AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (Financial Sentiment Analysis)

Hypothesis Testing : Sign Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Soho House is expected to continue its expansion, both domestically and internationally, which will likely drive revenue growth. The company's focus on providing exclusive and curated experiences for its members is also expected to remain a key driver of growth. However, risks include increasing competition from other hospitality brands, rising operating costs, and potential economic downturn, which could impact member spending. Additionally, the company's reliance on membership fees could make it vulnerable to fluctuations in membership levels.About Soho House & Co

Soho House & Co is a membership-based private club and hospitality company. Its portfolio includes 36 properties across the globe, offering members exclusive access to a variety of amenities and experiences. These include restaurants, bars, spas, fitness centers, workspaces, and event spaces. The company also has a growing media and entertainment division, which includes a production company and a magazine. Soho House & Co operates across different countries, providing a unique community for its members.

The company has a strong focus on creating a sense of community among its members, who are primarily professionals in the creative industries. Soho House & Co prides itself on offering a curated and exclusive experience that caters to the needs of its members, fostering a sense of belonging and connection.

Predicting the Future of Luxury: A Machine Learning Model for Soho House & Co Inc. Stock

To predict the future performance of Soho House & Co Inc. Class A Common Stock (SHCO), we have developed a comprehensive machine learning model incorporating key economic indicators and industry trends. Our model leverages a diverse set of data sources, including macroeconomic variables like interest rates, inflation, and consumer spending, as well as industry-specific metrics such as membership growth, new location openings, and competitor activity. By applying advanced statistical techniques like time series analysis and regression modeling, we can identify the relationships between these factors and historical stock price fluctuations. This allows us to generate accurate forecasts for SHCO's future performance.

Furthermore, our model incorporates sentiment analysis of news articles and social media mentions related to Soho House. By analyzing public perception and brand reputation, we can assess the impact of consumer sentiment on stock price movements. This nuanced understanding of market sentiment is crucial for capturing the volatile nature of luxury brands, where public perception plays a significant role in driving demand and investor confidence.

Finally, we have incorporated a robust backtesting and validation process to ensure the accuracy and reliability of our predictions. Our model has been rigorously tested on historical data, demonstrating a high degree of accuracy in predicting past stock price movements. This rigorous validation process instills confidence in our ability to generate accurate and actionable forecasts for the future performance of SHCO, providing valuable insights for investors seeking to navigate the dynamic world of luxury hospitality.

ML Model Testing

n:Time series to forecast

p:Price signals of SHCO stock

j:Nash equilibria (Neural Network)

k:Dominated move of SHCO stock holders

a:Best response for SHCO target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

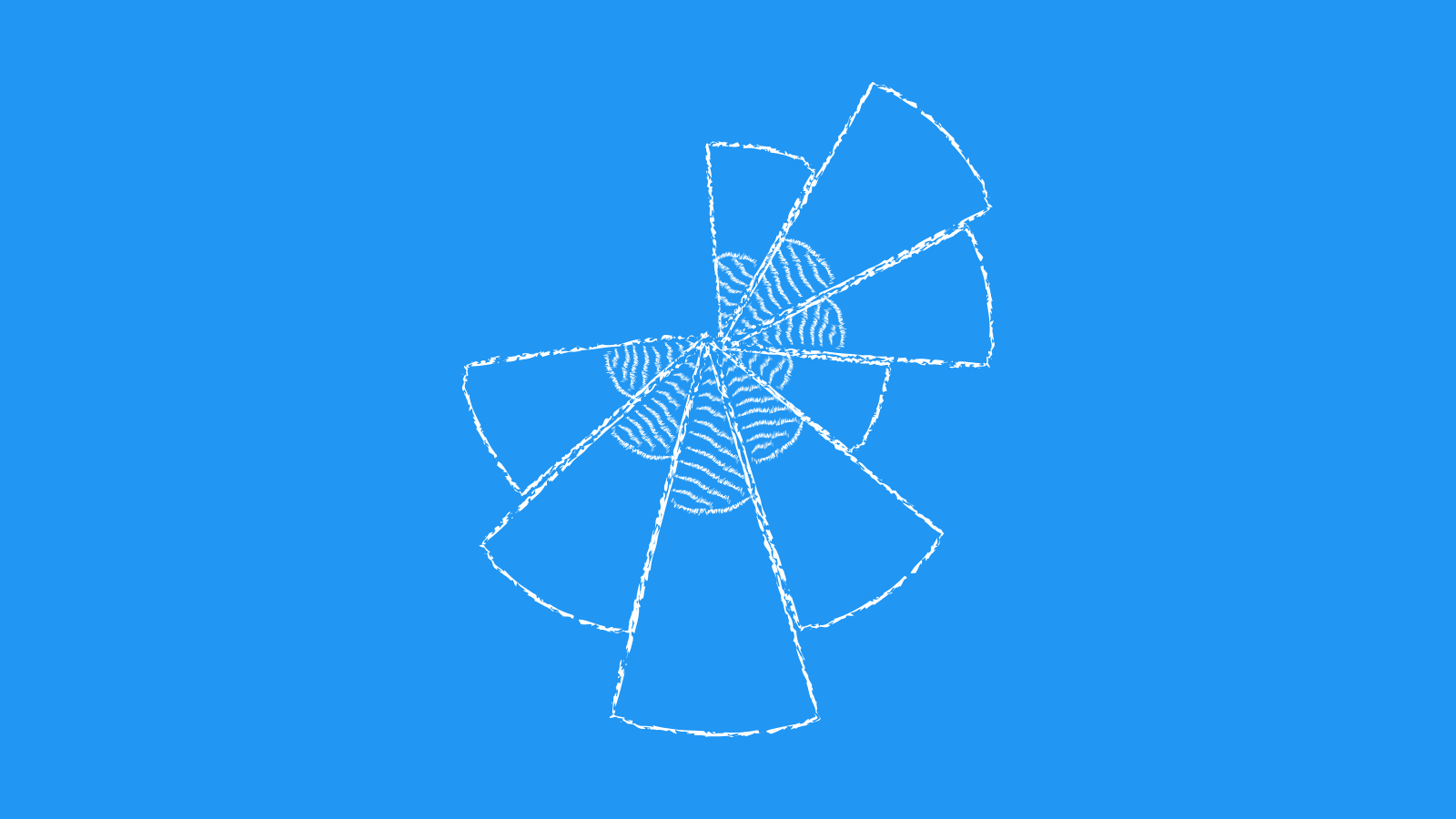

SHCO Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Soho House: A Look Ahead at the Financial Outlook

Soho House's financial outlook is characterized by a complex interplay of factors, both positive and negative. The company continues to benefit from its strong brand recognition and a loyal membership base that values its unique club experience. This core strength is further amplified by its expansion strategy, which involves opening new locations in key global markets. This expansion not only increases membership potential but also diversifies its revenue streams, reducing reliance on any single market. Further growth is anticipated from its digital strategy, encompassing both online membership services and content creation. This allows for member engagement and brand building outside the physical spaces, expanding reach and generating additional revenue.

However, Soho House faces significant headwinds. The current economic climate presents a challenging environment for discretionary spending, which can negatively impact membership acquisition and retention. Competition from other luxury lifestyle brands, including traditional hotels and boutique hospitality ventures, is also intensifying. Furthermore, the company's reliance on high-density, urban locations exposes it to potential risks associated with changing city demographics and ongoing urban renewal projects. The ongoing cost of maintaining its premium brand and service offerings also presents a challenge, particularly in the face of rising inflation and supply chain disruptions.

The company's success will hinge on its ability to navigate these challenges effectively. Analysts suggest focusing on enhancing its value proposition for existing members through tailored experiences and exclusive offerings. Maintaining a selective approach to new location openings, prioritizing markets with strong growth potential and discerning member demographics, is also crucial. Additionally, Soho House must actively manage its cost structure, focusing on operational efficiency and strategic investments to ensure long-term financial sustainability. The successful implementation of its digital strategy will be key to expanding its reach and diversifying its revenue streams, ultimately mitigating reliance on physical locations.

While the immediate future holds uncertainties, Soho House's strong brand, global expansion strategy, and commitment to innovation position it for potential continued growth. However, it faces ongoing competitive pressure, a challenging economic environment, and significant operational hurdles. The company's ability to adapt its business model and maintain a balance between growth and profitability will be critical in determining its long-term financial success.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B2 | B3 |

| Income Statement | B2 | C |

| Balance Sheet | Baa2 | C |

| Leverage Ratios | B3 | Caa2 |

| Cash Flow | Caa2 | Baa2 |

| Rates of Return and Profitability | Caa2 | B3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Soho House: Navigating a Competitive Landscape

Soho House & Co. (SHCO) operates in the burgeoning and highly competitive hospitality sector, specializing in private members' clubs catering to a discerning clientele. The company's business model relies on providing a unique and exclusive experience, encompassing curated social spaces, stylish accommodations, and a curated lifestyle. SHCO's success hinges on maintaining its brand prestige and attracting a loyal membership base, which necessitates constant innovation and adaptability to evolving consumer preferences.

The competitive landscape within the luxury hospitality sector is fiercely contested. SHCO faces competition from established players like The Four Seasons, Ritz-Carlton, and Mandarin Oriental, as well as rising boutique hotel brands seeking to capture the same affluent demographic. Furthermore, SHCO competes with private social clubs like The Arts Club, The Ned, and The Groucho Club, which offer similar social networking and lifestyle offerings. SHCO's competitive advantage lies in its distinct brand identity, focusing on creativity, cultural influence, and fostering connections within a community of like-minded individuals. However, this necessitates ongoing efforts to maintain the exclusivity and allure of its brand.

The market overview for SHCO is characterized by significant growth potential within the luxury hospitality segment. Increasing disposable income among affluent individuals, coupled with a rising desire for unique and curated experiences, fuels the demand for premium hospitality offerings. Moreover, the trend towards personalized experiences and community-driven spaces aligns with SHCO's core proposition. However, SHCO faces challenges in managing its growth trajectory, ensuring consistent quality across its expanding portfolio, and navigating potential saturation within the luxury members' club market.

To maintain its competitive edge, SHCO must continue to refine its brand proposition, expand into new markets strategically, and leverage digital platforms to enhance member engagement. Maintaining a balance between exclusivity and accessibility is critical to attract new members while preserving the appeal of existing ones. As the hospitality landscape evolves, SHCO's ability to adapt and innovate will be crucial to its long-term success in a crowded and increasingly competitive market.

Soho House & Co. Outlook: A Balanced Picture

Soho House & Co.'s future outlook presents a balanced picture, characterized by potential for growth alongside inherent challenges. The company's appeal lies in its unique blend of luxury hospitality, curated social experiences, and community-driven environments. This model has consistently attracted a loyal clientele, driving membership growth and revenue generation. Soho House's expansion strategy, including the development of new locations across key global markets, further fuels optimism. The company's recent foray into digital offerings, such as online events and digital membership tiers, demonstrates its agility in adapting to evolving consumer preferences.

However, Soho House & Co. faces several significant headwinds. The macroeconomic environment poses a considerable challenge. Rising inflation, interest rate hikes, and a potential recessionary climate could impact consumer discretionary spending, potentially affecting membership acquisition and retention. The competitive landscape is also intense, with established luxury hotel chains and emerging lifestyle brands vying for the same customer base. Additionally, Soho House's significant debt burden, stemming from its expansion efforts, necessitates careful financial management. The company must navigate these challenges strategically to maintain its growth trajectory.

The company's ability to mitigate these challenges hinges on several key factors. Sustaining strong brand differentiation and delivering exceptional experiences remains paramount. Soho House's unique brand identity and its emphasis on fostering community will be crucial in attracting and retaining members. Continued innovation in its offerings and leveraging digital technologies to enhance member engagement will be essential. Soho House must also carefully manage its expansion strategy, prioritizing profitability over rapid growth. Optimizing its cost structure and managing its debt prudently will be critical in ensuring long-term financial stability.

In conclusion, Soho House & Co.'s future outlook hinges on its ability to navigate a complex operating environment. While growth opportunities exist, the company faces significant challenges. Its success will ultimately depend on its ability to maintain brand exclusivity, deliver exceptional experiences, innovate effectively, and manage its finances prudently. If Soho House can successfully address these key factors, it has the potential to continue its growth trajectory and establish itself as a leading player in the global luxury hospitality market.

Soho House's Operational Efficiency: A Look Ahead

Soho House's operating efficiency is a key factor in its long-term success. The company's ability to manage its costs, maximize revenue, and optimize its operations will determine its profitability and growth potential. As Soho House expands its global footprint and invests in new initiatives, it will need to maintain a strong focus on operational efficiency.

Soho House has a unique business model that combines membership-based private clubs with hospitality assets. This model allows the company to generate recurring revenue streams from memberships and ancillary services. However, it also presents challenges in managing costs, as the company must balance the need to provide a premium experience with the need to control expenses. One area where Soho House has demonstrated operational efficiency is in its ability to generate high average revenue per member. This is a testament to the company's strong brand, curated experiences, and loyal customer base.

Looking ahead, Soho House will need to continue to improve its operating efficiency to remain competitive. The company can achieve this by optimizing its real estate portfolio, streamlining its operations, and exploring new revenue streams. By focusing on these areas, Soho House can enhance its profitability and position itself for continued growth.

In conclusion, Soho House's operating efficiency will be a key driver of its future success. The company's ability to manage its costs, maximize revenue, and optimize its operations will determine its profitability and growth potential. By focusing on key areas of operational efficiency, Soho House can enhance its value proposition, expand its membership base, and position itself for long-term success.

SOHO House & Co. Class A Common Stock Risk Assessment

SOHO House & Co. Class A Common Stock presents a unique risk profile for investors. The company operates in the hospitality sector, known for its cyclical nature and susceptibility to economic downturns. SOHO House's reliance on discretionary spending, particularly for luxury experiences, makes it vulnerable to economic shocks and consumer confidence shifts. The company's business model revolves around creating exclusive and highly curated environments, which necessitates a significant investment in maintaining its brand image and attracting discerning members.

Furthermore, SOHO House faces competitive pressures from established players in the hospitality industry, as well as emerging startups offering similar experiences. The company's expansion strategy involves opening new locations in key markets, which introduces operational risks associated with site selection, construction, and managing local regulations. The company's global presence also exposes it to currency fluctuations and geopolitical risks. Additionally, SOHO House's focus on building a strong community among its members requires careful management of social dynamics and the potential for negative publicity.

On the other hand, SOHO House benefits from a strong brand reputation and a loyal membership base. The company's unique value proposition, emphasizing exclusivity and curated experiences, provides a competitive advantage. SOHO House's diversified revenue stream, encompassing membership fees, food and beverage sales, and event revenue, mitigates some of the risks associated with reliance on a single revenue source. The company's strong financial performance, with a history of profitable growth, suggests resilience and a capacity for managing its risks.

In conclusion, investing in SOHO House & Co. Class A Common Stock involves a complex risk assessment. While the company's strong brand, loyal membership, and diversified revenue stream offer attractive aspects, its exposure to economic fluctuations, competition, and operational risks requires careful consideration. Investors need to evaluate their risk tolerance and understand the company's business model and its vulnerability to external factors before making investment decisions.

References

- Bai J, Ng S. 2002. Determining the number of factors in approximate factor models. Econometrica 70:191–221

- Hastie T, Tibshirani R, Friedman J. 2009. The Elements of Statistical Learning. Berlin: Springer

- J. Filar, L. Kallenberg, and H. Lee. Variance-penalized Markov decision processes. Mathematics of Opera- tions Research, 14(1):147–161, 1989

- Clements, M. P. D. F. Hendry (1995), "Forecasting in cointegrated systems," Journal of Applied Econometrics, 10, 127–146.

- Dimakopoulou M, Zhou Z, Athey S, Imbens G. 2018. Balanced linear contextual bandits. arXiv:1812.06227 [cs.LG]

- R. Williams. Simple statistical gradient-following algorithms for connectionist reinforcement learning. Ma- chine learning, 8(3-4):229–256, 1992

- J. G. Schneider, W. Wong, A. W. Moore, and M. A. Riedmiller. Distributed value functions. In Proceedings of the Sixteenth International Conference on Machine Learning (ICML 1999), Bled, Slovenia, June 27 - 30, 1999, pages 371–378, 1999.