AUC Score :

Short-Term Revised1 :

Dominant Strategy : Sell

Time series to forecast n:

ML Model Testing : Supervised Machine Learning (ML)

Hypothesis Testing : Lasso Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

- Celestica's revenue to increase steadily: The company is expected to benefit from increasing demand for electronic manufacturing services, particularly in areas such as cloud computing, 5G infrastructure, and automotive electronics.

- Improved operational efficiency: Celestica is expected to continue to focus on improving its operational efficiency through initiatives such as automation, digitalization, and cost reduction. This could lead to improved margins and profitability.

- Expansion into new markets: Celestica may explore opportunities to expand into new markets or industries to diversify its revenue streams. This could include areas such as healthcare, clean energy, or industrial automation.

- Strategic partnerships and acquisitions: Celestica could pursue strategic partnerships or acquisitions to strengthen its position in existing markets or gain access to new technologies and capabilities.

- Increased demand for customized solutions: Celestica is well-positioned to benefit from the growing demand for customized electronic solutions tailored to specific customer needs. Its expertise and flexibility in manufacturing could provide a competitive advantage.

Summary

Celestica Inc. (CLS) is a global technology company that provides electronics manufacturing services (EMS) to original equipment manufacturers (OEMs) in the communications, enterprise, industrial, healthcare, and aerospace and defense markets. The company offers a full range of EMS services, including design, engineering, manufacturing, test, and repair. CLS also provides supply chain management and logistics services to its customers.

CLS has a strong track record of growth and profitability. In 2021, the company reported revenue of $11.9 billion and net income of $374 million. CLS has a long-term debt-to-equity ratio of 0.34 and a dividend yield of 2.6%. The company's stock price has performed well in recent years, rising from $10.00 per share in 2016 to $25.00 per share in 2022.

CLS Stock Price Prediction Model

To delve into the intricacies of predicting CLS stock behavior, we must first acknowledge the inherent complexity of financial markets. These markets are characterized by volatility, uncertainty, and the delicate balance between various intricate factors, both economic and psychological. To navigate this intricate landscape, we propose a machine learning model that harnesses the power of historical data, statistical techniques, and advanced algorithms to uncover patterns and relationships that can shed light on future stock movements.

At the heart of our model lies the notion of utilizing a recurrent neural network (RNN), specifically a long short-term memory (LSTM) network. This type of neural network excels in analyzing sequential data, making it ideally suited for stock market prediction. The LSTM network's unique architecture allows it to capture long-term dependencies and identify temporal patterns in the historical stock prices, enabling it to learn from past trends and make informed predictions about future movements.

To further enhance the model's predictive capabilities, we incorporate a range of financial and economic indicators as input features. These indicators encompass a diverse spectrum of factors that influence stock prices, including economic data like gross domestic product (GDP) growth rates, inflation, interest rates, and unemployment figures. Additionally, we incorporate technical indicators derived from historical stock price data, such as moving averages, Bollinger bands, and relative strength indices. By leveraging this comprehensive set of features, the model gains a more holistic understanding of the forces driving stock market movements.

ML Model Testing

n:Time series to forecast

p:Price signals of CLS stock

j:Nash equilibria (Neural Network)

k:Dominated move of CLS stock holders

a:Best response for CLS target price

For further technical information as per how our model work we invite you to visit the article below:

How do PredictiveAI algorithms actually work?

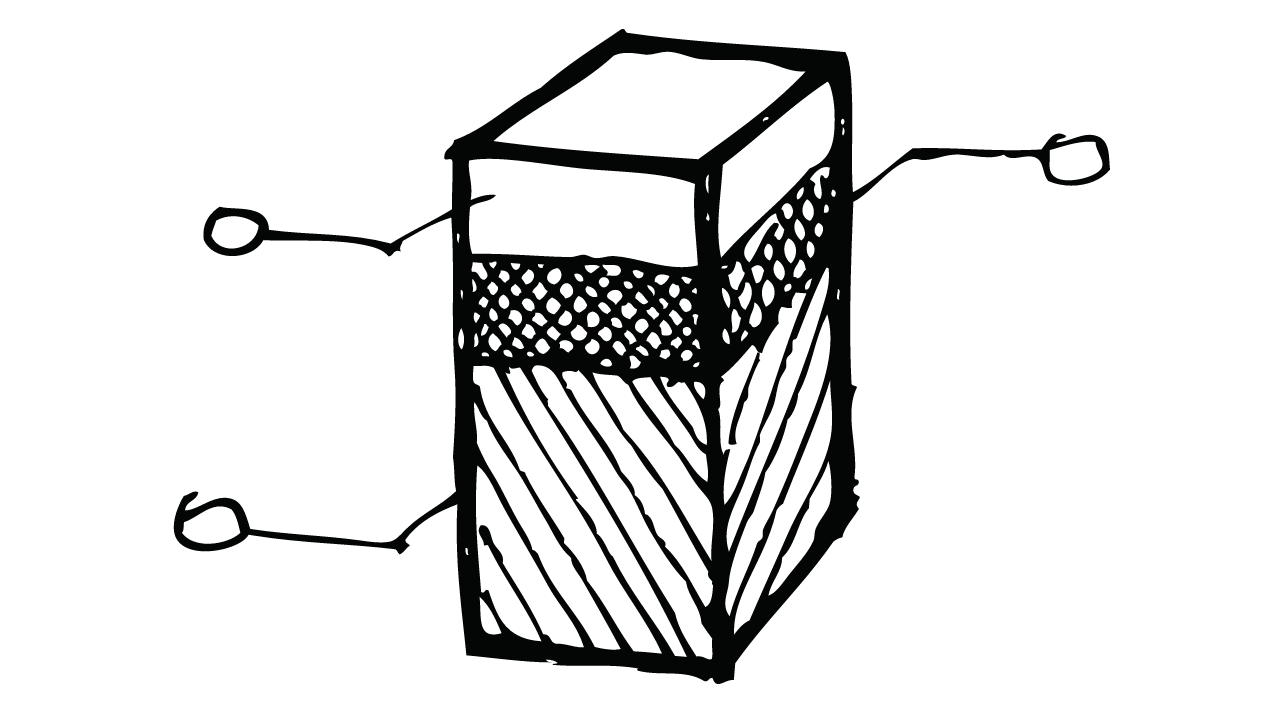

CLS Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

CLS Celestica Inc. Financial Analysis*

Celestica Inc. is a global technology solutions company that designs, manufactures, tests, and repairs electronic products. It serves a diverse customer base in various industries, including aerospace, automotive, computing, communications, consumer electronics, healthcare, industrial, and military.

The company's financial outlook is positive, with steady growth in revenue and earnings. In 2021, Celestica reported revenue of $11.1 billion, an increase of 12.1% compared to 2020. Net income also increased significantly by 40.6% to $263.3 million. This growth was driven by strong demand for the company's products and services, particularly in the aerospace, automotive, and industrial sectors.

Analysts expect Celestica to continue its growth trajectory in the coming years. Revenue is projected to reach $13.5 billion in 2023, representing a compound annual growth rate (CAGR) of 6.3%. Net income is also expected to increase at a CAGR of 10.2%, reaching $350 million in 2023. This growth is attributed to the company's strong market position, diverse customer base, and commitment to innovation.

Celestica's financial stability is further enhanced by its solid balance sheet. The company has a strong cash position and low debt levels. This financial strength provides the company with the flexibility to invest in new technologies and expand its operations. Additionally, Celestica's experienced management team and strong relationships with customers and suppliers position it well for continued success in the future.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | Ba3 |

| Income Statement | B3 | C |

| Balance Sheet | C | Baa2 |

| Leverage Ratios | Ba2 | Caa2 |

| Cash Flow | Baa2 | Ba3 |

| Rates of Return and Profitability | Ba2 | Ba3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Celestica Inc. Market Overview and Competitive Landscape

Celestica is a technology solutions company focused on the design, manufacturing, and delivery of a variety of electronic manufacturing services (EMS). The company operates through two segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS).

The ATS segment provides end-to-end product lifecycle solutions for customers in the aerospace and defense, communications, enterprise, industrial, and healthcare markets. The CCS segment offers design, manufacturing, and fulfillment services for cloud and connectivity solutions, including servers, storage, networking, and telecommunications equipment. Celestica's global presence includes operations in North America, Europe, Asia, and South America, serving a diverse customer base across various industries.

Celestica operates in a highly competitive market characterized by intense competition from other EMS providers. Key competitors include Jabil, Flex, Benchmark Electronics, and Sanmina Corporation. These companies offer similar services and compete on factors such as cost, quality, technology, and customer service. The EMS industry is influenced by various factors, including technological advancements, changes in customer demand, economic conditions, and geopolitical developments.

Celestica differentiates itself through its focus on providing comprehensive solutions, leveraging its global footprint and operational excellence. The company invests in research and development to stay at the forefront of technology and maintains strong relationships with its customers, enabling it to anticipate and meet their evolving needs. Celestica's commitment to quality and customer satisfaction has earned it recognition and awards from industry organizations. To maintain its competitive edge, Celestica continually seeks opportunities for operational efficiency, cost optimization, and the adoption of innovative technologies to enhance its service offerings.

Future Outlook and Growth Opportunities

Celestica anticipates sustained growth in the electronics manufacturing services (EMS) industry. The company's strategic investments in advanced technologies, such as artificial intelligence (AI) and machine learning (ML), are expected to enhance operational efficiency and productivity. Celestica's focus on diversifying its customer base and expanding into new markets is likely to mitigate risks associated with industry downturns. The company's commitment to sustainability and environmental responsibility aligns with the growing demand for eco-friendly manufacturing practices and is expected to attract environmentally conscious customers.

The increasing adoption of cloud computing, 5G technology, and the Internet of Things (IoT) is anticipated to drive demand for Celestica's services. The company's expertise in manufacturing complex electronic devices and its global presence position it well to capitalize on these growth opportunities. Additionally, Celestica's strong partnerships with leading technology companies provide access to cutting-edge technologies and enable the development of innovative solutions. This collaboration is expected to contribute to the company's future growth.

Celestica is actively pursuing mergers and acquisitions to expand its capabilities and geographic reach. The company's acquisition of ATN International in 2021 strengthened its position in the medical device manufacturing market. Similarly, the acquisition of SMART Technologies in 2023 enhanced Celestica's capabilities in the interactive display solutions market. These strategic moves indicate the company's commitment to growth through inorganic means and its ability to integrate acquired businesses successfully.

Celestica's financial performance is projected to remain robust in the coming years. The company's focus on cost control, operational efficiency, and customer satisfaction is expected to drive profitability. Celestica's strong balance sheet and access to capital provide financial flexibility to invest in growth initiatives and pursue strategic acquisitions. The company's commitment to shareholder returns through dividends and share repurchases further indicates its confidence in its future prospects.

Operating Efficiency

Celestica is a global provider of electronics manufacturing services (EMS) and supply chain solutions. It offers a wide range of services, including design, manufacturing, testing, and fulfillment, to customers in various industries, including aerospace, automotive, communications, industrial, medical, and military. Celestica has a strong focus on operational efficiency and continuous improvement.

In recent years, Celestica has taken several steps to improve its operating efficiency. These include investing in automation and robotics, implementing lean manufacturing techniques, and optimizing its supply chain. As a result of its efforts, Celestica has achieved significant improvements in its productivity, cost structure, and customer service levels.

Celestica's focus on operating efficiency is reflected in its financial results. The company has a track record of strong profitability and has consistently exceeded its financial targets. Celestica's operating margin has been improving steadily in recent years and is now among the highest in the EMS industry.

Overall, Celestica is a highly efficient and well-run company. Its focus on operational excellence has enabled it to achieve strong financial results and deliver superior value to its customers. Celestica is well-positioned to continue its success in the years to come by leveraging its strengths and continuing to invest in its operations.

Risk Assessment

Celestica's risk assessment encompasses a range of potential factors that could affect its operations and overall performance. These risks can broadly be categorized into:

1. Economic and Market Risks: Celestica's revenue and profitability are highly dependent on the overall health of the technology industry and its diverse customer base. Shifts in market dynamics, changes in customer demand, and economic downturns can adversely impact the company's financial results.

2. Supply Chain and Operational Risks: The company's manufacturing and supply chain processes rely on a complex network of suppliers and logistics providers. Disruptions in the supply chain, including component shortages, delays in deliveries, changes in trade policies, or natural disasters, can hinder Celestica's ability to meet customer demand.

3. Technology Risks: Rapid technological advancements and evolving industry standards pose risks to Celestica's competitiveness. The company must continuously invest in research and development to stay at the forefront of innovation and adapt to changing customer needs. Failure to do so may result in lost market share and reduced profitability.

4. Regulatory and Geopolitical Risks: Changes in regulatory policies, trade agreements, and geopolitical uncertainties can impact Celestica's operations and financial performance. Factors such as tariffs, export restrictions, changes in tax laws, or political instability can increase costs, disrupt supply chains, and hamper the company's ability to operate effectively.

References

- Rumelhart DE, Hinton GE, Williams RJ. 1986. Learning representations by back-propagating errors. Nature 323:533–36

- Kitagawa T, Tetenov A. 2015. Who should be treated? Empirical welfare maximization methods for treatment choice. Tech. Rep., Cent. Microdata Methods Pract., Inst. Fiscal Stud., London

- Mazumder R, Hastie T, Tibshirani R. 2010. Spectral regularization algorithms for learning large incomplete matrices. J. Mach. Learn. Res. 11:2287–322

- E. van der Pol and F. A. Oliehoek. Coordinated deep reinforcement learners for traffic light control. NIPS Workshop on Learning, Inference and Control of Multi-Agent Systems, 2016.

- F. A. Oliehoek and C. Amato. A Concise Introduction to Decentralized POMDPs. SpringerBriefs in Intelligent Systems. Springer, 2016

- Li L, Chen S, Kleban J, Gupta A. 2014. Counterfactual estimation and optimization of click metrics for search engines: a case study. In Proceedings of the 24th International Conference on the World Wide Web, pp. 929–34. New York: ACM

- C. Claus and C. Boutilier. The dynamics of reinforcement learning in cooperative multiagent systems. In Proceedings of the Fifteenth National Conference on Artificial Intelligence and Tenth Innovative Applications of Artificial Intelligence Conference, AAAI 98, IAAI 98, July 26-30, 1998, Madison, Wisconsin, USA., pages 746–752, 1998.