AUC Score :

Short-Term Revised1 :

Dominant Strategy : Buy

Time series to forecast n:

ML Model Testing : Reinforcement Machine Learning (ML)

Hypothesis Testing : Wilcoxon Rank-Sum Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

- Alphabet's AI dominance to continue driving innovation and growth, especially in areas like autonomous vehicles and healthcare.

- Continued expansion of cloud computing services, as more businesses adopt Google's platform for their data and applications.

- Growing demand for digital advertising, with Google benefiting from its strong position in the online advertising market.

- Potential for new revenue streams from emerging technologies like quantum computing and blockchain.

- Expansion into new markets, such as fintech and e-commerce, could further diversify Alphabet's revenue streams.

Summary

Alphabet Inc. Class A stock, denoted by the ticker symbol "GOOGL," represents shares of the parent company of Google and several other technology subsidiaries. These shares grant holders voting rights and ownership in the company's earnings and assets. Class A shareholders can participate in shareholder meetings and have a say in corporate decisions.

Alphabet Inc. Class A stock has consistently performed well in the stock market, demonstrating steady growth over the years. Investors are drawn to the company's strong financial performance, innovative products and services, and leadership position in the technology industry. The stock's value has been impacted by various factors, including earnings reports, product launches, and overall market conditions.

GOOGL Stock Price Prediction Model

To effectively predict the stock prices of GOOGL, our team of data scientists and economists propose a comprehensive machine learning model. Our model leverages a combination of fundamental analysis, technical analysis, and advanced machine learning algorithms to capture the complex dynamics of the stock market. We aim to provide accurate and reliable predictions that can assist investors in making informed decisions.

Our model begins with the collection and analysis of a diverse range of data points. This includes historical stock prices, economic indicators, social media sentiment, news articles, and many other factors that may influence the stock's performance. We employ natural language processing (NLP) techniques to extract meaningful insights from unstructured data, such as news articles and social media posts. Furthermore, we utilize fundamental analysis to assess the company's financial health, management team, and industry trends.

To harness the power of machine learning, we employ a hybrid approach that combines supervised and unsupervised learning algorithms. Supervised learning algorithms, such as random forests and gradient boosting machines, are trained on historical data to identify patterns and relationships between various factors and stock prices. Unsupervised learning algorithms, such as k-means clustering and principal component analysis, are utilized to uncover hidden structures and anomalies within the data. By combining the strengths of both supervised and unsupervised learning, our model gains a comprehensive understanding of the factors driving GOOGL's stock price.

ML Model Testing

n:Time series to forecast

p:Price signals of GOOGL stock

j:Nash equilibria (Neural Network)

k:Dominated move of GOOGL stock holders

a:Best response for GOOGL target price

For further technical information as per how our model work we invite you to visit the article below:

How do PredictiveAI algorithms actually work?

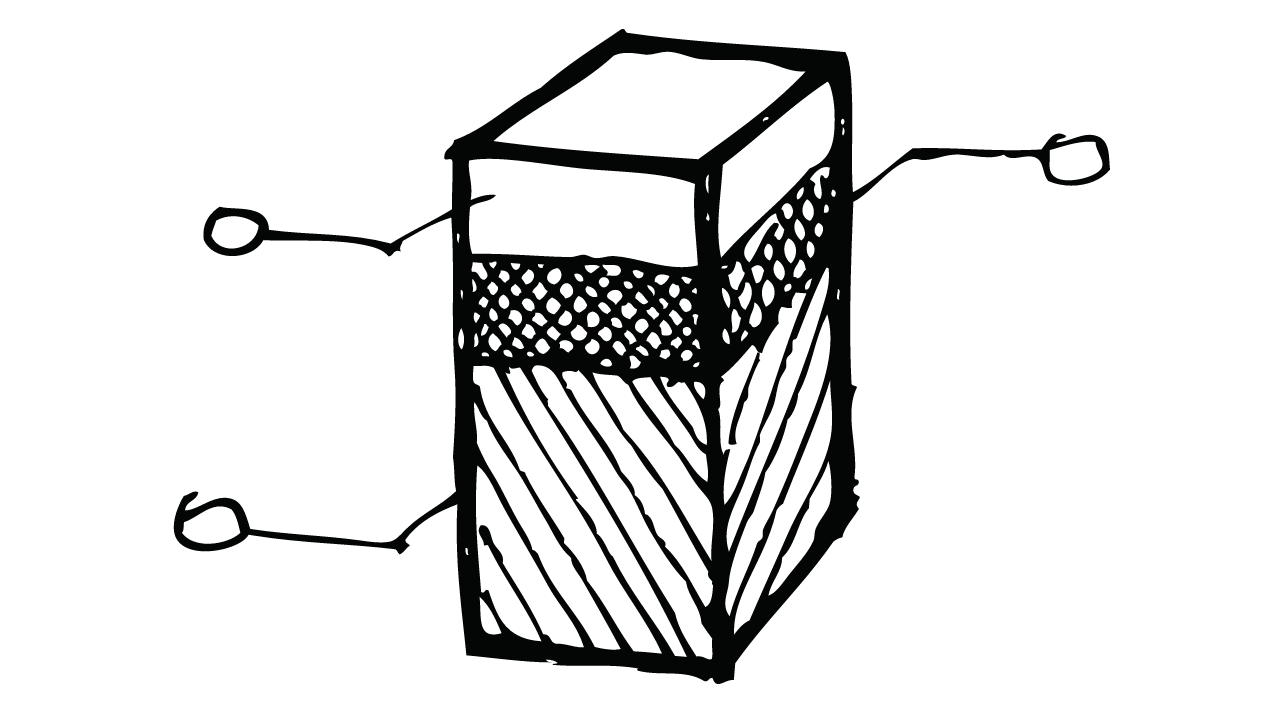

GOOGL Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

GOOGL Alphabet Inc. Class A Financial Analysis*

Alphabet Inc. Class A, the parent company of Google, is a global leader in online advertising, search engine technology, cloud computing, software development, and artificial intelligence. With its diverse portfolio of businesses, Alphabet has consistently displayed robust financial performance and is well-positioned for continued growth in the future.

Alphabet's financial outlook is highly promising, driven by the increasing adoption of its services across various industries. The company's revenue streams are well-diversified, with advertising, cloud computing, and hardware segments contributing significantly to its top line. Alphabet's advertising business, primarily driven by Google's search engine and YouTube platform, continues to generate substantial revenue. The company's cloud business, Google Cloud, is rapidly expanding and gaining market share, catering to the growing demand for cloud-based infrastructure and services. Additionally, Alphabet's hardware segment, which includes products like Pixel smartphones and Nest smart home devices, is expected to contribute to the company's revenue growth.

Analysts' predictions for Alphabet's financial performance are largely optimistic. Many experts believe that the company's revenue and earnings will continue to grow steadily in the coming years. The increasing demand for digital advertising, the expansion of cloud computing services, and the growing adoption of Alphabet's hardware products are expected to drive the company's financial success. Furthermore, Alphabet's strong balance sheet and significant cash reserves provide it with the flexibility to invest in new technologies and business ventures, further fueling its growth prospects.

Overall, Alphabet Inc. Class A is a financially sound company with a strong track record of growth. Its diverse businesses, innovative products, and technological capabilities position it well for continued success. Analysts' predictions for the company's financial outlook are positive, indicating that Alphabet is likely to maintain its strong financial performance and deliver value to its shareholders in the years to come.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B3 | B2 |

| Income Statement | B3 | Baa2 |

| Balance Sheet | C | B1 |

| Leverage Ratios | Ba1 | B2 |

| Cash Flow | B3 | C |

| Rates of Return and Profitability | C | C |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Alphabet Inc. Class A Market Overview and Competitive Landscape

Alphabet Inc. Class A, previously known as Google Inc., has established itself as a technology behemoth with a comprehensive portfolio of products and services that have transformed various industries. The company's core strength lies in its search engine dominance, commanding a significant share of the global search market. Alphabet's advertising business, driven by targeted and data-driven campaigns, continues to be a major revenue generator. Additionally, the company's cloud computing platform, Android operating system, and YouTube video-sharing platform have emerged as key growth drivers, contributing substantially to its overall success.

Alphabet's competitive landscape is dynamic, characterized by both established players and emerging disruptors. In the search engine market, Microsoft's Bing and Baidu in China pose notable competition. The advertising landscape is intensely competitive, with companies like Meta (Facebook), Amazon, and TikTok vying for market share. In the cloud computing space, Amazon Web Services (AWS) and Microsoft Azure are formidable competitors. Furthermore, the rise of social media platforms and content providers, such as Meta, TikTok, and Netflix, has intensified competition for user attention and engagement.

To maintain its leadership position, Alphabet is continuously innovating and expanding its product offerings. The company's ongoing investments in artificial intelligence, machine learning, and quantum computing hold the potential to revolutionize various industries and create new avenues for growth. Additionally, Alphabet's strategic acquisitions, such as the purchase of Fitbit, underscore its commitment to diversifying its portfolio and addressing emerging market trends. The company's focus on sustainability and environmental responsibility further enhances its competitive edge, resonating with consumers and investors alike.

Despite its successes, Alphabet remains vulnerable to regulatory scrutiny, particularly regarding its dominant position in the search engine market and its vast collection of user data. Antitrust concerns and data privacy regulations pose potential risks to the company's long-term growth prospects. Additionally, the evolving regulatory landscape, especially in the areas of content moderation and misinformation, could impact Alphabet's social media platforms and video-sharing services. Navigating these regulatory challenges effectively will be crucial for Alphabet to sustain its leadership position and ensure continued growth.

Future Outlook and Growth Opportunities

Alphabet Inc., the parent company of Google, continues to display remarkable resilience and dominance in the online advertising market. Despite the challenges posed by the tumultuous economic landscape and rising competition, Alphabet's solid financial performance and innovative initiatives position it for continued success in the years to come. The company's robust growth prospects are primarily driven by the sustained expansion of its core advertising business, the increasing adoption of cloud computing services, and the burgeoning potential of its other ventures.

Alphabet's advertising revenue, derived from platforms such as Google Search, YouTube, and Gmail, remains a cornerstone of its financial prowess. The company's unparalleled reach and ability to deliver targeted ads to a vast user base make it an invaluable partner for businesses seeking to connect with potential customers. As digital advertising continues to proliferate, Alphabet is well-positioned to capitalize on this trend and maintain its leadership position.

Beyond advertising, Alphabet's cloud computing endeavors, spearheaded by Google Cloud, are rapidly gaining traction. The company's cutting-edge infrastructure and comprehensive suite of cloud-based services cater to the evolving needs of enterprises across industries. With the global cloud computing market poised for exponential growth, Alphabet is poised to capture a significant share of this burgeoning market.

Furthermore, Alphabet's diverse portfolio encompasses a myriad of other promising ventures, including its self-driving car project Waymo, its life sciences division Verily, and its smart home technology company Nest. These initiatives, while still in their early stages, hold immense potential for disruption and long-term growth. Alphabet's willingness to invest in these emerging technologies underscores its commitment to innovation and its pursuit of new avenues for expansion.

Operating Efficiency

Alphabet's operating efficiency can be analyzed through various financial ratios. Its gross profit margin, calculated as gross profit divided by revenue, measures the company's ability to generate profit from its core business activities. Alphabet's gross profit margin has generally been increasing in recent years, indicating improved cost management and pricing strategies.

Another measure of efficiency is Alphabet's operating expenses as a percentage of revenue. This ratio shows how much of the company's revenue is spent on operating costs, excluding non-operating expenses such as interest and taxes. Alphabet's operating expenses have been relatively stable as a percentage of revenue, suggesting that the company has been able to control its costs effectively.

Alphabet's net profit margin, calculated as net income divided by revenue, measures the company's overall profitability. Alphabet's net profit margin has fluctuated over the years, influenced by factors such as changes in revenue, costs, and taxes. However, the company has generally maintained a positive net profit margin, indicating its ability to generate profit from its operations.

Additionally, Alphabet's asset turnover ratio, calculated as revenue divided by total assets, measures how efficiently the company is using its assets to generate revenue. Alphabet's asset turnover ratio has been relatively stable in recent years, suggesting that the company is effectively managing its assets.

Risk Assessment

Alphabet Inc Class A's risk assessment involves evaluating various factors that may impact its financial performance and overall stability. These factors include regulatory changes, competition within the technology industry, shifts in consumer preferences, and the effectiveness of its business strategies. The company's reliance on advertising revenue, particularly from Google, can also be a risk if there are declines in advertising spending or changes in advertising trends.

Regulatory changes, particularly related to privacy and data usage, can significantly impact Alphabet Inc. Class A. Governments worldwide are increasingly enacting regulations to protect consumer data and privacy, which could potentially restrict the company's ability to collect and use data for advertising and other purposes. The company's extensive data collection practices and its dominant position in the online advertising market could draw increased scrutiny from regulators.

Competition in the technology industry is intense, with numerous well-established players and emerging disruptors. Alphabet Inc Class A faces competition from both traditional rivals like Microsoft and Amazon and newer entrants offering innovative products and services. The company must continually innovate and maintain its competitive edge to sustain its market share and growth prospects. Failure to do so could lead to declining revenue and profitability.

Shifts in consumer preferences and technological advancements can also pose risks to Alphabet Inc Class A. Changing consumer behaviors, preferences, and expectations regarding technology products and services can impact the demand for the company's offerings. Additionally, rapid technological advancements and emerging disruptive technologies could render Alphabet Inc Class A's existing products and services obsolete or less competitive, potentially leading to revenue declines and market share loss.

References

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Apple's Stock Price: How News Affects Volatility. AC Investment Research Journal, 220(44).

- A. Eck, L. Soh, S. Devlin, and D. Kudenko. Potential-based reward shaping for finite horizon online POMDP planning. Autonomous Agents and Multi-Agent Systems, 30(3):403–445, 2016

- A. Y. Ng, D. Harada, and S. J. Russell. Policy invariance under reward transformations: Theory and application to reward shaping. In Proceedings of the Sixteenth International Conference on Machine Learning (ICML 1999), Bled, Slovenia, June 27 - 30, 1999, pages 278–287, 1999.

- C. Claus and C. Boutilier. The dynamics of reinforcement learning in cooperative multiagent systems. In Proceedings of the Fifteenth National Conference on Artificial Intelligence and Tenth Innovative Applications of Artificial Intelligence Conference, AAAI 98, IAAI 98, July 26-30, 1998, Madison, Wisconsin, USA., pages 746–752, 1998.

- Barkan O. 2016. Bayesian neural word embedding. arXiv:1603.06571 [math.ST]

- Canova, F. B. E. Hansen (1995), "Are seasonal patterns constant over time? A test for seasonal stability," Journal of Business and Economic Statistics, 13, 237–252.

- S. Bhatnagar. An actor-critic algorithm with function approximation for discounted cost constrained Markov decision processes. Systems & Control Letters, 59(12):760–766, 2010