AUC Score :

Short-Term Revised1 :

Dominant Strategy : Buy

Time series to forecast n:

Methodology : Modular Neural Network (Financial Sentiment Analysis)

Hypothesis Testing : Lasso Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Andretti Acquisition Corp. Class A Ordinary Shares prediction model is evaluated with Modular Neural Network (Financial Sentiment Analysis) and Lasso Regression1,2,3,4 and it is concluded that the WNNR stock is predictable in the short/long term. Modular neural networks (MNNs) are a type of artificial neural network that can be used for financial sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of financial sentiment analysis, MNNs can be used to identify the sentiment of financial news articles, social media posts, and other forms of online content. This information can then be used to make investment decisions, to identify trends in the market, and to target investors with relevant advertising.5 According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Buy

Key Points

- Trading Interaction

- Should I buy stocks now or wait amid such uncertainty?

- Technical Analysis with Algorithmic Trading

WNNR Stock Price Forecast

We consider Andretti Acquisition Corp. Class A Ordinary Shares Decision Process with Modular Neural Network (Financial Sentiment Analysis) where A is the set of discrete actions of WNNR stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

Sample Set: Neural Network

Stock/Index: WNNR Andretti Acquisition Corp. Class A Ordinary Shares

Time series to forecast: 8 Weeks

According to price forecasts, the dominant strategy among neural network is: Buy

n:Time series to forecast

p:Price signals of WNNR stock

j:Nash equilibria (Neural Network)

k:Dominated move of WNNR stock holders

a:Best response for WNNR target price

Modular neural networks (MNNs) are a type of artificial neural network that can be used for financial sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of financial sentiment analysis, MNNs can be used to identify the sentiment of financial news articles, social media posts, and other forms of online content. This information can then be used to make investment decisions, to identify trends in the market, and to target investors with relevant advertising.5 Lasso regression, also known as L1 regularization, is a type of regression analysis that adds a penalty to the least squares objective function in order to reduce the variance of the estimates and to induce sparsity in the model. This is done by adding a term to the objective function that is proportional to the sum of the absolute values of the coefficients. The penalty term is called the "lasso" penalty, and it is controlled by a parameter called the "lasso constant". Lasso regression can be used to address the problem of multicollinearity in linear regression, as well as the problem of overfitting. Multicollinearity occurs when two or more independent variables are highly correlated. This can cause the standard errors of the coefficients to be large, and it can also cause the coefficients to be unstable. Overfitting occurs when a model is too closely fit to the training data, and as a result, it does not generalize well to new data.6,7

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

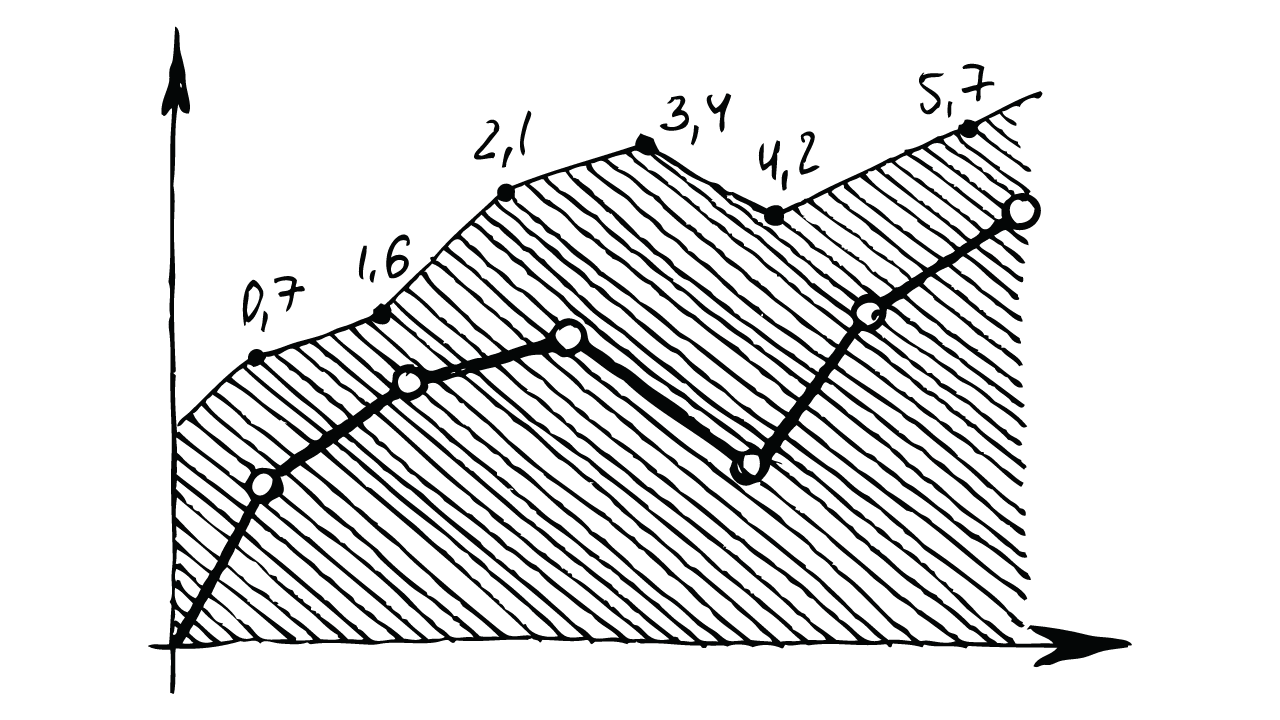

WNNR Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Modular Neural Network (Financial Sentiment Analysis) based WNNR Stock Prediction Model

- The characteristics of the hedged item, including how and when the hedged item affects profit or loss, also affect the period over which the forward element of a forward contract that hedges a time-period related hedged item is amortised, which is over the period to which the forward element relates. For example, if a forward contract hedges the exposure to variability in threemonth interest rates for a three-month period that starts in six months' time, the forward element is amortised during the period that spans months seven to nine.

- At the date of initial application, an entity shall determine whether the treatment in paragraph 5.7.7 would create or enlarge an accounting mismatch in profit or loss on the basis of the facts and circumstances that exist at the date of initial application. This Standard shall be applied retrospectively on the basis of that determination.

- The rebuttable presumption in paragraph 5.5.11 is not an absolute indicator that lifetime expected credit losses should be recognised, but is presumed to be the latest point at which lifetime expected credit losses should be recognised even when using forward-looking information (including macroeconomic factors on a portfolio level).

- The characteristics of the hedged item, including how and when the hedged item affects profit or loss, also affect the period over which the forward element of a forward contract that hedges a time-period related hedged item is amortised, which is over the period to which the forward element relates. For example, if a forward contract hedges the exposure to variability in threemonth interest rates for a three-month period that starts in six months' time, the forward element is amortised during the period that spans months seven to nine.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

WNNR Andretti Acquisition Corp. Class A Ordinary Shares Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | B1 |

| Income Statement | Caa2 | Caa2 |

| Balance Sheet | Ba1 | Baa2 |

| Leverage Ratios | Baa2 | Ba3 |

| Cash Flow | Baa2 | C |

| Rates of Return and Profitability | Baa2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- Banerjee, A., J. J. Dolado, J. W. Galbraith, D. F. Hendry (1993), Co-integration, Error-correction, and the Econometric Analysis of Non-stationary Data. Oxford: Oxford University Press.

- Athey S, Imbens GW. 2017b. The state of applied econometrics: causality and policy evaluation. J. Econ. Perspect. 31:3–32

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Apple's Stock Price: How News Affects Volatility. AC Investment Research Journal, 220(44).

- Breiman L. 2001a. Random forests. Mach. Learn. 45:5–32

- Hastie T, Tibshirani R, Tibshirani RJ. 2017. Extended comparisons of best subset selection, forward stepwise selection, and the lasso. arXiv:1707.08692 [stat.ME]

- Bertsimas D, King A, Mazumder R. 2016. Best subset selection via a modern optimization lens. Ann. Stat. 44:813–52

- Sutton RS, Barto AG. 1998. Reinforcement Learning: An Introduction. Cambridge, MA: MIT Press

Frequently Asked Questions

Q: What is the prediction methodology for WNNR stock?A: WNNR stock prediction methodology: We evaluate the prediction models Modular Neural Network (Financial Sentiment Analysis) and Lasso Regression

Q: Is WNNR stock a buy or sell?

A: The dominant strategy among neural network is to Buy WNNR Stock.

Q: Is Andretti Acquisition Corp. Class A Ordinary Shares stock a good investment?

A: The consensus rating for Andretti Acquisition Corp. Class A Ordinary Shares is Buy and is assigned short-term Ba3 & long-term B1 estimated rating.

Q: What is the consensus rating of WNNR stock?

A: The consensus rating for WNNR is Buy.

Q: What is the prediction period for WNNR stock?

A: The prediction period for WNNR is 8 Weeks