AUC Score :

Short-Term Revised1 :

Dominant Strategy : Buy

Time series to forecast n:

Methodology : Modular Neural Network (Market News Sentiment Analysis)

Hypothesis Testing : Wilcoxon Rank-Sum Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Abstract

ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED prediction model is evaluated with Modular Neural Network (Market News Sentiment Analysis) and Wilcoxon Rank-Sum Test1,2,3,4 and it is concluded that the ACF stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for news feed sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of news feed sentiment analysis, MNNs can be used to identify the sentiment of news articles, social media posts, and other forms of online content. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Buy

Key Points

- What is a prediction confidence?

- Stock Forecast Based On a Predictive Algorithm

- Stock Rating

ACF Target Price Prediction Modeling Methodology

We consider ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED Decision Process with Modular Neural Network (Market News Sentiment Analysis) where A is the set of discrete actions of ACF stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Wilcoxon Rank-Sum Test)5,6,7= X R(Modular Neural Network (Market News Sentiment Analysis)) X S(n):→ 16 Weeks

n:Time series to forecast

p:Price signals of ACF stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Market News Sentiment Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for news feed sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of news feed sentiment analysis, MNNs can be used to identify the sentiment of news articles, social media posts, and other forms of online content. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising.Wilcoxon Rank-Sum Test

The Wilcoxon rank-sum test, also known as the Mann-Whitney U test, is a non-parametric test that is used to compare the medians of two independent samples. It is a rank-based test, which means that it does not assume that the data is normally distributed. The Wilcoxon rank-sum test is calculated by first ranking the data from both samples, and then finding the sum of the ranks for one of the samples. The Wilcoxon rank-sum test statistic is then calculated by subtracting the sum of the ranks for one sample from the sum of the ranks for the other sample. The p-value for the Wilcoxon rank-sum test is calculated using a table of critical values. The p-value is the probability of obtaining a test statistic at least as extreme as the one observed, assuming that the null hypothesis is true.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

ACF Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: ACF ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED

Time series to forecast: 16 Weeks

According to price forecasts, the dominant strategy among neural network is: Buy

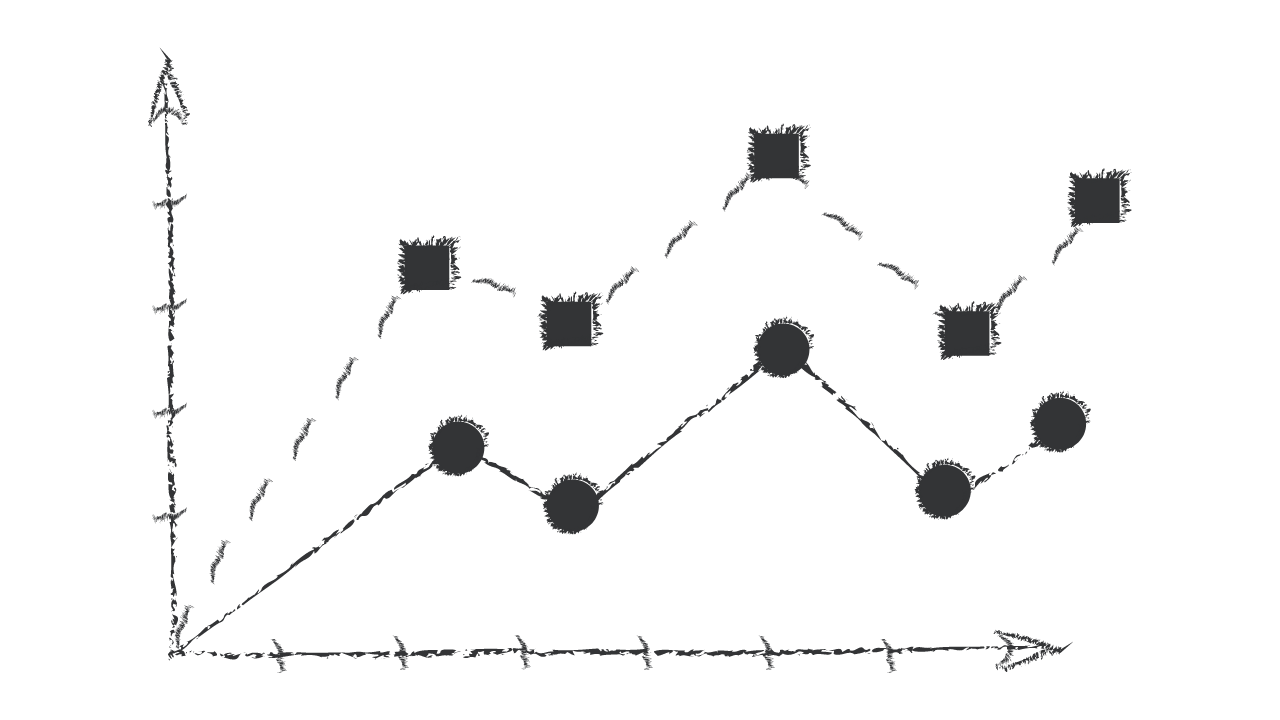

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Modular Neural Network (Market News Sentiment Analysis) based ACF Stock Prediction Model

- The underlying pool must contain one or more instruments that have contractual cash flows that are solely payments of principal and interest on the principal amount outstanding

- As noted in paragraph B4.3.1, when an entity becomes a party to a hybrid contract with a host that is not an asset within the scope of this Standard and with one or more embedded derivatives, paragraph 4.3.3 requires the entity to identify any such embedded derivative, assess whether it is required to be separated from the host contract and, for those that are required to be separated, measure the derivatives at fair value at initial recognition and subsequently. These requirements can be more complex, or result in less reliable measures, than measuring the entire instrument at fair value through profit or loss. For that reason this Standard permits the entire hybrid contract to be designated as at fair value through profit or loss.

- For the avoidance of doubt, the effects of replacing the original counterparty with a clearing counterparty and making the associated changes as described in paragraph 6.5.6 shall be reflected in the measurement of the hedging instrument and therefore in the assessment of hedge effectiveness and the measurement of hedge effectiveness

- An entity may retain the right to a part of the interest payments on transferred assets as compensation for servicing those assets. The part of the interest payments that the entity would give up upon termination or transfer of the servicing contract is allocated to the servicing asset or servicing liability. The part of the interest payments that the entity would not give up is an interest-only strip receivable. For example, if the entity would not give up any interest upon termination or transfer of the servicing contract, the entire interest spread is an interest-only strip receivable. For the purposes of applying paragraph 3.2.13, the fair values of the servicing asset and interest-only strip receivable are used to allocate the carrying amount of the receivable between the part of the asset that is derecognised and the part that continues to be recognised. If there is no servicing fee specified or the fee to be received is not expected to compensate the entity adequately for performing the servicing, a liability for the servicing obligation is recognised at fair value.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

ACF ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B2 | B3 |

| Income Statement | C | B1 |

| Balance Sheet | C | C |

| Leverage Ratios | B2 | C |

| Cash Flow | Ba3 | Caa2 |

| Rates of Return and Profitability | Baa2 | Ba3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED is assigned short-term B2 & long-term B3 estimated rating. ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED prediction model is evaluated with Modular Neural Network (Market News Sentiment Analysis) and Wilcoxon Rank-Sum Test1,2,3,4 and it is concluded that the ACF stock is predictable in the short/long term. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Buy

Prediction Confidence Score

References

- Krizhevsky A, Sutskever I, Hinton GE. 2012. Imagenet classification with deep convolutional neural networks. In Advances in Neural Information Processing Systems, Vol. 25, ed. Z Ghahramani, M Welling, C Cortes, ND Lawrence, KQ Weinberger, pp. 1097–105. San Diego, CA: Neural Inf. Process. Syst. Found.

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Tesla Stock: Hold for Now, But Watch for Opportunities. AC Investment Research Journal, 220(44).

- Byron, R. P. O. Ashenfelter (1995), "Predicting the quality of an unborn grange," Economic Record, 71, 40–53.

- Blei DM, Lafferty JD. 2009. Topic models. In Text Mining: Classification, Clustering, and Applications, ed. A Srivastava, M Sahami, pp. 101–24. Boca Raton, FL: CRC Press

- Bierens HJ. 1987. Kernel estimators of regression functions. In Advances in Econometrics: Fifth World Congress, Vol. 1, ed. TF Bewley, pp. 99–144. Cambridge, UK: Cambridge Univ. Press

- Bessler, D. A. S. W. Fuller (1993), "Cointegration between U.S. wheat markets," Journal of Regional Science, 33, 481–501.

- L. Panait and S. Luke. Cooperative multi-agent learning: The state of the art. Autonomous Agents and Multi-Agent Systems, 11(3):387–434, 2005.

Frequently Asked Questions

Q: What is the prediction methodology for ACF stock?A: ACF stock prediction methodology: We evaluate the prediction models Modular Neural Network (Market News Sentiment Analysis) and Wilcoxon Rank-Sum Test

Q: Is ACF stock a buy or sell?

A: The dominant strategy among neural network is to Buy ACF Stock.

Q: Is ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED stock a good investment?

A: The consensus rating for ACROW FORMWORK AND CONSTRUCTION SERVICES LIMITED is Buy and is assigned short-term B2 & long-term B3 estimated rating.

Q: What is the consensus rating of ACF stock?

A: The consensus rating for ACF is Buy.

Q: What is the prediction period for ACF stock?

A: The prediction period for ACF is 16 Weeks