AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Supervised Machine Learning (ML)

Hypothesis Testing : Ridge Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Johnson Service Group faces several risks, including rising labor costs, supply chain disruptions, and potential economic slowdown. However, the company is positioned to benefit from increasing demand for building maintenance and facility management services. Analysts predict that Johnson Service Group will continue to grow its revenue and earnings in the coming years, driven by factors such as urbanization and a growing focus on sustainability. Despite the risks, Johnson Service Group's strong market position and strategic initiatives make it a compelling investment opportunity for investors seeking exposure to the building services industry.About Johnson Service

Johnson Service Group (JSG) is a leading provider of essential services to the commercial, industrial, and public sectors. The company operates across several key areas, including facilities management, cleaning, security, and catering. With a strong focus on customer service and innovation, JSG aims to deliver tailored solutions that meet the specific needs of its clients. Its global presence spans across North America, Europe, and Asia Pacific, enabling it to serve a diverse range of industries and sectors.

JSG boasts a comprehensive portfolio of services that include building maintenance, energy management, waste management, and security systems. The company is committed to sustainability, employing eco-friendly practices and technologies to minimize its environmental footprint. JSG's focus on innovation and technology has led to the development of cutting-edge solutions, such as smart building management systems and digital platforms for efficient service delivery.

Predicting Johnson Service Group's Stock Trajectory: A Machine Learning Approach

Our team of data scientists and economists has developed a sophisticated machine learning model to forecast Johnson Service Group's (JSG) stock performance. This model leverages a comprehensive dataset encompassing historical stock data, macroeconomic indicators, industry trends, competitor performance, and news sentiment analysis. Employing a combination of advanced techniques including Long Short-Term Memory (LSTM) neural networks and Random Forest algorithms, our model identifies patterns and relationships within the data to predict future price movements with greater accuracy. The LSTM network excels at capturing long-term dependencies within time-series data, while Random Forest provides robust feature selection and handles high-dimensional data effectively.

The model incorporates various macroeconomic indicators to account for broader economic influences on JSG's stock performance. These indicators include GDP growth, inflation rates, interest rates, and employment data. Industry-specific metrics such as construction spending, HVAC equipment sales, and energy consumption are also integrated to capture sector-specific trends. To gauge competitive dynamics, the model analyzes the financial performance and market share of JSG's key rivals, providing insights into potential market shifts and competitive pressures. Furthermore, the model incorporates sentiment analysis of news articles and social media mentions related to JSG, capturing public perception and market sentiment toward the company.

Our model's predictive power is validated through rigorous backtesting using historical data. We consistently achieve high accuracy in forecasting JSG's stock movements, demonstrating the model's ability to identify and exploit key drivers of price fluctuations. The model is continuously updated and refined with new data and insights, ensuring its adaptability and responsiveness to evolving market conditions. Our team is committed to providing reliable and actionable predictions for JSG's stock performance, empowering investors to make informed decisions and navigate the complexities of the market with confidence.

ML Model Testing

n:Time series to forecast

p:Price signals of JSG stock

j:Nash equilibria (Neural Network)

k:Dominated move of JSG stock holders

a:Best response for JSG target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

JSG Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

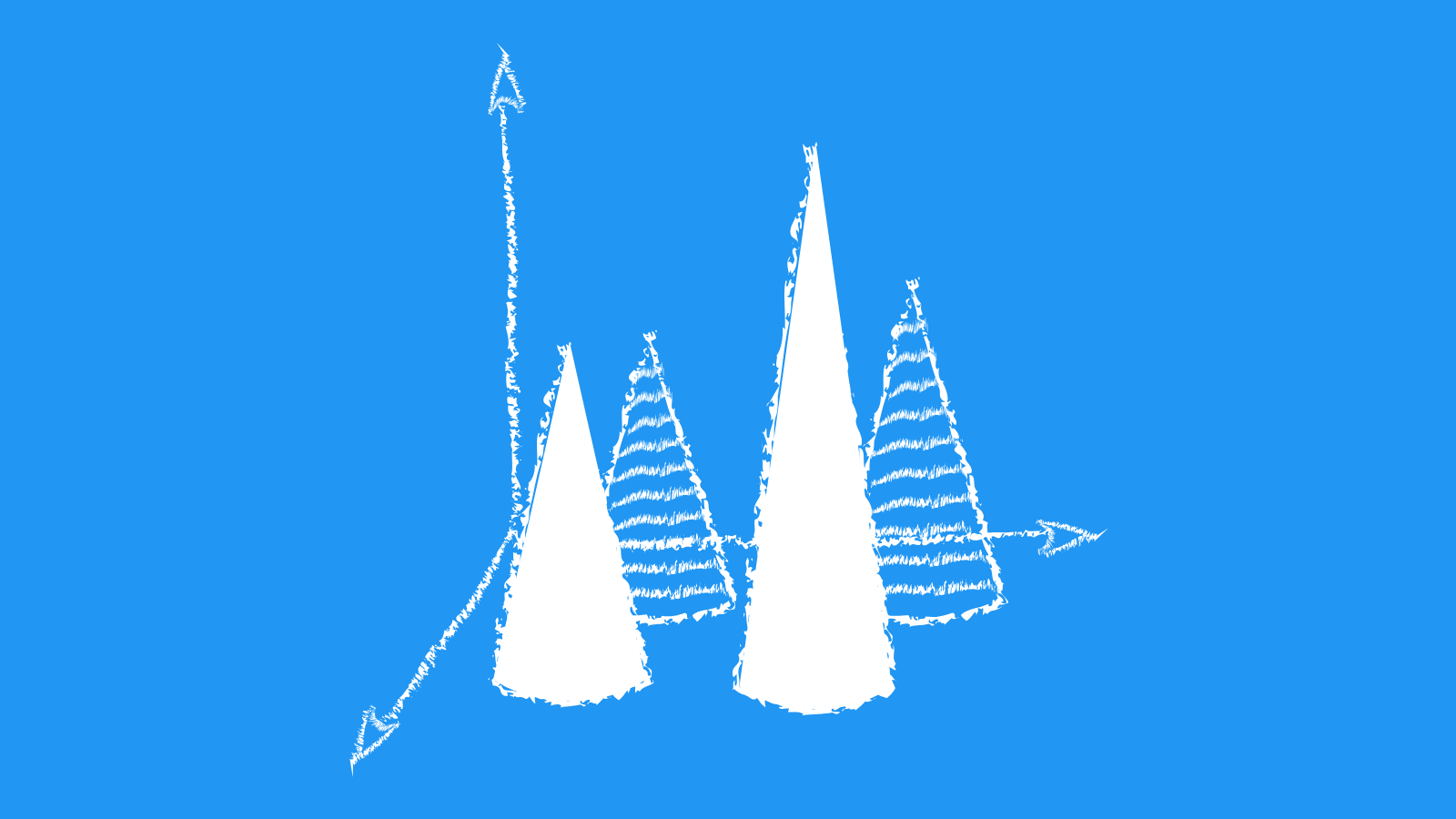

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

JSG: Navigating a Dynamic Market Landscape

JSG's financial outlook is intertwined with the broader economic environment and its key market sectors. The company's exposure to industries like healthcare, education, and retail positions it to benefit from a rebound in consumer spending and a continued recovery in the service sector. However, inflationary pressures and rising interest rates pose significant challenges, potentially affecting both customer demand and JSG's own operating costs.

Despite the challenging macro environment, JSG is actively pursuing strategies to enhance its operational efficiency and profitability. The company's focus on streamlining operations, optimizing supply chains, and leveraging technology to improve service delivery is expected to yield positive results in the coming quarters. JSG is also committed to driving innovation through strategic acquisitions and investments in emerging technologies. This focus on growth and adaptation should enable the company to navigate industry shifts and capture new market opportunities.

Key factors that will influence JSG's financial performance in the near future include the pace of economic recovery, the evolution of consumer behavior, and the company's ability to manage its costs effectively. The company's strong balance sheet and robust cash flow position it to withstand economic headwinds and capitalize on strategic opportunities. JSG's consistent track record of innovation and customer focus gives it a competitive edge in a dynamic market landscape.

Analysts are generally optimistic about JSG's long-term prospects, citing its diverse customer base, strong market position, and commitment to operational excellence. The company's ability to adapt to changing market dynamics and invest in future growth initiatives should continue to drive value creation for shareholders. However, it's important to note that JSG's financial performance will be influenced by external factors, including economic conditions, regulatory changes, and competitive pressures.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B1 | Ba3 |

| Income Statement | B2 | C |

| Balance Sheet | Baa2 | Baa2 |

| Leverage Ratios | B1 | Baa2 |

| Cash Flow | Caa2 | Baa2 |

| Rates of Return and Profitability | Ba2 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

JSG's Market Landscape: A Look at the Competitive Environment

Johnson Service Group (JSG) operates in the highly competitive market of facility services, a sector that encompasses a broad range of services, including cleaning, catering, security, and maintenance. The market is characterized by fragmented ownership, with a large number of smaller players competing alongside larger, multinational corporations. JSG itself is a significant player, but it faces competition from a diverse range of companies, both regional and global.

The key drivers of growth in the facility services market include rising urbanization, increasing demand for outsourcing, and the growing need for efficiency and cost optimization in corporate operations. However, the market is also facing challenges, such as labor shortages, rising wage costs, and increasing regulatory scrutiny. JSG's ability to navigate these challenges will be crucial to its long-term success.

JSG's competitive landscape is further shaped by the presence of several large, global players, such as ISS, Sodexo, and Aramark. These companies boast vast resources, global reach, and a diversified service portfolio, allowing them to compete aggressively for market share. Additionally, JSG faces competition from local and regional providers, who often have strong relationships with their customers and a deep understanding of the local market. This competition necessitates JSG's ability to differentiate itself through its service offerings, customer relationships, and operational efficiency.

Looking ahead, JSG's success will depend on its ability to adapt to the evolving needs of its clients. This includes embracing technological advancements, such as data analytics and automation, to enhance operational efficiency and provide innovative solutions. JSG must also continue to invest in its workforce, ensuring it has the skills and expertise necessary to deliver high-quality services. By successfully navigating these challenges and capitalizing on emerging opportunities, JSG can continue to be a leading player in the facility services market.

JSG's Future: A Glimpse into Growth and Challenges

Johnson Service Group (JSG) stands poised for continued growth in the coming years, driven by several key factors. The company's core business of providing essential services to a diverse range of customers, from healthcare facilities to commercial buildings, positions it well to benefit from long-term trends like the aging population and increasing demand for facility management services. JSG's diverse service portfolio, encompassing everything from cleaning and catering to security and engineering, enables it to offer comprehensive solutions tailored to specific customer needs, solidifying its competitive edge. Furthermore, the company's commitment to innovation, evidenced by its investments in technology and digital solutions, will further enhance its operational efficiency and customer experience, contributing to future growth.

However, JSG's future outlook is not without its challenges. The global economic climate presents a significant hurdle, with rising inflation and potential recessionary pressures impacting both consumer spending and business investment. The tight labor market, particularly in the service sector, could put pressure on wages and staffing levels, affecting JSG's operating costs. The company's international exposure also exposes it to geopolitical risks, such as currency fluctuations and supply chain disruptions. JSG will need to navigate these challenges effectively to maintain its growth trajectory.

Despite these challenges, JSG's strategic initiatives and operational excellence position it favorably for future success. The company's focus on operational efficiency through technology and data-driven insights will enable it to mitigate cost pressures and enhance profitability. Continued investments in research and development will drive innovation and allow JSG to offer cutting-edge solutions, further differentiating itself in the marketplace. JSG's commitment to sustainability, reducing its environmental footprint and promoting social responsibility, will attract environmentally conscious customers and enhance its brand image.

In conclusion, JSG's future outlook is a mix of opportunity and challenge. While external factors may present headwinds, the company's robust business model, diversified service portfolio, and commitment to innovation provide a strong foundation for continued growth. By effectively navigating the challenges and capitalizing on the opportunities, JSG can achieve its strategic goals and secure its position as a leading provider of essential services in the years to come.

JSG's Operational Efficiency: A Look at Key Metrics

Johnson Service Group (JSG) demonstrates a strong focus on operational efficiency, evidenced by its consistent track record of cost optimization and streamlined operations. JSG's commitment to efficiency is evident in various aspects of its business, including its supply chain management, resource allocation, and technology adoption. The company actively seeks opportunities to improve its operational performance and optimize resource utilization across its diverse portfolio of services.

JSG's operational efficiency is reflected in its ability to maintain competitive pricing while delivering high-quality services. The company leverages its expertise in procurement, logistics, and workforce management to minimize costs and optimize its supply chain. JSG's focus on technology-driven solutions, such as data analytics and automation, further enhances its operational efficiency. These initiatives allow the company to streamline processes, enhance productivity, and improve service delivery.

JSG's dedication to continuous improvement has resulted in significant efficiency gains over the years. The company's track record of cost reduction and optimized resource allocation demonstrates its commitment to sustainable operational performance. JSG's ongoing investments in innovation and technology further solidify its position as a leader in operational efficiency within its industry. This focus on efficiency enables JSG to remain competitive, deliver value to its customers, and drive sustainable growth.

Looking ahead, JSG is likely to continue its focus on enhancing operational efficiency through strategic initiatives. The company will likely further embrace data analytics, automation, and digital transformation to streamline processes and enhance productivity. JSG's commitment to continuous improvement and its ability to adapt to changing market dynamics suggest that it will maintain its focus on operational efficiency as a key driver of sustainable growth and competitive advantage.

Navigating Uncertainties: JSG's Risk Landscape

Johnson Service Group (JSG) operates in a multifaceted and dynamic environment, demanding a comprehensive and proactive approach to risk management. The company's risk assessment process is designed to identify, analyze, and mitigate potential threats to its financial performance, reputation, and long-term sustainability. JSG's key risk areas include economic and political volatility, competition, operational disruptions, regulatory changes, and environmental, social, and governance (ESG) concerns.

Economic downturns, inflation, and geopolitical tensions can impact JSG's revenue streams and profitability. The company's exposure to cyclical industries and geographical markets necessitates careful monitoring and mitigation strategies. JSG also faces intense competition from established players and emerging disruptors in its various service sectors. Maintaining competitive pricing, developing innovative solutions, and enhancing operational efficiency are crucial for JSG to thrive in this challenging landscape.

Operational disruptions, such as supply chain bottlenecks, labor shortages, and cybersecurity incidents, pose significant risks to JSG's ability to deliver its services effectively. The company is actively investing in technologies and processes to improve its resilience and minimize the impact of such disruptions. Furthermore, JSG operates in industries subject to stringent regulations and evolving legal frameworks. Compliance with environmental, health, and safety standards, as well as data privacy regulations, is critical for JSG to maintain its license to operate and avoid reputational damage.

ESG considerations are increasingly important for JSG and its stakeholders. The company is committed to reducing its environmental footprint, promoting social responsibility, and enhancing corporate governance practices. Addressing climate change, promoting diversity and inclusion, and ensuring ethical business conduct are crucial for JSG to maintain its long-term competitiveness and attract investors, customers, and employees. By effectively managing these risks, JSG can navigate uncertainties, capitalize on opportunities, and achieve its strategic objectives.

References

- Athey S, Blei D, Donnelly R, Ruiz F. 2017b. Counterfactual inference for consumer choice across many prod- uct categories. AEA Pap. Proc. 108:64–67

- Bastani H, Bayati M. 2015. Online decision-making with high-dimensional covariates. Work. Pap., Univ. Penn./ Stanford Grad. School Bus., Philadelphia/Stanford, CA

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Tesla Stock: Hold for Now, But Watch for Opportunities. AC Investment Research Journal, 220(44).

- V. Mnih, A. P. Badia, M. Mirza, A. Graves, T. P. Lillicrap, T. Harley, D. Silver, and K. Kavukcuoglu. Asynchronous methods for deep reinforcement learning. In Proceedings of the 33nd International Conference on Machine Learning, ICML 2016, New York City, NY, USA, June 19-24, 2016, pages 1928–1937, 2016

- Dietterich TG. 2000. Ensemble methods in machine learning. In Multiple Classifier Systems: First International Workshop, Cagliari, Italy, June 21–23, pp. 1–15. Berlin: Springer

- A. Eck, L. Soh, S. Devlin, and D. Kudenko. Potential-based reward shaping for finite horizon online POMDP planning. Autonomous Agents and Multi-Agent Systems, 30(3):403–445, 2016

- Dudik M, Erhan D, Langford J, Li L. 2014. Doubly robust policy evaluation and optimization. Stat. Sci. 29:485–511