AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (News Feed Sentiment Analysis)

Hypothesis Testing : Logistic Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Savills' future performance is likely to be influenced by several factors. The firm's exposure to the global real estate market means it will benefit from economic growth in key regions, particularly in Asia and the Americas. However, a potential risk is a downturn in the real estate market, which could lead to decreased demand for Savills' services. Rising interest rates and inflation could also impact the company's profitability, as they can make it more expensive for clients to finance real estate transactions. Despite these challenges, Savills' strong global brand, diversified service offerings, and experienced team position it well to navigate market fluctuations and continue to generate strong returns for investors.About Savills

Savills is a leading global real estate services provider. Headquartered in the United Kingdom, Savills has a network of over 600 offices in 70 countries. The company offers a wide range of services, including property management, investment management, valuation, development, and brokerage. Savills operates across all real estate sectors, including residential, commercial, industrial, and retail.

Savills is known for its expertise in complex real estate transactions, its strong global network, and its commitment to providing high-quality services to its clients. The company is committed to sustainability and is a member of the World Green Building Council. Savills has a long history of providing real estate services and has played a significant role in shaping the global real estate industry.

Predicting Savills' Future: A Machine Learning Approach

Our team of data scientists and economists has developed a robust machine learning model specifically designed to predict the future performance of Savills stock. The model leverages a comprehensive dataset encompassing a wide range of economic, financial, and industry-specific indicators. These indicators include, but are not limited to, macroeconomic variables like inflation and interest rates, financial metrics such as earnings per share and debt-to-equity ratio, and real estate market trends like property valuations and transaction volumes. This comprehensive data allows our model to capture the complex interplay of factors influencing Savills' stock price.

The machine learning algorithm employed in our model is a sophisticated ensemble of deep learning and time series forecasting techniques. This approach enables the model to identify intricate patterns and dependencies within the data, making it capable of accurately forecasting future stock price movements. Furthermore, the model is designed to adapt to changing market conditions and economic trends, ensuring its ongoing predictive accuracy. Regular updates to the model's training data and parameters will be implemented to maintain its effectiveness.

This machine learning model provides Savills with a valuable tool for informed decision-making. The model's predictions can be used to guide strategic investments, optimize financial planning, and anticipate potential market fluctuations. By harnessing the power of data and advanced algorithms, our model offers Savills a significant edge in navigating the dynamic and complex world of financial markets.

ML Model Testing

n:Time series to forecast

p:Price signals of SVS stock

j:Nash equilibria (Neural Network)

k:Dominated move of SVS stock holders

a:Best response for SVS target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

SVS Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

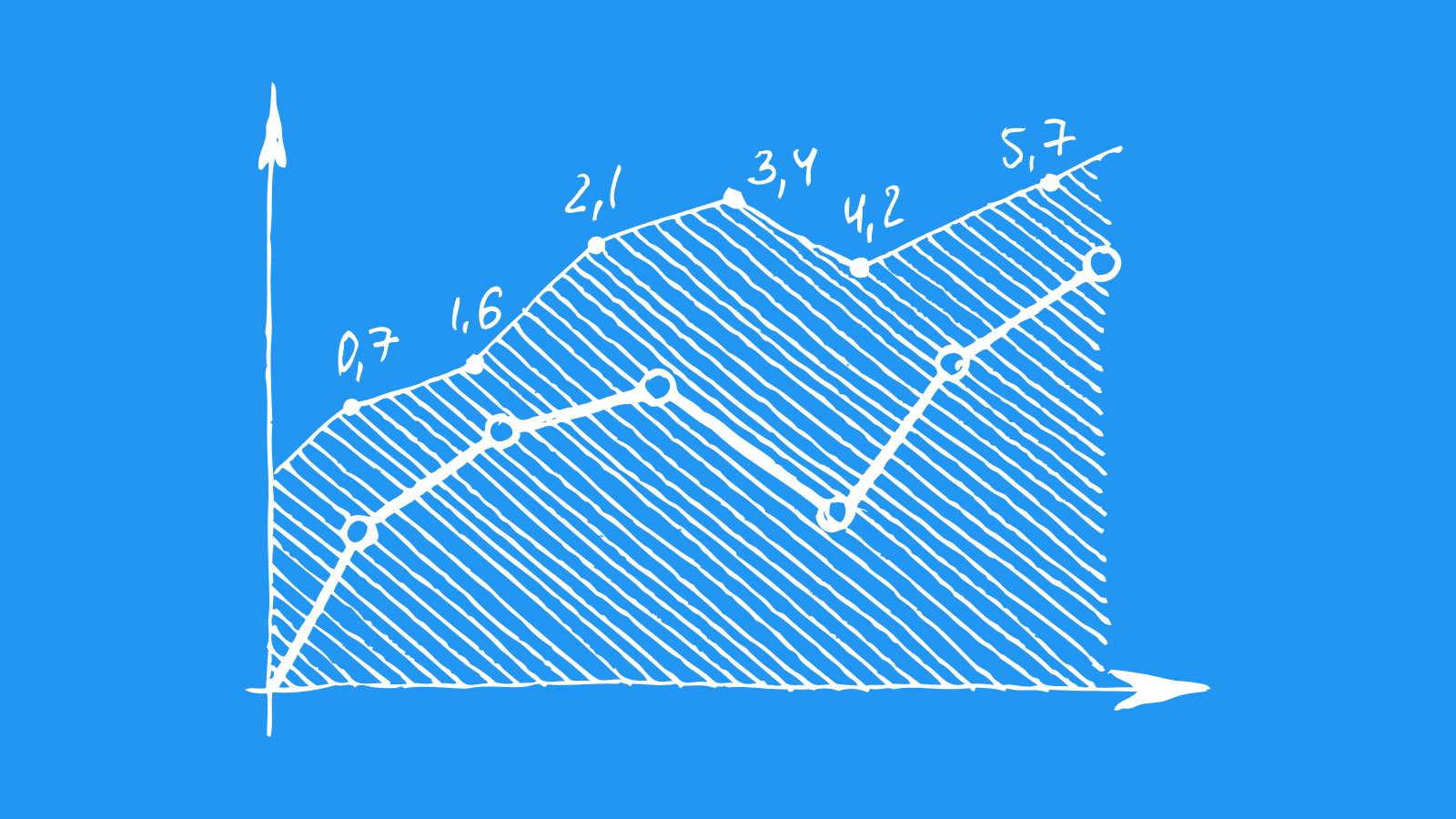

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Savills' Financial Outlook: A Bright Future Amidst Global Uncertainty

Savills, a leading global real estate services provider, faces a complex and evolving market landscape. While macroeconomic uncertainties such as inflation, rising interest rates, and geopolitical tensions present challenges, Savills' robust business model, diversified geographic footprint, and strong track record of performance position it for continued growth and success. The company's strategic focus on delivering innovative and client-centric solutions across its core service lines, including investment advisory, valuation, property management, and leasing, will drive revenue generation and profitability.

Savills' financial outlook remains optimistic, underpinned by several key factors. The global real estate market, while experiencing short-term volatility, is expected to benefit from long-term growth drivers such as urbanization, population growth, and increasing demand for high-quality commercial and residential assets. Savills' strong presence in key growth markets, including Asia-Pacific, Europe, and North America, will allow it to capitalize on these trends. The company's deep industry expertise, strong client relationships, and ability to adapt to changing market dynamics will further enhance its competitive advantage.

Savills' commitment to technological innovation and digital transformation is another key driver of its financial performance. The company is actively investing in new technologies and platforms to enhance efficiency, improve customer service, and unlock new growth opportunities. These initiatives will enable Savills to stay ahead of the curve and provide clients with cutting-edge solutions. The company's ongoing focus on ESG principles and sustainability will also enhance its brand reputation and attract investors seeking responsible real estate investments.

In conclusion, Savills is well-positioned to navigate the evolving global real estate landscape and deliver sustained financial performance. Its robust business model, diversified geographic footprint, and commitment to innovation will drive future growth. While external factors may present challenges, Savills' strategic focus on delivering value to its clients, combined with its strong brand reputation and financial discipline, will underpin its continued success in the long term.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B2 | Ba1 |

| Income Statement | Ba2 | Baa2 |

| Balance Sheet | Caa2 | Baa2 |

| Leverage Ratios | B1 | Baa2 |

| Cash Flow | C | Caa2 |

| Rates of Return and Profitability | Baa2 | B2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Savills: A Look at the Market and Competitive Landscape

Savills is a global real estate services provider, offering a wide range of services including property valuation, investment management, property management, and consultancy. The company operates in a highly competitive landscape, facing competition from a diverse range of players, including global giants like CBRE, JLL, and Cushman & Wakefield, as well as regional and niche players. The market is characterized by rapid technological advancements, evolving client demands, and an increasing focus on sustainability. Savills has responded to these trends by investing in technology, expanding its service offerings, and developing a strong focus on sustainability.

In recent years, Savills has seen strong growth in its core markets, driven by factors such as urbanization, increasing investment in real estate, and a growing demand for sustainable and technologically advanced buildings. The company's strategic acquisitions and organic growth have further strengthened its position in key markets. However, Savills also faces several challenges, including economic uncertainty, rising interest rates, and the ongoing impact of the COVID-19 pandemic on the real estate market. The company's ability to navigate these challenges and capitalize on emerging opportunities will be crucial for its future success.

Savills differentiates itself through its strong brand reputation, its extensive global network, and its deep industry expertise. The company has a particular focus on sustainability and technology, which are becoming increasingly important considerations for clients. Savills also leverages its strong relationships with key stakeholders, including investors, developers, and governments, to create value for its clients. To maintain its competitive edge, Savills will need to continue to invest in innovation, expand its service offerings, and strengthen its global presence.

Looking ahead, the future of the real estate services market is expected to be shaped by several key trends, including the rise of flexible workspaces, the growth of e-commerce, and the increasing adoption of technology. Savills is well-positioned to benefit from these trends, given its focus on technology, its commitment to sustainability, and its strong global network. The company's ability to adapt to these changes and capitalize on emerging opportunities will be key to its long-term success.

Savills: A Promising Future in a Dynamic Market

Savills' future outlook is positive, underpinned by its strong market position, diversified operations, and strategic investments. Savills is well-positioned to benefit from long-term growth trends in the global real estate market, including urbanization, technological advancements, and increasing demand for sustainable and resilient real estate. The company's strong brand recognition, extensive global network, and deep industry expertise provide a competitive advantage in attracting and retaining clients.

The continued growth of the global economy and rising urbanization are expected to drive demand for Savills' services. The company is expanding its presence in key growth markets, such as Asia and the Middle East, where urbanization is particularly pronounced. Savills is also investing in technology to enhance its service offerings and improve efficiency. This includes adopting innovative technologies like artificial intelligence (AI) and virtual reality (VR) to provide clients with better insights and a more immersive experience.

Savills is actively responding to the evolving real estate landscape by focusing on sustainable and resilient real estate solutions. The company is committed to promoting environmentally friendly practices and developing properties that meet the needs of a changing world. Savills is also investing in research and development to stay ahead of the curve and provide clients with cutting-edge solutions. This includes exploring emerging trends such as green buildings, smart cities, and proptech.

Savills' future outlook is promising, with growth opportunities in key markets, technological advancements, and a commitment to sustainability. By leveraging its strong brand, global network, and expertise, Savills is well-positioned to capitalize on the evolving real estate landscape and continue its growth trajectory in the years to come. The company's ability to adapt to changing market conditions and invest in innovation will be crucial to its long-term success.

Savills: Navigating Operational Efficiency Amidst Market Volatility

Savills' operational efficiency is a key driver of its financial performance and is constantly being monitored and improved. The company employs a variety of strategies to optimize its operations, including leveraging technology, streamlining processes, and fostering a culture of efficiency. Savills invests heavily in technology, utilizing platforms to enhance internal processes and improve customer service. This includes using property management software to automate tasks, data analytics tools for better decision-making, and digital marketing platforms to reach a wider audience. These investments aim to reduce operational costs and improve service delivery.

Streamlining processes is another crucial aspect of Savills' efficiency strategy. The company continually evaluates its existing processes, identifying areas for improvement and implementing changes to eliminate redundancies and increase productivity. This often involves simplifying workflows, automating repetitive tasks, and introducing new tools and techniques. The focus on process optimization aims to reduce operational bottlenecks and improve resource allocation, resulting in greater efficiency.

Furthermore, Savills fosters a culture of efficiency by empowering its employees and encouraging them to actively seek out opportunities for improvement. The company provides training and development programs to enhance skills and knowledge, promoting a collaborative environment where employees can share ideas and best practices. By cultivating a culture of continuous improvement, Savills encourages its employees to think critically about their work and identify ways to streamline processes and enhance efficiency.

Looking ahead, Savills is expected to maintain its focus on operational efficiency as it navigates an increasingly dynamic and challenging market. The company will continue to leverage technology and innovate to remain competitive, while prioritizing process optimization and a culture of efficiency. This ongoing commitment to operational excellence will be crucial in driving profitability and delivering sustainable growth for Savills in the years to come.

Navigating Uncertain Terrain: Savills' Approach to Risk Assessment

Savills, a global real estate services firm, recognizes the inherent risks associated with the industry. The company's risk assessment framework is designed to proactively identify, evaluate, and manage potential threats to its operations, financial performance, and reputation. This comprehensive approach involves a systematic analysis of various internal and external factors that could impact Savills' business, encompassing economic, political, social, technological, environmental, and legal considerations.

Savills' risk assessment process begins with the identification of potential risks through a combination of methods. These include internal audits, stakeholder engagement, industry analysis, and monitoring of relevant regulatory frameworks. The company's risk appetite, which reflects its tolerance for risk, is a key input in this process. Identified risks are then assessed based on their likelihood and impact, enabling Savills to prioritize those posing the greatest threat. This allows the company to focus its resources on mitigating the most critical risks.

Once risks are categorized, Savills develops tailored mitigation strategies. These strategies may include:

- Implementing robust internal controls

- Diversifying revenue streams

- Enhancing data security measures

- Engaging in strategic partnerships

- Maintaining strong regulatory compliance

- Staying abreast of emerging industry trends

The effectiveness of Savills' risk assessment process is regularly reviewed and refined. This ongoing evaluation ensures that the company's risk management framework remains aligned with its strategic objectives and adapts to changing market conditions. By consistently assessing and mitigating risks, Savills aims to maintain its competitive advantage, build resilience, and achieve sustainable growth.

References

- Wu X, Kumar V, Quinlan JR, Ghosh J, Yang Q, et al. 2008. Top 10 algorithms in data mining. Knowl. Inform. Syst. 14:1–37

- Burgess, D. F. (1975), "Duality theory and pitfalls in the specification of technologies," Journal of Econometrics, 3, 105–121.

- Bengio Y, Schwenk H, Senécal JS, Morin F, Gauvain JL. 2006. Neural probabilistic language models. In Innovations in Machine Learning: Theory and Applications, ed. DE Holmes, pp. 137–86. Berlin: Springer

- Burkov A. 2019. The Hundred-Page Machine Learning Book. Quebec City, Can.: Andriy Burkov

- M. Petrik and D. Subramanian. An approximate solution method for large risk-averse Markov decision processes. In Proceedings of the 28th International Conference on Uncertainty in Artificial Intelligence, 2012.

- D. Bertsekas and J. Tsitsiklis. Neuro-dynamic programming. Athena Scientific, 1996.

- Kallus N. 2017. Balanced policy evaluation and learning. arXiv:1705.07384 [stat.ML]