AUC Score :

Short-Term Revised1 :

Dominant Strategy : Hold

Time series to forecast n:

Methodology : Inductive Learning (ML)

Hypothesis Testing : Beta

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Summary

Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock prediction model is evaluated with Inductive Learning (ML) and Beta1,2,3,4 and it is concluded that the EDD stock is predictable in the short/long term. Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Hold

Key Points

- Trading Interaction

- What is prediction in deep learning?

- What statistical methods are used to analyze data?

EDD Target Price Prediction Modeling Methodology

We consider Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock Decision Process with Inductive Learning (ML) where A is the set of discrete actions of EDD stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

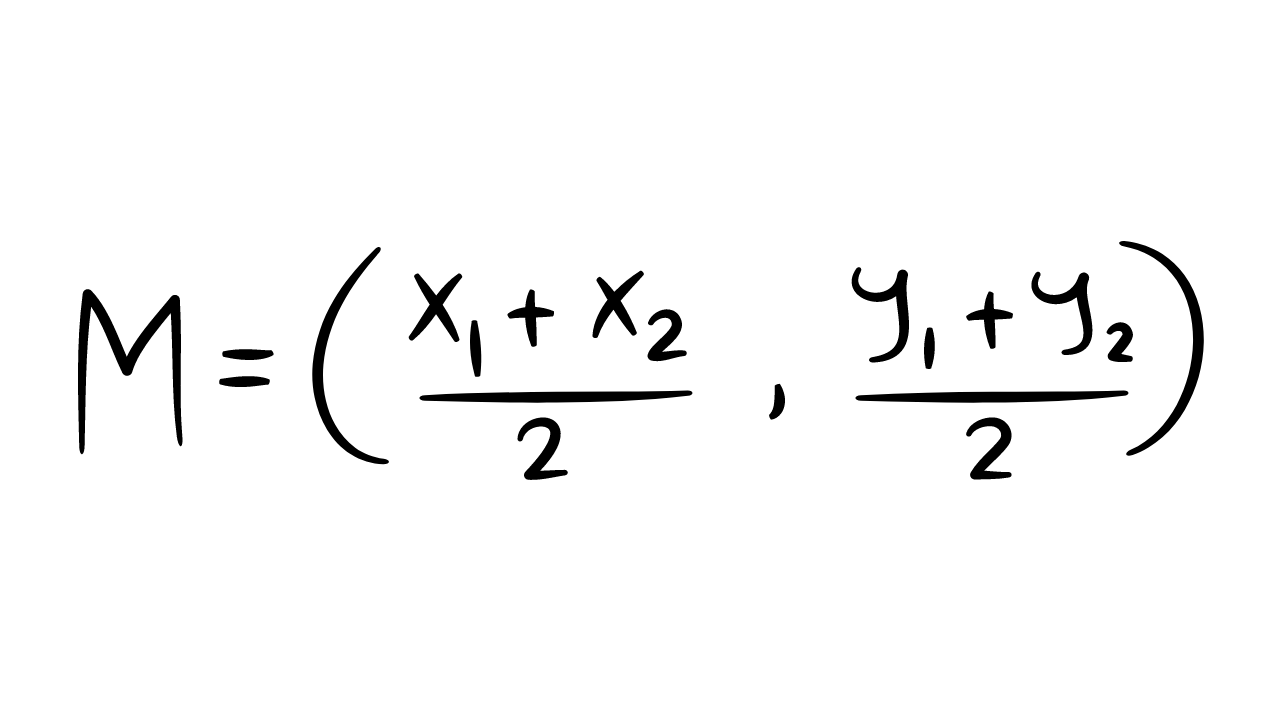

F(Beta)5,6,7= X R(Inductive Learning (ML)) X S(n):→ 3 Month

n:Time series to forecast

p:Price signals of EDD stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Inductive Learning (ML)

Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses.Beta

In statistics, beta (β) is a measure of the strength of the relationship between two variables. It is calculated as the slope of the line of best fit in a regression analysis. Beta can range from -1 to 1, with a value of 0 indicating no relationship between the two variables. A positive beta indicates that as one variable increases, the other variable also increases. A negative beta indicates that as one variable increases, the other variable decreases. For example, a study might find that there is a positive relationship between height and weight. This means that taller people tend to weigh more. The beta coefficient for this relationship would be positive.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

EDD Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: EDD Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock

Time series to forecast: 3 Month

According to price forecasts, the dominant strategy among neural network is: Hold

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Inductive Learning (ML) based EDD Stock Prediction Model

- The business model may be to hold assets to collect contractual cash flows even if the entity sells financial assets when there is an increase in the assets' credit risk. To determine whether there has been an increase in the assets' credit risk, the entity considers reasonable and supportable information, including forward looking information. Irrespective of their frequency and value, sales due to an increase in the assets' credit risk are not inconsistent with a business model whose objective is to hold financial assets to collect contractual cash flows because the credit quality of financial assets is relevant to the entity's ability to collect contractual cash flows. Credit risk management activities that are aimed at minimising potential credit losses due to credit deterioration are integral to such a business model. Selling a financial asset because it no longer meets the credit criteria specified in the entity's documented investment policy is an example of a sale that has occurred due to an increase in credit risk. However, in the absence of such a policy, the entity may demonstrate in other ways that the sale occurred due to an increase in credit risk.

- If an entity previously accounted for a derivative liability that is linked to, and must be settled by, delivery of an equity instrument that does not have a quoted price in an active market for an identical instrument (ie a Level 1 input) at cost in accordance with IAS 39, it shall measure that derivative liability at fair value at the date of initial application. Any difference between the previous carrying amount and the fair value shall be recognised in the opening retained earnings of the reporting period that includes the date of initial application.

- For the purposes of measuring expected credit losses, the estimate of expected cash shortfalls shall reflect the cash flows expected from collateral and other credit enhancements that are part of the contractual terms and are not recognised separately by the entity. The estimate of expected cash shortfalls on a collateralised financial instrument reflects the amount and timing of cash flows that are expected from foreclosure on the collateral less the costs of obtaining and selling the collateral, irrespective of whether foreclosure is probable (ie the estimate of expected cash flows considers the probability of a foreclosure and the cash flows that would result from it). Consequently, any cash flows that are expected from the realisation of the collateral beyond the contractual maturity of the contract should be included in this analysis. Any collateral obtained as a result of foreclosure is not recognised as an asset that is separate from the collateralised financial instrument unless it meets the relevant recognition criteria for an asset in this or other Standards.

- Such designation may be used whether paragraph 4.3.3 requires the embedded derivatives to be separated from the host contract or prohibits such separation. However, paragraph 4.3.5 would not justify designating the hybrid contract as at fair value through profit or loss in the cases set out in paragraph 4.3.5(a) and (b) because doing so would not reduce complexity or increase reliability.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

EDD Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B2 | Ba3 |

| Income Statement | Caa2 | Baa2 |

| Balance Sheet | B3 | Ba3 |

| Leverage Ratios | B1 | B2 |

| Cash Flow | B3 | Caa2 |

| Rates of Return and Profitability | Ba3 | Ba3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock is assigned short-term B2 & long-term Ba3 estimated rating. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock prediction model is evaluated with Inductive Learning (ML) and Beta1,2,3,4 and it is concluded that the EDD stock is predictable in the short/long term. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Hold

Prediction Confidence Score

References

- M. Puterman. Markov Decision Processes: Discrete Stochastic Dynamic Programming. Wiley, New York, 1994.

- Hoerl AE, Kennard RW. 1970. Ridge regression: biased estimation for nonorthogonal problems. Technometrics 12:55–67

- Chow, G. C. (1960), "Tests of equality between sets of coefficients in two linear regressions," Econometrica, 28, 591–605.

- Andrews, D. W. K. (1993), "Tests for parameter instability and structural change with unknown change point," Econometrica, 61, 821–856.

- Hoerl AE, Kennard RW. 1970. Ridge regression: biased estimation for nonorthogonal problems. Technometrics 12:55–67

- T. Shardlow and A. Stuart. A perturbation theory for ergodic Markov chains and application to numerical approximations. SIAM journal on numerical analysis, 37(4):1120–1137, 2000

- Bierens HJ. 1987. Kernel estimators of regression functions. In Advances in Econometrics: Fifth World Congress, Vol. 1, ed. TF Bewley, pp. 99–144. Cambridge, UK: Cambridge Univ. Press

Frequently Asked Questions

Q: What is the prediction methodology for EDD stock?A: EDD stock prediction methodology: We evaluate the prediction models Inductive Learning (ML) and Beta

Q: Is EDD stock a buy or sell?

A: The dominant strategy among neural network is to Hold EDD Stock.

Q: Is Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock stock a good investment?

A: The consensus rating for Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Morgan Stanley Emerging Markets Domestic Debt Fund Inc. Common Stock is Hold and is assigned short-term B2 & long-term Ba3 estimated rating.

Q: What is the consensus rating of EDD stock?

A: The consensus rating for EDD is Hold.

Q: What is the prediction period for EDD stock?

A: The prediction period for EDD is 3 Month