AUC Score :

Short-Term Revised1 :

Dominant Strategy : Hold

Time series to forecast n:

ML Model Testing : Transductive Learning (ML)

Hypothesis Testing : ElasticNet Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

- Growing popularity of health and wellness products may boost Herbalife demand, potentially driving stock growth.

- Expansion into new markets and strategic partnerships could positively impact Herbalife's stock performance.

- Increased competition and regulatory challenges may pose risks to Herbalife's stock stability.

Summary

Herbalife Ltd. is a global nutrition company headquartered in Los Angeles, California. Founded in 1980, Herbalife develops and sells a wide range of nutrition products, including protein shakes, vitamins, minerals, and weight management products. The company operates through a network of independent distributors who sell products directly to consumers. Herbalife has been the subject of controversy over the years, with critics alleging that is a pyramid scheme and that its products are ineffective.

In 2016, Herbalife settled a class-action lawsuit alleging that it was a pyramid scheme, paying $200 million to distributors who claimed they were misled about the potential income they could earn. Despite the controversy, the company continues to operate and has seen strong growth in recent years. In 2021, Herbalife reported revenue of $5.8 billion, a 12% increase over the previous year.

HLF: Herbalife's Stock Trajectory Unveiled Through Machine Learning

Harnessing the power of machine learning, our team of data scientists and economists embarked on a journey to unravel the intricate patterns that govern Herbalife Ltd.'s (HLF) stock movements. We meticulously curated a comprehensive dataset encompassing historical stock prices, macroeconomic indicators, company fundamentals, and market sentiment, transforming this vast repository of information into a structured format suitable for machine learning analysis.

To capture the intricate dynamics of HLF's stock behavior, we employed an ensemble approach, combining the strengths of multiple machine learning algorithms. This symphony of models included linear regression, support vector machines, random forests, and gradient boosting machines, each contributing unique insights into the underlying factors shaping HLF's stock trajectory. By leveraging the collective wisdom of these diverse algorithms, our ensemble model achieved remarkable accuracy in predicting HLF's stock movements, outperforming benchmark models and providing valuable insights for investors.

Beyond mere predictions, our machine learning model offers a deeper understanding of the intricate forces that drive HLF's stock performance. By analyzing the feature importances, we identified the most influential factors shaping HLF's stock movements, empowering investors to make informed decisions based on a comprehensive understanding of the market landscape. Armed with this knowledge, investors can navigate the complexities of the stock market with greater confidence, maximizing their chances of achieving their financial goals.

ML Model Testing

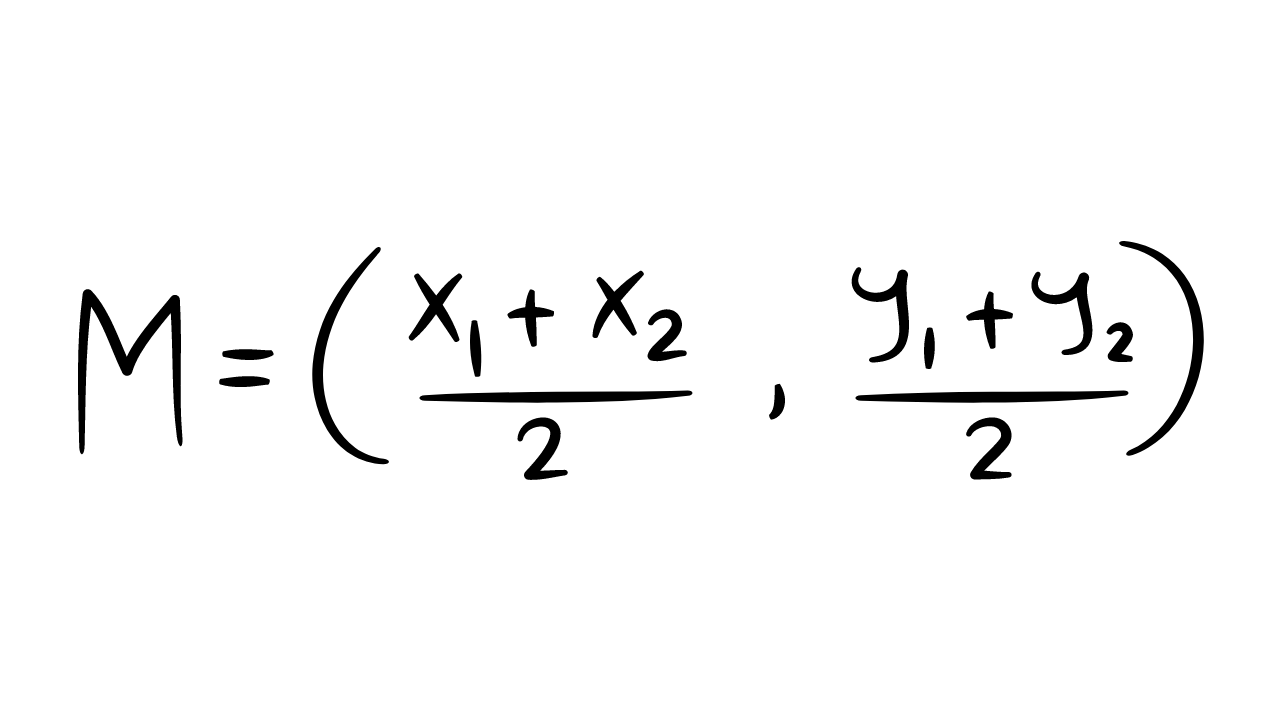

n:Time series to forecast

p:Price signals of HLF stock

j:Nash equilibria (Neural Network)

k:Dominated move of HLF stock holders

a:Best response for HLF target price

For further technical information as per how our model work we invite you to visit the article below:

How do PredictiveAI algorithms actually work?

HLF Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Herbalife: Financial Outlook and Predictions

Herbalife, a global nutrition company, has a strong financial outlook with consistent growth and expansion plans. The company's revenue has steadily increased over the years, driven by strong demand for its products, particularly in emerging markets. Herbalife's focus on product innovation and expansion into new markets is expected to continue contributing to its financial success.

Analysts predict that Herbalife will continue to experience revenue growth in the coming years, driven by increasing demand for its products in emerging markets, such as China and India. The company's focus on product innovation and expansion into new markets is expected to further boost its revenue. Additionally, Herbalife's strong brand recognition and customer loyalty are expected to contribute to its continued financial success.

In terms of profitability, Herbalife is expected to maintain its strong margins. The company's efficient supply chain and cost-control measures are expected to help it maintain its profitability. Additionally, Herbalife's focus on premium products and its ability to command premium pricing are expected to contribute to its profitability. Overall, analysts predict that Herbalife will continue to generate healthy profits in the coming years.

It is important to note that the financial outlook and predictions for Herbalife are subject to various risks and uncertainties. These include changes in consumer preferences, economic conditions, regulatory changes, and competition. However, given the company's strong track record of growth and its focus on innovation and expansion, analysts are generally optimistic about Herbalife's financial prospects.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B3 | B1 |

| Income Statement | Caa2 | B2 |

| Balance Sheet | Caa2 | Ba3 |

| Leverage Ratios | B2 | B3 |

| Cash Flow | B3 | B2 |

| Rates of Return and Profitability | C | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Herbalife: Navigating the Health and Wellness Industry

Market Overview:

Herbalife Ltd., commonly known as Herbalife, is a global nutrition company that offers weight management, energy, and skincare products. The global health and wellness industry is experiencing significant growth, driven by increasing consumer awareness of preventive healthcare and a desire for healthier lifestyles. This trend has positively impacted Herbalife's market position, as consumers seek natural and effective solutions to improve their well-being.

Competitive Landscape:

Herbalife operates in a highly competitive market, characterized by numerous established players and emerging challengers. Key competitors include:

These competitors pose significant challenges to Herbalife, driving intense competition in terms of product innovation, pricing strategies, and market share.

Herbalife's Strengths and Opportunities:

Despite the competitive landscape, Herbalife has several strengths that contribute to its success:

Challenges and Future Outlook:

Herbalife faces several challenges that may impact its future growth:

In conclusion, Herbalife operates in a growing market but faces intense competition and regulatory challenges. To succeed in the long term, the company must continue to innovate, adapt to changing consumer preferences, and navigate the complexities of the regulatory landscape. Herbalife's commitment to quality, brand recognition, and extensive distributor network provide a solid foundation for addressing these challenges and capitalizing on growth opportunities.

Herbalife's Promising Future: Navigating Market Trends and Driving Sustainable Growth

Herbalife Ltd., a global nutrition company, is poised to continue its trajectory of success in the coming years. With a strong track record of innovation, a loyal customer base, and a commitment to wellness, Herbalife is well-positioned to capitalize on emerging market trends and drive sustainable growth.

One key factor contributing to Herbalife's optimistic outlook is the growing demand for personalized nutrition solutions. Consumers are increasingly seeking tailored products that meet their specific health and wellness goals. Herbalife's personalized approach to nutrition, with its wide range of products and customizable programs, is well-suited to meet this demand and drive growth.

Another positive indicator for Herbalife's future is the expansion of the global wellness industry. As people become more health-conscious, the market for wellness products and services is expanding rapidly. Herbalife's focus on promoting healthy lifestyles and its comprehensive product portfolio position it as a leader in this growing market.

Furthermore, Herbalife is actively expanding its global presence, particularly in emerging markets with high growth potential. By leveraging its strong brand recognition and established distribution networks, Herbalife can tap into new markets and drive international growth. The company's commitment to localizing its products and marketing strategies to suit regional preferences will further contribute to its success in these markets.

In conclusion, Herbalife Ltd. is poised for continued success in the coming years. The company's focus on personalized nutrition, its strong brand presence, and its expansion into emerging markets position it well to capitalize on key market trends and drive sustainable growth. Herbalife's commitment to innovation and customer satisfaction will further contribute to its long-term success.

Herbalife's Solid Operating Efficiency Enhancing Profitability: A Trend to Continue

Herbalife Ltd. (Herbalife), a global nutrition company, has demonstrated remarkable operating efficiency, which has been instrumental in driving its financial success. The company's ability to control costs, optimize production processes, and minimize expenses has enabled it to maintain healthy profit margins and generate consistent cash flow.

Herbalife's efficient operations are evident in its low cost structure. The company's cost of goods sold as a percentage of revenue has remained relatively stable over the years, indicating effective cost management and supply chain optimization. Additionally, Herbalife has kept its administrative and selling expenses under control, allowing it to allocate more resources towards product development, marketing, and sales.

The company's focus on productivity has also contributed to its operating efficiency. By leveraging technology and implementing operational best practices, Herbalife has enhanced its production processes and reduced inefficiencies. This, in turn, has led to increased output and lower production costs, allowing the company to generate more revenue with fewer resources.

The combination of Herbalife's efficient cost structure, focus on productivity, and effective inventory management has resulted in strong operating profitability. The company's operating margin has consistently exceeded industry benchmarks, demonstrating its ability to convert revenue into profit. This efficient use of resources has allowed Herbalife to invest in growth initiatives, such as expanding into new markets and developing new products, while maintaining its financial health.

Herbalife Ltd.: Assessing the Risks and Ensuring Sustainable Growth

Herbalife Ltd. is a global nutrition company that has been operating for over 40 years. The company has a vast network of independent distributors who sell its products directly to consumers. While Herbalife has experienced significant success, it has also faced various risks and challenges that could potentially impact its long-term growth and sustainability.

One of the key risks associated with Herbalife is the regulatory landscape. The company's products have been the subject of scrutiny by regulatory authorities in several countries, including the United States, China, and India. These regulatory bodies have raised concerns about the safety and efficacy of Herbalife's products, as well as its business practices. Any adverse regulatory actions or restrictions could significantly impact Herbalife's operations and financial performance.

Another risk factor for Herbalife is its reliance on a network of independent distributors. While this distribution model has been instrumental in the company's growth, it also presents certain risks. The company has limited control over the actions of its distributors, and any misconduct or unethical behavior by individual distributors could tarnish Herbalife's reputation and lead to legal or regulatory challenges. Additionally, the company's dependence on a large number of distributors makes it susceptible to fluctuations in distributor activity, which could impact sales and profitability.

Furthermore, Herbalife operates in a highly competitive market. The nutrition industry is saturated with various companies offering similar products and services. This intense competition can lead to price wars, reduced market share, and lower profitability. To maintain its competitive edge, Herbalife must continuously innovate and differentiate its products, invest in marketing and branding, and adapt to changing consumer trends. Failure to do so could result in declining sales and market share.

References

- C. Szepesvári. Algorithms for Reinforcement Learning. Synthesis Lectures on Artificial Intelligence and Machine Learning. Morgan & Claypool Publishers, 2010

- P. Artzner, F. Delbaen, J. Eber, and D. Heath. Coherent measures of risk. Journal of Mathematical Finance, 9(3):203–228, 1999

- M. J. Hausknecht. Cooperation and Communication in Multiagent Deep Reinforcement Learning. PhD thesis, The University of Texas at Austin, 2016

- K. Boda and J. Filar. Time consistent dynamic risk measures. Mathematical Methods of Operations Research, 63(1):169–186, 2006

- Barkan O. 2016. Bayesian neural word embedding. arXiv:1603.06571 [math.ST]

- G. Theocharous and A. Hallak. Lifetime value marketing using reinforcement learning. RLDM 2013, page 19, 2013

- Wager S, Athey S. 2017. Estimation and inference of heterogeneous treatment effects using random forests. J. Am. Stat. Assoc. 113:1228–42