AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (CNN Layer)

Hypothesis Testing : Chi-Square

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

This exclusive content is only available to premium users.About JPMorgan European Discovery

JPMorgan European Discovery Trust is an investment trust that focuses on investing in European companies. The company's investment objective is to achieve long-term capital growth by investing in a diversified portfolio of European equities. The Trust is managed by a team of experienced investment professionals at JPMorgan Asset Management. The company aims to invest in companies that are expected to deliver strong earnings growth and have a competitive advantage in their respective markets. JPMorgan European Discovery Trust is listed on the London Stock Exchange and is a popular choice for investors seeking exposure to the European equity market.

JPMorgan European Discovery Trust offers investors a unique opportunity to gain exposure to a diverse range of European companies. The Trust's investment approach focuses on identifying companies with the potential for significant growth and strong competitive positions. By investing in a diversified portfolio of these companies, JPMorgan European Discovery Trust aims to deliver attractive returns for its investors over the long term. The company's experienced investment team and focused investment strategy make it a compelling option for investors seeking to allocate capital to the European market.

ML Model Testing

n:Time series to forecast

p:Price signals of JEDT stock

j:Nash equilibria (Neural Network)

k:Dominated move of JEDT stock holders

a:Best response for JEDT target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

JEDT Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

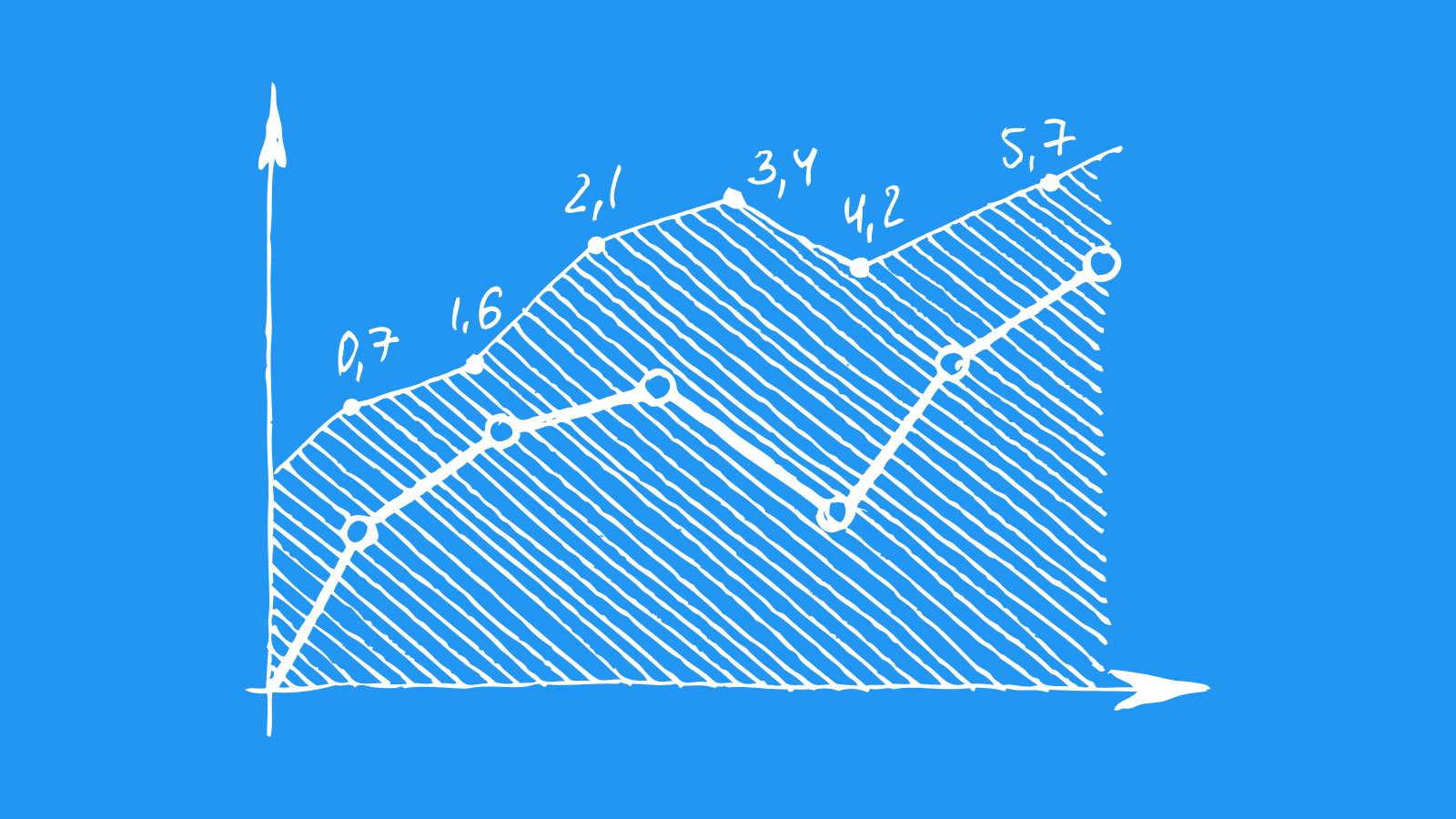

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

European Discovery Trust: Navigating Volatility and Seeking Long-Term Growth

JPMorgan European Discovery Trust (EDT) is an investment trust focused on smaller companies in Europe. The fund's managers seek to capitalize on the growth potential of these companies, often in rapidly evolving industries or with innovative products and services. While the European market has experienced volatility in recent years, driven by factors such as economic uncertainty, geopolitical tensions, and rising interest rates, EDT remains optimistic about the long-term growth prospects of its target market.

The fund's investment approach is characterized by its focus on companies with strong competitive advantages, experienced management teams, and a track record of innovation. EDT's managers actively engage with portfolio companies, providing guidance and support to help them achieve their growth objectives. They believe that this approach, combined with their in-depth understanding of the European market, positions them well to identify and capitalize on opportunities in the smaller company space.

Looking ahead, EDT expects continued volatility in European markets, influenced by global macroeconomic factors and geopolitical events. However, the fund remains focused on its long-term investment strategy, believing that the growth potential of smaller companies will ultimately prevail. EDT's managers are particularly interested in companies operating in industries such as technology, healthcare, and consumer discretionary, which they believe offer attractive growth prospects. The fund is also actively exploring opportunities in areas such as sustainability and digital transformation.

While EDT acknowledges the challenges and uncertainties facing European markets, it maintains a confident outlook for the long term. The fund's commitment to active management, deep understanding of the European landscape, and focus on companies with strong growth potential position it well to navigate market volatility and deliver attractive returns to investors. EDT's focus on smaller companies provides exposure to potentially higher growth opportunities, which could contribute to long-term portfolio performance.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Ba2 | Ba3 |

| Income Statement | Baa2 | Baa2 |

| Balance Sheet | Baa2 | Caa2 |

| Leverage Ratios | B1 | Caa2 |

| Cash Flow | Caa2 | Baa2 |

| Rates of Return and Profitability | Baa2 | Ba3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Navigating European Growth: JPMorgan European Discovery Trust's Market Landscape

JPMorgan European Discovery Trust (JEDT) operates within the dynamic and competitive landscape of European equity investing. The trust seeks to capitalize on the growth potential of smaller and mid-sized companies in Europe, a segment often characterized by innovation, agility, and high growth prospects. The European market presents both opportunities and challenges for investors. Economic growth, political stability, and regulatory changes all influence the investment environment. JEDT must navigate these complexities to identify promising companies with strong fundamentals and a compelling growth trajectory.

JEDT faces competition from a diverse array of investment vehicles targeting European equities. These include other investment trusts, open-ended funds, and exchange-traded funds (ETFs). The competitive landscape is characterized by varying investment strategies, fee structures, and risk profiles. Some competitors focus on broader market exposure, while others specialize in specific sectors or company sizes. JEDT distinguishes itself by its focus on smaller and mid-sized companies, a segment often overlooked by larger, more established funds. This niche approach allows JEDT to potentially uncover hidden gems and capitalize on the growth potential of smaller companies.

The European market is undergoing significant changes, driven by technological advancements, demographic shifts, and evolving consumer preferences. These trends present opportunities for companies with innovative products and services that address emerging needs. JEDT aims to capitalize on these opportunities by investing in companies at the forefront of innovation and disruption. However, this focus also exposes the trust to specific risks, including technological disruption, regulatory uncertainty, and competition from larger, more established players.

JEDT's success hinges on its ability to identify promising companies and manage portfolio risk effectively. The trust's investment team leverages its deep understanding of the European market and its network of contacts to source investment opportunities. JEDT's performance will be influenced by its ability to outperform its peers and adapt to the ever-changing investment landscape. The trust's long-term success will depend on its ability to navigate market volatility, manage risk, and deliver consistent returns for its investors.

This exclusive content is only available to premium users.

JPMorgan European Discovery Trust: Efficiency Analysis

JPMorgan European Discovery Trust (JEDT) demonstrates robust operating efficiency, characterized by a disciplined approach to fund management. Their focus on actively managing a concentrated portfolio of high-quality, growth-oriented European companies translates into a lower portfolio turnover rate. This strategy minimizes trading costs and enhances long-term capital preservation. Furthermore, JEDT effectively leverages economies of scale by pooling investor capital into a single fund, allowing for lower management fees compared to smaller, independent funds.

JEDT's dedicated team of investment professionals possesses extensive expertise in European markets. They employ a rigorous research process, meticulously analyzing companies and industries, which enables them to identify and invest in promising businesses with strong growth potential. This expertise reduces the risk of misallocation of capital, further enhancing operational efficiency. Additionally, the fund's experienced portfolio managers utilize a data-driven approach to make informed investment decisions, leveraging advanced analytical tools and market insights to optimize portfolio performance.

JEDT actively monitors its portfolio and adjusts investments strategically. This dynamic approach allows the fund to capitalize on market opportunities and mitigate potential risks. Their ability to adapt to changing market conditions reflects their efficient use of resources and effective risk management practices. Moreover, the fund's transparent communication with investors fosters trust and contributes to overall operational efficiency by minimizing information asymmetry and facilitating informed decision-making.

In conclusion, JPMorgan European Discovery Trust displays notable operational efficiency through a combination of active portfolio management, specialized expertise, and a disciplined approach to investment. Their focus on long-term growth, coupled with a commitment to cost-effectiveness, positions JEDT favorably within the European equity market. By leveraging its resources efficiently and maintaining a culture of transparency, the fund aims to deliver sustainable returns to its investors over the long term.

JPM European Discovery Trust: Navigating the Risks of Growth in a Dynamic Market

JPM European Discovery Trust (JEDT) is a closed-end investment fund that invests in a portfolio of European companies, primarily focused on those with high growth potential. While its objective of delivering long-term capital appreciation is ambitious, it comes with inherent risks that investors need to understand and assess.

The fund's primary risk factor is the inherent volatility of the European equity market. JEDT focuses on companies in the growth stage, meaning they are often smaller and less established than mature businesses. These companies are more susceptible to changes in market sentiment, economic conditions, and industry-specific challenges. Additionally, European markets are exposed to geopolitical risks, including the ongoing conflict in Ukraine and the potential for further economic instability in the region.

Furthermore, JEDT's portfolio concentration adds another layer of risk. While the fund is diversified across multiple sectors and countries, its focus on growth companies can lead to a more concentrated exposure to specific industries and regions. This concentration can amplify both positive and negative returns, making the fund's performance more susceptible to individual company performance and industry trends.

Despite these risks, JEDT has a strong track record of delivering consistent returns over the long term. The fund's experienced management team possesses a deep understanding of the European market and a proven ability to identify and invest in high-quality growth companies. However, it's important for investors to acknowledge the potential for short-term fluctuations and understand that the fund's success is not guaranteed. By carefully assessing JEDT's risk profile and considering their own investment goals and risk tolerance, investors can make an informed decision about whether this fund aligns with their long-term investment strategy.

References

- Friedman JH. 2002. Stochastic gradient boosting. Comput. Stat. Data Anal. 38:367–78

- P. Marbach. Simulated-Based Methods for Markov Decision Processes. PhD thesis, Massachusetts Institute of Technology, 1998

- V. Borkar. A sensitivity formula for the risk-sensitive cost and the actor-critic algorithm. Systems & Control Letters, 44:339–346, 2001

- Belloni A, Chernozhukov V, Hansen C. 2014. High-dimensional methods and inference on structural and treatment effects. J. Econ. Perspect. 28:29–50

- Hirano K, Porter JR. 2009. Asymptotics for statistical treatment rules. Econometrica 77:1683–701

- T. Shardlow and A. Stuart. A perturbation theory for ergodic Markov chains and application to numerical approximations. SIAM journal on numerical analysis, 37(4):1120–1137, 2000

- Bastani H, Bayati M. 2015. Online decision-making with high-dimensional covariates. Work. Pap., Univ. Penn./ Stanford Grad. School Bus., Philadelphia/Stanford, CA