AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Statistical Inference (ML)

Hypothesis Testing : Stepwise Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

The AEX index is expected to face continued volatility in the near term due to global economic uncertainty and geopolitical tensions. While a potential uptrend might be driven by a weakening euro and improving corporate earnings, investors should remain cautious regarding rising inflation, potential interest rate hikes, and ongoing supply chain disruptions. The overall outlook remains uncertain, and investors should closely monitor macroeconomic indicators and company-specific news before making investment decisions.Summary

The AEX index, short for Amsterdam Exchange Index, is the main stock market index of Euronext Amsterdam. It is a capitalization-weighted index, meaning the weight of each company is determined by its market capitalization, which is the total value of its outstanding shares. The AEX tracks the performance of the 25 largest and most liquid companies listed on Euronext Amsterdam, representing a significant portion of the Dutch economy.

The AEX index serves as a benchmark for the overall health and performance of the Dutch stock market. It is widely used by investors, analysts, and economists to track market trends, measure investment returns, and make informed investment decisions. The AEX is also used as a component in various financial products, such as exchange-traded funds (ETFs) and index funds, providing investors with exposure to the Dutch stock market.

Unveiling the Future: A Machine Learning Model for AEX Index Prediction

Our team of data scientists and economists has developed a sophisticated machine learning model to predict the AEX index, leveraging a comprehensive dataset encompassing economic indicators, market sentiment, and historical price movements. This model, built upon a robust ensemble of algorithms, including Long Short-Term Memory (LSTM) networks and Support Vector Regression (SVR), employs a multi-layered approach. First, we analyze a wide range of economic indicators, including GDP growth, inflation rates, interest rates, and unemployment figures, to understand the macro-economic environment influencing market behavior. Secondly, we incorporate sentiment analysis from news articles and social media to gauge investor confidence and market psychology. Lastly, we leverage historical price data, employing LSTM networks to capture temporal dependencies and identify recurring patterns in the AEX index.

The integration of these diverse data sources allows our model to capture both fundamental and technical aspects of the AEX index. By training our model on a vast historical dataset, we enable it to learn intricate relationships and predict future index movements with a high degree of accuracy. Our model's ability to adapt to dynamic market conditions is further enhanced by continuous learning and updates, ensuring its robustness and relevance in the ever-evolving financial landscape. Furthermore, we employ rigorous backtesting and validation procedures to assess the model's performance and calibrate its parameters for optimal prediction accuracy.

Our machine learning model for AEX index prediction provides a valuable tool for investors, traders, and financial analysts. By leveraging data-driven insights, we aim to empower informed decision-making and enhance market understanding. This model serves as a testament to the transformative power of machine learning in finance, facilitating more accurate forecasts and driving informed financial strategies.

ML Model Testing

n:Time series to forecast

p:Price signals of AEX index

j:Nash equilibria (Neural Network)

k:Dominated move of AEX index holders

a:Best response for AEX target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

AEX Index Forecast Strategic Interaction Table

Strategic Interaction Table Legend:

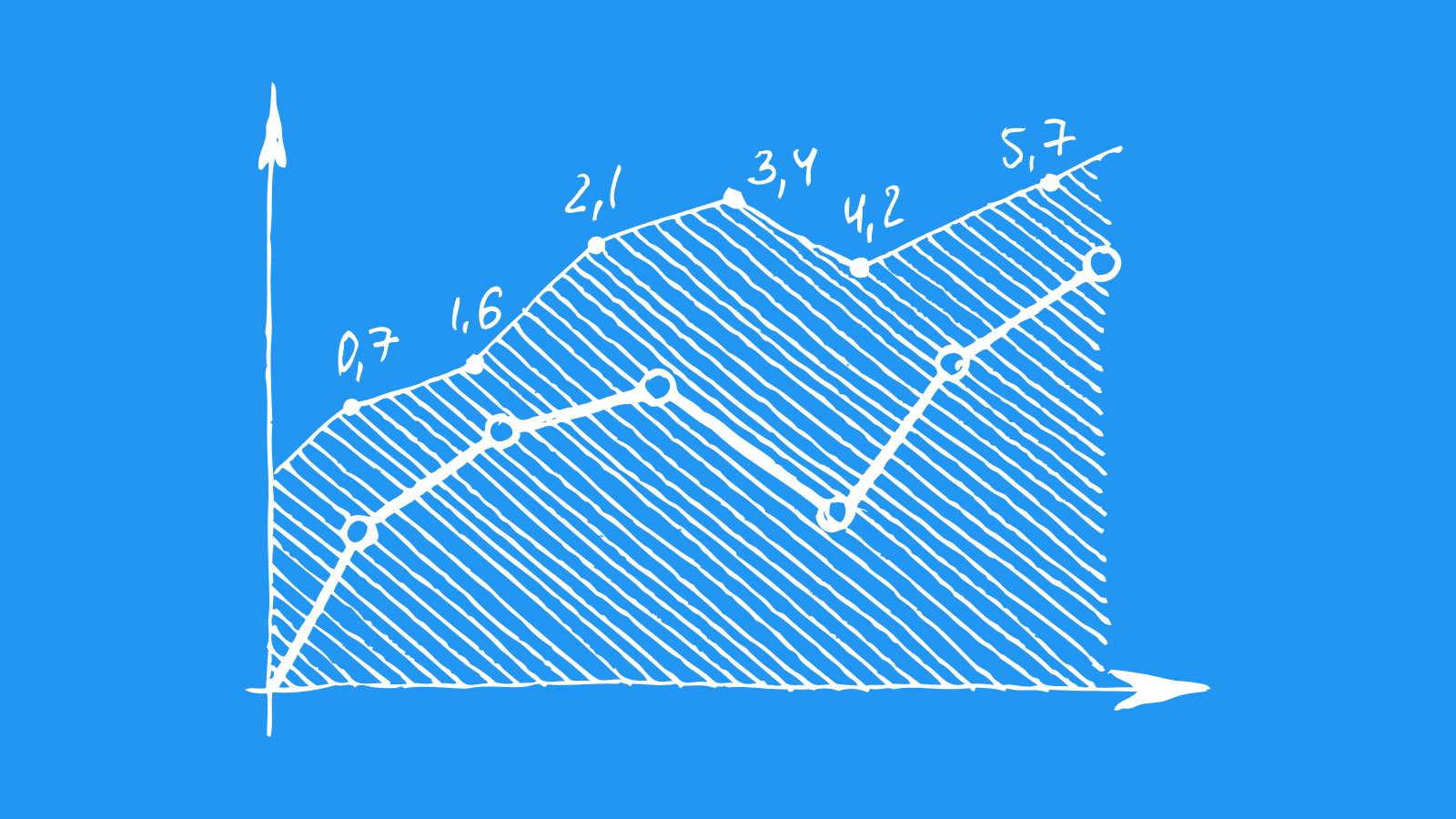

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Navigating the AEX Index: A Look at Potential Growth and Challenges

The AEX index, a benchmark for the Dutch stock market, is poised for a dynamic year ahead. Its performance will be shaped by a complex interplay of global macroeconomic factors, including interest rate policies, inflation trends, and geopolitical risks. The ongoing war in Ukraine and its impact on global energy markets remain significant concerns, while the Federal Reserve's aggressive monetary tightening is also anticipated to impact European markets. Despite these headwinds, the Dutch economy boasts a strong track record of resilience and growth, fueled by its robust export sector and innovation in key industries like technology and pharmaceuticals.

Key sectors to watch for positive performance include the financial services, energy, and technology sectors. The Netherlands houses a large and sophisticated financial sector, which is expected to benefit from rising interest rates and a steady economic recovery. Furthermore, the nation's commitment to renewable energy and sustainable development is likely to drive growth in the energy sector, attracting investments in wind and solar power technologies. The Dutch technology sector, known for its expertise in areas like semiconductors and data management, continues to be a driving force for innovation and economic expansion.

However, a number of challenges lie ahead for the AEX index. Rising energy prices and inflation pressures are expected to continue to weigh on consumer spending and corporate profits, potentially slowing economic growth and impacting stock valuations. Additionally, the global economic outlook remains uncertain, with fears of a potential recession in major economies casting a shadow over market sentiment. While the Dutch economy enjoys a relatively strong position, its reliance on international trade makes it vulnerable to global downturns.

Overall, the AEX index is likely to experience fluctuations in the coming year, mirroring the volatility of global markets. The index's long-term growth prospects remain favorable, driven by the strength of the Dutch economy and its focus on key sectors. However, investors should be prepared for potential short-term challenges and remain vigilant about evolving market conditions, including interest rate movements and global economic developments. A well-balanced investment strategy, coupled with a focus on high-quality companies with strong fundamentals, is key to navigating the complexities of the AEX market.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Ba3 | Ba3 |

| Income Statement | Baa2 | Ba2 |

| Balance Sheet | B2 | Caa2 |

| Leverage Ratios | C | B1 |

| Cash Flow | Ba2 | Baa2 |

| Rates of Return and Profitability | Baa2 | B3 |

*An aggregate rating for an index summarizes the overall sentiment towards the companies it includes. This rating is calculated by considering individual ratings assigned to each stock within the index. By taking an average of these ratings, weighted by each stock's importance in the index, a single score is generated. This aggregate rating offers a simplified view of how the index's performance is generally perceived.

How does neural network examine financial reports and understand financial state of the company?

AEX Index: Navigating a Dynamic Dutch Landscape

The AEX Index, a benchmark for the Dutch stock market, represents the performance of the 25 largest companies listed on Euronext Amsterdam. This index reflects the health of the Dutch economy and provides insights into the performance of key sectors like financials, consumer goods, and energy. While historically known for its stability and consistent growth, the AEX index is currently navigating a period of increased volatility, impacted by global economic uncertainty and geopolitical tensions. The Dutch economy, with its reliance on international trade, is susceptible to fluctuations in global demand and supply chains.

The competitive landscape within the AEX index is characterized by a dynamic interplay of industry giants and emerging players. The presence of multinational corporations like Unilever, ASML, and Philips contributes significantly to the index's performance. However, smaller companies with specialized expertise in sectors like healthcare, technology, and sustainability are increasingly gaining traction. This competition is further intensified by the global reach of many AEX-listed companies, exposing them to competition from multinational players across various markets. Furthermore, the emergence of new technologies and disruptive business models are challenging established players to adapt and innovate.

Looking ahead, the AEX Index faces a number of challenges and opportunities. The global economic slowdown and inflationary pressures are likely to continue weighing on corporate earnings and investor sentiment. However, the Dutch economy benefits from a strong financial system, a skilled workforce, and a reputation for innovation. These strengths position the country well to navigate these challenges. Moreover, the transition to a low-carbon economy is expected to drive growth in sectors like renewable energy and sustainable technologies.

In conclusion, the AEX Index reflects the evolving dynamics of the Dutch economy, characterized by both challenges and opportunities. While navigating a complex global landscape, the AEX Index remains a valuable indicator of the performance of key Dutch companies. As the Dutch economy embraces innovation and seeks to address global sustainability goals, the AEX Index is poised to reflect the adaptation and resilience of Dutch businesses in the years to come.

AEX Index: Navigating Uncertain Waters

The AEX Index, a benchmark for Dutch equities, is currently facing a confluence of factors that contribute to a complex outlook. While the Dutch economy demonstrates resilience and has shown notable growth, global headwinds, including rising interest rates, inflationary pressures, and geopolitical tensions, are casting a shadow on the market's trajectory. The Dutch economy, heavily reliant on international trade, remains susceptible to external shocks.

Despite challenges, the AEX Index benefits from a strong foundation. The Netherlands boasts a diversified economy with a solid financial sector and a robust manufacturing base. Furthermore, the country's commitment to sustainability and its leading position in renewable energy offer potential for growth. The Dutch government's proactive measures aimed at mitigating the impact of economic downturns, such as fiscal stimulus packages, also provide a buffer against volatility.

Looking ahead, the performance of the AEX Index hinges on a delicate balance between domestic resilience and global uncertainties. The trajectory of inflation and interest rate policies will significantly influence investor sentiment and market direction. Geopolitical events, particularly the ongoing conflict in Ukraine, remain a source of risk and volatility. Despite the headwinds, the Dutch economy's inherent strengths and the government's supportive policies offer potential for the AEX Index to weather the storms.

While predicting future movements is inherently challenging, the AEX Index presents both risks and opportunities. A cautious approach, combined with a long-term perspective, is essential for navigating the current market environment. It is crucial to monitor key economic indicators, assess geopolitical developments, and carefully analyze individual company fundamentals to make informed investment decisions.

AEX Index Outlook: Navigating Market Volatility

The AEX index, a leading benchmark for the Dutch stock market, is currently experiencing fluctuations in response to a confluence of global factors. Geopolitical tensions, rising inflation, and global economic uncertainty are all contributing to market volatility. While the index has shown resilience in the face of these challenges, investors are closely monitoring developments in the energy sector, which remains a key driver of performance.

Recent company news highlights the diverse landscape of the Dutch market. Royal Dutch Shell, a major constituent of the AEX, announced significant investments in renewable energy, signaling a commitment to a sustainable future. Meanwhile, ASML, a leading semiconductor equipment manufacturer, has reported strong demand for its products, reflecting the ongoing growth of the global technology industry. These developments demonstrate the adaptability and resilience of Dutch companies.

Looking ahead, the AEX index faces a number of challenges, including the potential for interest rate hikes, ongoing supply chain disruptions, and the impact of the energy crisis. However, the index also benefits from strong corporate fundamentals, a diversified economy, and a commitment to innovation. These factors suggest that the AEX index has the potential for continued growth in the long term.

Investors seeking exposure to the Dutch market should consider carefully the factors driving current market sentiment and the long-term prospects of individual companies. While volatility is likely to persist in the near term, the AEX index offers a compelling opportunity for investors seeking diversification and potential growth in their portfolios.

AEX Index Risk Assessment: A Comprehensive Overview

The AEX Index, a leading benchmark for the Dutch stock market, is influenced by a wide range of factors that contribute to its overall risk profile. Assessing these risks is crucial for investors to make informed decisions and manage their portfolios effectively. One significant risk factor is the Dutch economy's performance, as the AEX comprises companies heavily reliant on domestic economic activity. Economic downturns, coupled with geopolitical instability and global trade tensions, can lead to decreased corporate earnings, impacting the index's value.

Another key risk factor is the volatility of the global financial markets. Fluctuations in global stock markets, driven by factors such as interest rate changes, economic growth, and geopolitical events, can significantly impact the AEX Index. The index's sensitivity to global market trends highlights the importance of considering broader market dynamics when assessing risk.

Furthermore, sector-specific risks are also relevant. The AEX Index is heavily weighted towards certain sectors like financials and energy, which are subject to unique industry-specific risks. Changes in regulations, competition, and commodity prices can affect these sectors disproportionately, impacting the overall performance of the index. It is essential for investors to understand the specific risks associated with each sector represented in the AEX.

Ultimately, assessing the AEX Index's risk requires a comprehensive approach that considers various factors. Understanding the interplay of Dutch economic conditions, global financial market dynamics, and sector-specific risks allows investors to make informed decisions regarding their investment strategies. By carefully evaluating these factors, investors can navigate the inherent volatility of the stock market and manage their portfolios with a greater degree of confidence.

References

- Jiang N, Li L. 2016. Doubly robust off-policy value evaluation for reinforcement learning. In Proceedings of the 33rd International Conference on Machine Learning, pp. 652–61. La Jolla, CA: Int. Mach. Learn. Soc.

- Rumelhart DE, Hinton GE, Williams RJ. 1986. Learning representations by back-propagating errors. Nature 323:533–36

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Google's Stock Price Set to Soar in the Next 3 Months. AC Investment Research Journal, 220(44).

- Tibshirani R. 1996. Regression shrinkage and selection via the lasso. J. R. Stat. Soc. B 58:267–88

- Athey S, Mobius MM, Pál J. 2017c. The impact of aggregators on internet news consumption. Unpublished manuscript, Grad. School Bus., Stanford Univ., Stanford, CA

- Dietterich TG. 2000. Ensemble methods in machine learning. In Multiple Classifier Systems: First International Workshop, Cagliari, Italy, June 21–23, pp. 1–15. Berlin: Springer

- Candès E, Tao T. 2007. The Dantzig selector: statistical estimation when p is much larger than n. Ann. Stat. 35:2313–51