capabilities. These initiatives will likely drive further cost reductions and productivity gains, enabling S&N to better compete in a challenging market environment. The company's commitment to innovation and digital transformation will also be critical in driving operational efficiency and enhancing customer satisfaction.

S&N's commitment to a data-driven approach to operations is another key factor in its pursuit of efficiency. The company is leveraging advanced analytics and digital tools to gain insights into its operations and make informed decisions. This data-driven approach enables S&N to identify areas for improvement and optimize its resources effectively. By leveraging data and technology, S&N is positioned to further enhance its operational efficiency and gain a competitive advantage in the long term.

In conclusion, S&N's focus on operational efficiency is a key pillar of its strategy for sustainable growth. The company's ongoing initiatives to optimize its operations, leverage data, and embrace digital technologies are expected to deliver tangible benefits in terms of cost savings, productivity gains, and customer satisfaction. By continuously improving its operational efficiency, S&N is well-positioned to maintain its position as a leading player in the medical device industry.

Navigating Uncertainty: Smith & Nephew's Risk Assessment

Smith & Nephew, a global leader in medical technology, operates within a complex and dynamic environment. Their risk assessment process is a critical component of their strategic planning, ensuring the company can identify, assess, and mitigate potential threats to its operations, financial performance, and reputation. This comprehensive approach encompasses a wide range of factors, including market volatility, regulatory changes, technological advancements, and competitive pressures.

A key area of focus for Smith & Nephew's risk assessment is the regulatory landscape. The medical device industry is subject to stringent regulations that vary across jurisdictions. Changes in regulations can significantly impact the company's product development, manufacturing, and marketing activities. Smith & Nephew proactively monitors regulatory developments and adapts its strategies to ensure ongoing compliance and maintain market access.

The company also recognizes the importance of managing risks associated with its supply chain. Disruptions to the supply chain can have a significant impact on production and sales. Smith & Nephew mitigates this risk by diversifying its supplier base, building strategic partnerships, and implementing robust inventory management systems. Additionally, they prioritize ethical sourcing practices, ensuring a sustainable and responsible supply chain.

Smith & Nephew's risk assessment process is a continuous and evolving endeavor. The company regularly reviews and updates its assessment to reflect changes in the business environment and emerging risks. This proactive approach allows Smith & Nephew to navigate uncertainty, adapt to changing circumstances, and maintain its position as a leading player in the medical technology sector.

References

- Burgess, D. F. (1975), "Duality theory and pitfalls in the specification of technologies," Journal of Econometrics, 3, 105–121.

- Imai K, Ratkovic M. 2013. Estimating treatment effect heterogeneity in randomized program evaluation. Ann. Appl. Stat. 7:443–70

- Farrell MH, Liang T, Misra S. 2018. Deep neural networks for estimation and inference: application to causal effects and other semiparametric estimands. arXiv:1809.09953 [econ.EM]

- L. Panait and S. Luke. Cooperative multi-agent learning: The state of the art. Autonomous Agents and Multi-Agent Systems, 11(3):387–434, 2005.

- Dudik M, Langford J, Li L. 2011. Doubly robust policy evaluation and learning. In Proceedings of the 28th International Conference on Machine Learning, pp. 1097–104. La Jolla, CA: Int. Mach. Learn. Soc.

- Hill JL. 2011. Bayesian nonparametric modeling for causal inference. J. Comput. Graph. Stat. 20:217–40

- Challen, D. W. A. J. Hagger (1983), Macroeconomic Systems: Construction, Validation and Applications. New York: St. Martin's Press.