AUC Score :

Short-Term Revised1 :

Dominant Strategy : Strong Buy

Time series to forecast n:

Methodology : Modular Neural Network (Financial Sentiment Analysis)

Hypothesis Testing : Wilcoxon Rank-Sum Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Abstract

Exelon Corporation Common Stock prediction model is evaluated with Modular Neural Network (Financial Sentiment Analysis) and Wilcoxon Rank-Sum Test1,2,3,4 and it is concluded that the EXC stock is predictable in the short/long term. Modular neural networks (MNNs) are a type of artificial neural network that can be used for financial sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of financial sentiment analysis, MNNs can be used to identify the sentiment of financial news articles, social media posts, and other forms of online content. This information can then be used to make investment decisions, to identify trends in the market, and to target investors with relevant advertising. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Strong Buy

Key Points

- Technical Analysis with Algorithmic Trading

- Trading Signals

- Market Outlook

EXC Target Price Prediction Modeling Methodology

We consider Exelon Corporation Common Stock Decision Process with Modular Neural Network (Financial Sentiment Analysis) where A is the set of discrete actions of EXC stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Wilcoxon Rank-Sum Test)5,6,7= X R(Modular Neural Network (Financial Sentiment Analysis)) X S(n):→ 16 Weeks

n:Time series to forecast

p:Price signals of EXC stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Financial Sentiment Analysis)

Modular neural networks (MNNs) are a type of artificial neural network that can be used for financial sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of financial sentiment analysis, MNNs can be used to identify the sentiment of financial news articles, social media posts, and other forms of online content. This information can then be used to make investment decisions, to identify trends in the market, and to target investors with relevant advertising.Wilcoxon Rank-Sum Test

The Wilcoxon rank-sum test, also known as the Mann-Whitney U test, is a non-parametric test that is used to compare the medians of two independent samples. It is a rank-based test, which means that it does not assume that the data is normally distributed. The Wilcoxon rank-sum test is calculated by first ranking the data from both samples, and then finding the sum of the ranks for one of the samples. The Wilcoxon rank-sum test statistic is then calculated by subtracting the sum of the ranks for one sample from the sum of the ranks for the other sample. The p-value for the Wilcoxon rank-sum test is calculated using a table of critical values. The p-value is the probability of obtaining a test statistic at least as extreme as the one observed, assuming that the null hypothesis is true.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

EXC Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: EXC Exelon Corporation Common Stock

Time series to forecast: 16 Weeks

According to price forecasts, the dominant strategy among neural network is: Strong Buy

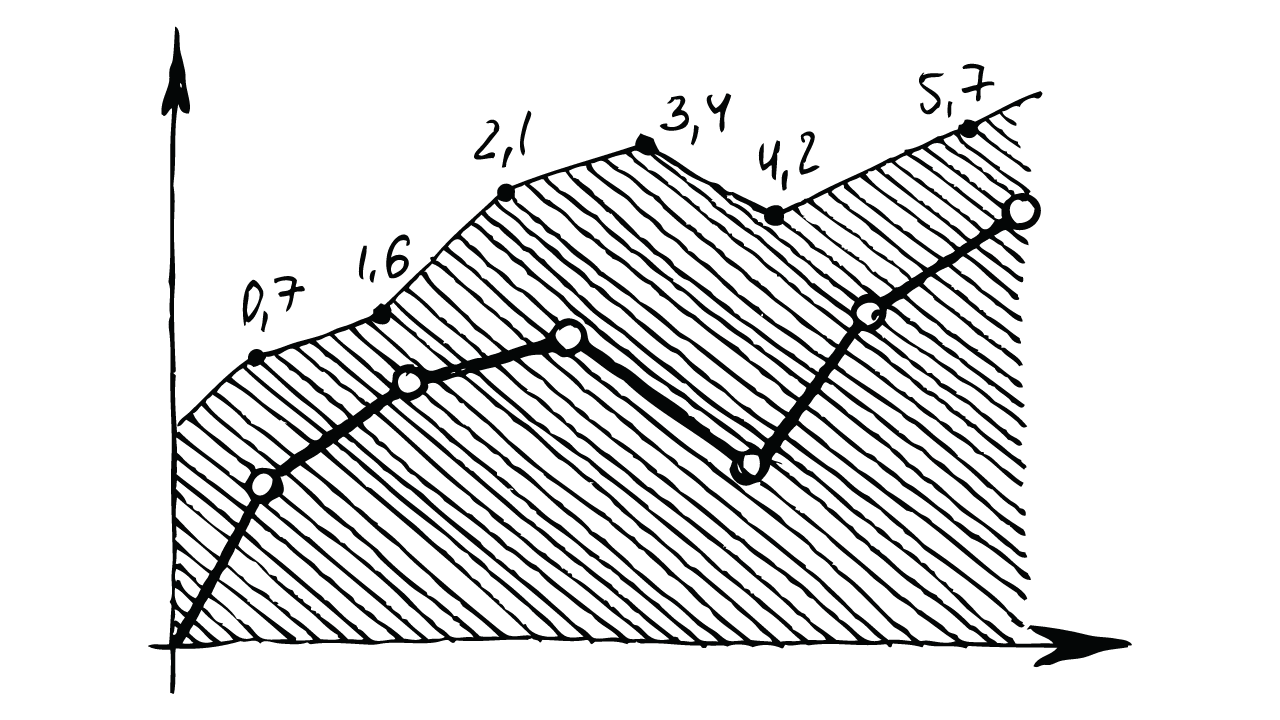

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Modular Neural Network (Financial Sentiment Analysis) based EXC Stock Prediction Model

- If, at the date of initial application, it is impracticable (as defined in IAS 8) for an entity to assess a modified time value of money element in accordance with paragraphs B4.1.9B–B4.1.9D on the basis of the facts and circumstances that existed at the initial recognition of the financial asset, an entity shall assess the contractual cash flow characteristics of that financial asset on the basis of the facts and circumstances that existed at the initial recognition of the financial asset without taking into account the requirements related to the modification of the time value of money element in paragraphs B4.1.9B–B4.1.9D. (See also paragraph 42R of IFRS 7.)

- An entity that first applies IFRS 17 as amended in June 2020 at the same time it first applies this Standard shall apply paragraphs 7.2.1–7.2.28 instead of paragraphs 7.2.38–7.2.42.

- An entity shall apply this Standard for annual periods beginning on or after 1 January 2018. Earlier application is permitted. If an entity elects to apply this Standard early, it must disclose that fact and apply all of the requirements in this Standard at the same time (but see also paragraphs 7.1.2, 7.2.21 and 7.3.2). It shall also, at the same time, apply the amendments in Appendix C.

- When measuring hedge ineffectiveness, an entity shall consider the time value of money. Consequently, the entity determines the value of the hedged item on a present value basis and therefore the change in the value of the hedged item also includes the effect of the time value of money.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

EXC Exelon Corporation Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B2 | B2 |

| Income Statement | C | C |

| Balance Sheet | Caa2 | Ba3 |

| Leverage Ratios | Baa2 | B3 |

| Cash Flow | Ba3 | Ba1 |

| Rates of Return and Profitability | B3 | B3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

Exelon Corporation Common Stock is assigned short-term B2 & long-term B2 estimated rating. Exelon Corporation Common Stock prediction model is evaluated with Modular Neural Network (Financial Sentiment Analysis) and Wilcoxon Rank-Sum Test1,2,3,4 and it is concluded that the EXC stock is predictable in the short/long term. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Strong Buy

Prediction Confidence Score

References

- Firth JR. 1957. A synopsis of linguistic theory 1930–1955. In Studies in Linguistic Analysis (Special Volume of the Philological Society), ed. JR Firth, pp. 1–32. Oxford, UK: Blackwell

- Athey S, Mobius MM, Pál J. 2017c. The impact of aggregators on internet news consumption. Unpublished manuscript, Grad. School Bus., Stanford Univ., Stanford, CA

- Abadir, K. M., K. Hadri E. Tzavalis (1999), "The influence of VAR dimensions on estimator biases," Econometrica, 67, 163–181.

- R. Sutton, D. McAllester, S. Singh, and Y. Mansour. Policy gradient methods for reinforcement learning with function approximation. In Proceedings of Advances in Neural Information Processing Systems 12, pages 1057–1063, 2000

- Candès E, Tao T. 2007. The Dantzig selector: statistical estimation when p is much larger than n. Ann. Stat. 35:2313–51

- M. Babes, E. M. de Cote, and M. L. Littman. Social reward shaping in the prisoner's dilemma. In 7th International Joint Conference on Autonomous Agents and Multiagent Systems (AAMAS 2008), Estoril, Portugal, May 12-16, 2008, Volume 3, pages 1389–1392, 2008.

- Bell RM, Koren Y. 2007. Lessons from the Netflix prize challenge. ACM SIGKDD Explor. Newsl. 9:75–79

Frequently Asked Questions

Q: What is the prediction methodology for EXC stock?A: EXC stock prediction methodology: We evaluate the prediction models Modular Neural Network (Financial Sentiment Analysis) and Wilcoxon Rank-Sum Test

Q: Is EXC stock a buy or sell?

A: The dominant strategy among neural network is to Strong Buy EXC Stock.

Q: Is Exelon Corporation Common Stock stock a good investment?

A: The consensus rating for Exelon Corporation Common Stock is Strong Buy and is assigned short-term B2 & long-term B2 estimated rating.

Q: What is the consensus rating of EXC stock?

A: The consensus rating for EXC is Strong Buy.

Q: What is the prediction period for EXC stock?

A: The prediction period for EXC is 16 Weeks