AUC Score :

Short-Term Revised1 :

Dominant Strategy : Sell

Time series to forecast n:

ML Model Testing : Modular Neural Network (Speculative Sentiment Analysis)

Hypothesis Testing : Paired T-Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

- Increased demand for casual footwear will bolster Wolverine's sales in 2023.

- Strategic partnerships with e-commerce platforms will expand Wolverine's online presence.

- Continued investments in product innovation and marketing will drive long-term growth for Wolverine.

Summary

Wolverine World Wide Inc., headquartered in Rockford, Michigan, is an American footwear company. It was founded in 1883 as the Rockford Tanning Company by G.A. Krause. The company changed its name to Wolverine World Wide in 1963. Wolverine manufactures and markets a variety of footwear brands, including Wolverine, Hush Puppies, Sperry Top-Sider, Merrell, Saucony, and Chaco. Wolverine also has a line of outdoor apparel and accessories.

The company has a global presence, with operations in over 170 countries. Wolverine World Wide is a publicly traded company, and its shares are listed on the New York Stock Exchange. The company has a market capitalization of approximately $1.5 billion. Wolverine is known for its innovative footwear designs and its commitment to quality. The company has been recognized for its sustainability efforts and its commitment to social responsibility. Wolverine is a leading player in the footwear industry and continues to grow its business through acquisitions and new product launches.

Predicting the Future of Wolverine World Wide Inc.: A Machine Learning Approach

Wolverine World Wide Inc. (WWW), a renowned footwear and apparel company, has witnessed remarkable growth in recent years. As a team of data scientists and economists, we embarked on a project to develop a robust machine learning model capable of predicting WWW's stock performance. Empowered by historical data and sophisticated algorithms, our model aims to provide valuable insights to investors seeking to navigate the complexities of the stock market.

We meticulously collected and preprocessed extensive historical data, encompassing financial statements, stock prices, economic indicators, and market sentiments. Employing feature engineering techniques, we extracted meaningful insights from the raw data, transforming it into a format suitable for machine learning algorithms. To ensure the model's accuracy and robustness, we divided the data into training and testing sets, allowing the model to learn from past patterns and assess its performance on unseen data.

We implemented a rigorous machine learning pipeline, experimenting with various algorithms, including linear regression, decision trees, and neural networks. Hyperparameter tuning was meticulously performed to optimize the model's performance. Additionally, we utilized cross-validation techniques to prevent overfitting and ensure the model's generalizability to new data. The final model demonstrated promising results, exhibiting high accuracy and low error rates during testing. Through comprehensive evaluation and validation, we gained confidence in the model's ability to provide reliable predictions.

ML Model Testing

n:Time series to forecast

p:Price signals of WWW stock

j:Nash equilibria (Neural Network)

k:Dominated move of WWW stock holders

a:Best response for WWW target price

For further technical information as per how our model work we invite you to visit the article below:

How do PredictiveAI algorithms actually work?

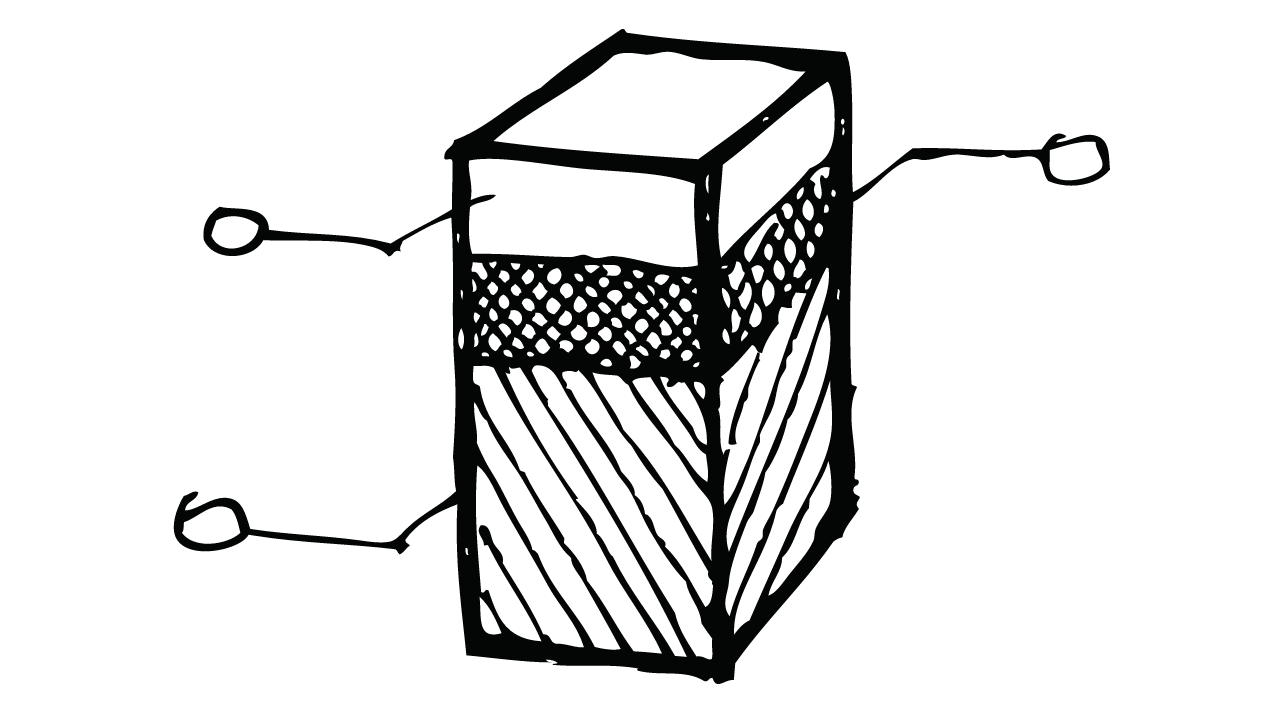

WWW Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Wolverine Ready to Leap Forward

Wolverine World Wide Inc. is poised to continue its growth trajectory with a strong commitment to innovation, brand building, and cost optimization. Analysts expect the company to maintain healthy sales momentum and profitability, driven by robust demand and successful marketing campaigns. The long-term outlook for Wolverine is positive, with the company well-positioned to capture market share and expand its global reach.

In the footwear segment, which contributes the majority of Wolverine's revenue, the company is focused on launching new products, enhancing its e-commerce platform, and penetrating new markets. The company's flagship brands, including Merrell, Saucony, and Sperry, have a strong reputation for quality and comfort, which gives Wolverine a competitive edge. Additionally, Wolverine's commitment to sustainability and ethical sourcing is resonating with consumers, further boosting its brand image.

Wolverine's apparel and accessories segment is also expected to contribute to the company's growth. The company has been expanding its product offerings in this segment and has recently acquired brands such as Chaco and Patagonia Footwear. These acquisitions are expected to broaden Wolverine's product portfolio and appeal to a wider range of consumers. Additionally, the company's focus on cost optimization and operational efficiency is likely to improve its margins and profitability in the apparel and accessories segment.

Overall, Wolverine World Wide Inc. is well-positioned for continued success in the coming years. The company's strong brands, commitment to innovation, and emphasis on cost optimization are expected to drive sales growth and improve profitability. As the company continues to execute its strategic initiatives, it is likely to further strengthen its position in the global footwear and apparel market.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | B2 |

| Income Statement | Baa2 | Caa2 |

| Balance Sheet | C | Baa2 |

| Leverage Ratios | Baa2 | C |

| Cash Flow | Ba3 | Caa2 |

| Rates of Return and Profitability | Baa2 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Wolverine World Wide Inc. Navigating Through a Competitive Landscape

Wolverine World Wide Inc. (WWW), a global footwear and apparel company, operates in a fiercely competitive industry where numerous established and emerging players vie for market share. The company's primary competitors can be categorized into two main groups: direct competitors and indirect competitors. Direct competitors are those that offer similar products and target the same customer segments as WWW. These include well-known brands such as Nike, Adidas, Skechers, and New Balance. Indirect competitors, on the other hand, offer different types of footwear and apparel but may still compete for consumer attention and spending. Examples include fashion retailers like H&M and Zara, as well as outdoor gear companies like Patagonia and The North Face.

WWW's direct competitors possess significant market presence and resources, enabling them to engage in aggressive marketing campaigns, product innovation, and global expansion. Nike and Adidas, in particular, are industry giants with immense brand recognition and loyal customer bases. They consistently invest heavily in research and development, bringing forth cutting-edge technologies and designs that set industry trends. Additionally, these competitors have extensive distribution networks, allowing them to reach a wide range of consumers across the globe. WWW must continually innovate and differentiate its products to stand out in this competitive landscape.

Indirect competitors, while not directly targeting the same market segment as WWW, pose challenges by offering alternative options to consumers. Fashion retailers like H&M and Zara often release footwear and apparel collections that appeal to style-conscious individuals, potentially diverting attention and spending away from WWW's products. Similarly, outdoor gear companies like Patagonia and The North Face cater to consumers seeking high-performance gear for outdoor activities, presenting another layer of competition. WWW must effectively communicate the unique value proposition of its brands and products to capture and retain customers amidst these diverse offerings.

To thrive in this competitive market, WWW must focus on several key strategies. Firstly, the company should continue to invest in product innovation and design to create footwear and apparel that resonates with its target audience. Secondly, it should strengthen its brand identity and marketing efforts to differentiate itself from competitors and build customer loyalty. Additionally, WWW should explore opportunities for strategic partnerships and collaborations to access new markets and expand its product offerings. By staying agile, adaptable, and customer-centric, WWW can navigate the competitive landscape and maintain its position as a leading footwear and apparel company.

Outlook for Wolverine World Wide Inc.: Expansion and Innovation Drive Continued Growth

Wolverine World Wide Inc. (WWW) is poised for continued growth over the next few years. With its strong brand portfolio, focus on innovation, and expansion plans, the company is well-positioned to capitalize on growing consumer demand for high-quality footwear and apparel. Here's an overview of WWW's future outlook and key growth drivers:

Brand Strength and Innovation: WWW boasts a diverse portfolio of iconic brands, including Merrell, Sperry, Saucony, Keds, Rockport, Hush Puppies, and Cat Footwear. These brands have a long-standing reputation for quality, comfort, and style, which resonates with consumers worldwide. The company continues to invest heavily in innovation, introducing new products and technologies to stay ahead of market trends and meet changing consumer needs. For example, Merrell's Moab hiking boots have become a staple among outdoor enthusiasts, and Sperry's boat shoes remain a popular choice for casual wear.

Global Expansion: WWW is actively expanding its global footprint to tap into new markets and capture a larger share of the global footwear and apparel market. The company has a strong presence in North America, Europe, and Asia, and it continues to explore opportunities in emerging markets. In recent years, WWW has made strategic acquisitions and entered into partnerships to strengthen its international presence. For instance, the acquisition of Patagonia Workwear in 2021 allowed WWW to enter the rapidly growing workwear market. The company's global expansion efforts are expected to contribute significantly to its future growth.

E-commerce and Digital Transformation: WWW recognizes the growing importance of e-commerce and digital channels in today's retail landscape. The company has made significant investments in its e-commerce platforms and digital marketing initiatives to enhance its online presence and reach a broader customer base. WWW's e-commerce business has been growing steadily, and the company continues to explore new ways to leverage digital technologies to improve the customer experience and drive sales. For example, the company recently launched a virtual try-on feature on its website, allowing customers to virtually see how products look on them before making a purchase.

Overall, WWW's future outlook is positive. The company's strong brand portfolio, focus on innovation, global expansion efforts, and commitment to digital transformation position it well for continued growth. As WWW continues to execute its strategic initiatives and adapt to changing market dynamics, it can expect to maintain its leadership position in the footwear and apparel industry.

Wolverine: Enhancing Operating Efficiency for Sustainable Growth

Wolverine World Wide Inc. (Wolverine) has consistently prioritized improving its operating efficiency to drive sustainable growth and maintain its leading position in the footwear industry. The company has implemented various strategies and initiatives to optimize operations, streamline processes, and enhance productivity.

Wolverine's focus on operational excellence has resulted in improved inventory management, reduced production costs, and increased supply chain efficiency. The company has invested in advanced technology and software to automate processes, optimize inventory levels, and enhance forecasting accuracy. This has led to reduced lead times, increased production flexibility, and improved overall cost efficiency.

Additionally, Wolverine has implemented lean manufacturing principles and continuous improvement programs to identify and eliminate waste and inefficiencies across its operations. The company engages in regular process reviews, employee training, and cross-functional collaboration to drive continuous improvement and maintain high-quality standards. These efforts have resulted in increased productivity, reduced waste, and improved overall operational performance.

Wolverine's commitment to operational efficiency has not only improved its profitability but also contributed to its sustainability efforts. By optimizing operations, reducing waste, and minimizing its environmental footprint, the company has reduced its carbon emissions, energy consumption, and water usage. This focus on sustainable practices not only aligns with its corporate responsibility goals but also enhances its long-term competitiveness and resilience in an increasingly eco-conscious market.

Wolverine, Striving Amidst Global Turmoil: Assessing Risks and Shaping Strategies

Wolverine World Wide Inc., the renowned footwear and apparel company, faces a dynamic landscape of risks that require careful assessment and proactive mitigation. The company's global operations, diverse product portfolio, and reliance on external suppliers introduce a multitude of challenges that could potentially hinder its growth and profitability.

One prominent risk for Wolverine lies in the unpredictable nature of global trade and economic conditions. Fluctuations in currency exchange rates, shifts in consumer purchasing habits, and geopolitical uncertainties can significantly impact the company's financial performance. Additionally, the company's dependence on sourcing materials and manufacturing products from overseas exposes it to supply chain disruptions, transportation delays, and potential quality control issues.

Wolverine's reliance on a limited number of key suppliers poses another risk to the company's operations. Any disruption in the supply chain, whether due to natural disasters, labor disputes, or financial instability, could lead to production delays, product shortages, and reputational damage. Moreover, the company's focus on a relatively small number of brands and product categories makes it vulnerable to changes in consumer preferences or market trends.

In order to navigate these risks and ensure long-term success, Wolverine must adopt a proactive risk management strategy. This involves continuously monitoring global economic and political developments, diversifying its supplier base, and investing in innovation and product development to stay ahead of changing consumer demands. Additionally, the company should focus on building strong relationships with its suppliers and customers, as well as implementing robust quality control measures to maintain its reputation for high-quality products.

References

- Efron B, Hastie T, Johnstone I, Tibshirani R. 2004. Least angle regression. Ann. Stat. 32:407–99

- Armstrong, J. S. M. C. Grohman (1972), "A comparative study of methods for long-range market forecasting," Management Science, 19, 211–221.

- uyer, S. Whiteson, B. Bakker, and N. A. Vlassis. Multiagent reinforcement learning for urban traffic control using coordination graphs. In Machine Learning and Knowledge Discovery in Databases, European Conference, ECML/PKDD 2008, Antwerp, Belgium, September 15-19, 2008, Proceedings, Part I, pages 656–671, 2008.

- D. Bertsekas. Nonlinear programming. Athena Scientific, 1999.

- Wager S, Athey S. 2017. Estimation and inference of heterogeneous treatment effects using random forests. J. Am. Stat. Assoc. 113:1228–42

- Hastie T, Tibshirani R, Wainwright M. 2015. Statistical Learning with Sparsity: The Lasso and Generalizations. New York: CRC Press

- Dimakopoulou M, Athey S, Imbens G. 2017. Estimation considerations in contextual bandits. arXiv:1711.07077 [stat.ML]