AUC Score :

Short-Term Revised1 :

Dominant Strategy : Sell

Time series to forecast n:

Methodology : Modular Neural Network (News Feed Sentiment Analysis)

Hypothesis Testing : Statistical Hypothesis Testing

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Abstract

Invesco Senior Income Trust Common Stock (DE) prediction model is evaluated with Modular Neural Network (News Feed Sentiment Analysis) and Statistical Hypothesis Testing1,2,3,4 and it is concluded that the VVR stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for news feed sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of news feed sentiment analysis, MNNs can be used to identify the sentiment of news articles, social media posts, and other forms of online content. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

Key Points

- Game Theory

- Is Target price a good indicator?

- What are main components of Markov decision process?

VVR Target Price Prediction Modeling Methodology

We consider Invesco Senior Income Trust Common Stock (DE) Decision Process with Modular Neural Network (News Feed Sentiment Analysis) where A is the set of discrete actions of VVR stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Statistical Hypothesis Testing)5,6,7= X R(Modular Neural Network (News Feed Sentiment Analysis)) X S(n):→ 3 Month

n:Time series to forecast

p:Price signals of VVR stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (News Feed Sentiment Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for news feed sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of news feed sentiment analysis, MNNs can be used to identify the sentiment of news articles, social media posts, and other forms of online content. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising.Statistical Hypothesis Testing

Statistical hypothesis testing is a process used to determine whether there is enough evidence to support a claim about a population based on a sample. The process involves making two hypotheses, a null hypothesis and an alternative hypothesis, and then collecting data and using statistical tests to determine which hypothesis is more likely to be true. The null hypothesis is the statement that there is no difference between the population and the sample. The alternative hypothesis is the statement that there is a difference between the population and the sample. The statistical test is used to calculate a p-value, which is the probability of obtaining the observed data or more extreme data if the null hypothesis is true. A p-value of less than 0.05 is typically considered to be statistically significant, which means that there is less than a 5% chance of obtaining the observed data or more extreme data if the null hypothesis is true.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

VVR Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: VVR Invesco Senior Income Trust Common Stock (DE)

Time series to forecast: 3 Month

According to price forecasts, the dominant strategy among neural network is: Sell

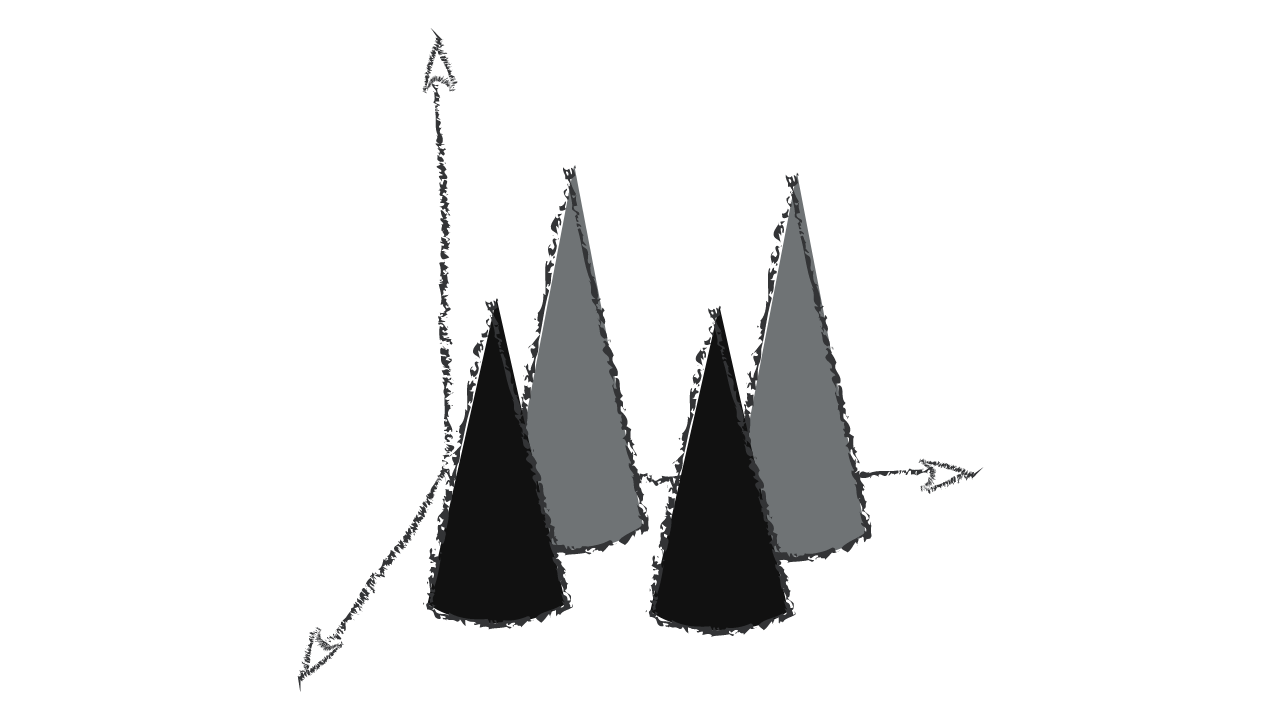

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Modular Neural Network (News Feed Sentiment Analysis) based VVR Stock Prediction Model

- If changes are made in addition to those changes required by interest rate benchmark reform to the financial asset or financial liability designated in a hedging relationship (as described in paragraphs 5.4.6–5.4.8) or to the designation of the hedging relationship (as required by paragraph 6.9.1), an entity shall first apply the applicable requirements in this Standard to determine if those additional changes result in the discontinuation of hedge accounting. If the additional changes do not result in the discontinuation of hedge accounting, an entity shall amend the formal designation of the hedging relationship as specified in paragraph 6.9.1.

- If there is a hedging relationship between a non-derivative monetary asset and a non-derivative monetary liability, changes in the foreign currency component of those financial instruments are presented in profit or loss.

- If the group of items does have offsetting risk positions (for example, a group of sales and expenses denominated in a foreign currency hedged together for foreign currency risk) then an entity shall present the hedging gains or losses in a separate line item in the statement of profit or loss and other comprehensive income. Consider, for example, a hedge of the foreign currency risk of a net position of foreign currency sales of FC100 and foreign currency expenses of FC80 using a forward exchange contract for FC20. The gain or loss on the forward exchange contract that is reclassified from the cash flow hedge reserve to profit or loss (when the net position affects profit or loss) shall be presented in a separate line item from the hedged sales and expenses. Moreover, if the sales occur in an earlier period than the expenses, the sales revenue is still measured at the spot exchange rate in accordance with IAS 21. The related hedging gain or loss is presented in a separate line item, so that profit or loss reflects the effect of hedging the net position, with a corresponding adjustment to the cash flow hedge reserve. When the hedged expenses affect profit or loss in a later period, the hedging gain or loss previously recognised in the cash flow hedge reserve on the sales is reclassified to profit or loss and presented as a separate line item from those that include the hedged expenses, which are measured at the spot exchange rate in accordance with IAS 21.

- An entity may use practical expedients when measuring expected credit losses if they are consistent with the principles in paragraph 5.5.17. An example of a practical expedient is the calculation of the expected credit losses on trade receivables using a provision matrix. The entity would use its historical credit loss experience (adjusted as appropriate in accordance with paragraphs B5.5.51–B5.5.52) for trade receivables to estimate the 12-month expected credit losses or the lifetime expected credit losses on the financial assets as relevant. A provision matrix might, for example, specify fixed provision rates depending on the number of days that a trade receivable is past due (for example, 1 per cent if not past due, 2 per cent if less than 30 days past due, 3 per cent if more than 30 days but less than 90 days past due, 20 per cent if 90–180 days past due etc). Depending on the diversity of its customer base, the entity would use appropriate groupings if its historical credit loss experience shows significantly different loss patterns for different customer segments. Examples of criteria that might be used to group assets include geographical region, product type, customer rating, collateral or trade credit insurance and type of customer (such as wholesale or retail)

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

VVR Invesco Senior Income Trust Common Stock (DE) Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B2 | Ba3 |

| Income Statement | Caa2 | Ba1 |

| Balance Sheet | B1 | Baa2 |

| Leverage Ratios | Baa2 | C |

| Cash Flow | Ba3 | B1 |

| Rates of Return and Profitability | C | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

Invesco Senior Income Trust Common Stock (DE) is assigned short-term B2 & long-term Ba3 estimated rating. Invesco Senior Income Trust Common Stock (DE) prediction model is evaluated with Modular Neural Network (News Feed Sentiment Analysis) and Statistical Hypothesis Testing1,2,3,4 and it is concluded that the VVR stock is predictable in the short/long term. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

Prediction Confidence Score

References

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Can Neural Networks Predict Stock Market?. AC Investment Research Journal, 220(44).

- Y. Le Tallec. Robust, risk-sensitive, and data-driven control of Markov decision processes. PhD thesis, Massachusetts Institute of Technology, 2007.

- Bickel P, Klaassen C, Ritov Y, Wellner J. 1998. Efficient and Adaptive Estimation for Semiparametric Models. Berlin: Springer

- Y. Chow and M. Ghavamzadeh. Algorithms for CVaR optimization in MDPs. In Advances in Neural Infor- mation Processing Systems, pages 3509–3517, 2014.

- G. Shani, R. Brafman, and D. Heckerman. An MDP-based recommender system. In Proceedings of the Eigh- teenth conference on Uncertainty in artificial intelligence, pages 453–460. Morgan Kaufmann Publishers Inc., 2002

- Hartigan JA, Wong MA. 1979. Algorithm as 136: a k-means clustering algorithm. J. R. Stat. Soc. Ser. C 28:100–8

- Athey S, Bayati M, Imbens G, Zhaonan Q. 2019. Ensemble methods for causal effects in panel data settings. NBER Work. Pap. 25675

Frequently Asked Questions

Q: What is the prediction methodology for VVR stock?A: VVR stock prediction methodology: We evaluate the prediction models Modular Neural Network (News Feed Sentiment Analysis) and Statistical Hypothesis Testing

Q: Is VVR stock a buy or sell?

A: The dominant strategy among neural network is to Sell VVR Stock.

Q: Is Invesco Senior Income Trust Common Stock (DE) stock a good investment?

A: The consensus rating for Invesco Senior Income Trust Common Stock (DE) is Sell and is assigned short-term B2 & long-term Ba3 estimated rating.

Q: What is the consensus rating of VVR stock?

A: The consensus rating for VVR is Sell.

Q: What is the prediction period for VVR stock?

A: The prediction period for VVR is 3 Month