Dominant Strategy : Buy

Time series to forecast n: 13 Jun 2023 for 8 Weeks

Methodology : Transductive Learning (ML)

Abstract

Windtree Therapeutics Inc. Common Stock prediction model is evaluated with Transductive Learning (ML) and Polynomial Regression1,2,3,4 and it is concluded that the WINT stock is predictable in the short/long term. Transductive learning is a supervised machine learning (ML) method in which the model is trained on both labeled and unlabeled data. The goal of transductive learning is to predict the labels of the unlabeled data. Transductive learning is a hybrid of inductive and semi-supervised learning. Inductive learning algorithms are trained on labeled data only, while semi-supervised learning algorithms are trained on a combination of labeled and unlabeled data. Transductive learning algorithms can achieve better performance than inductive learning algorithms on tasks where there is a small amount of labeled data. This is because transductive learning algorithms can use the unlabeled data to help them learn the relationships between the features and the labels. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Buy

Key Points

- How useful are statistical predictions?

- Can statistics predict the future?

- Fundemental Analysis with Algorithmic Trading

WINT Target Price Prediction Modeling Methodology

We consider Windtree Therapeutics Inc. Common Stock Decision Process with Transductive Learning (ML) where A is the set of discrete actions of WINT stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

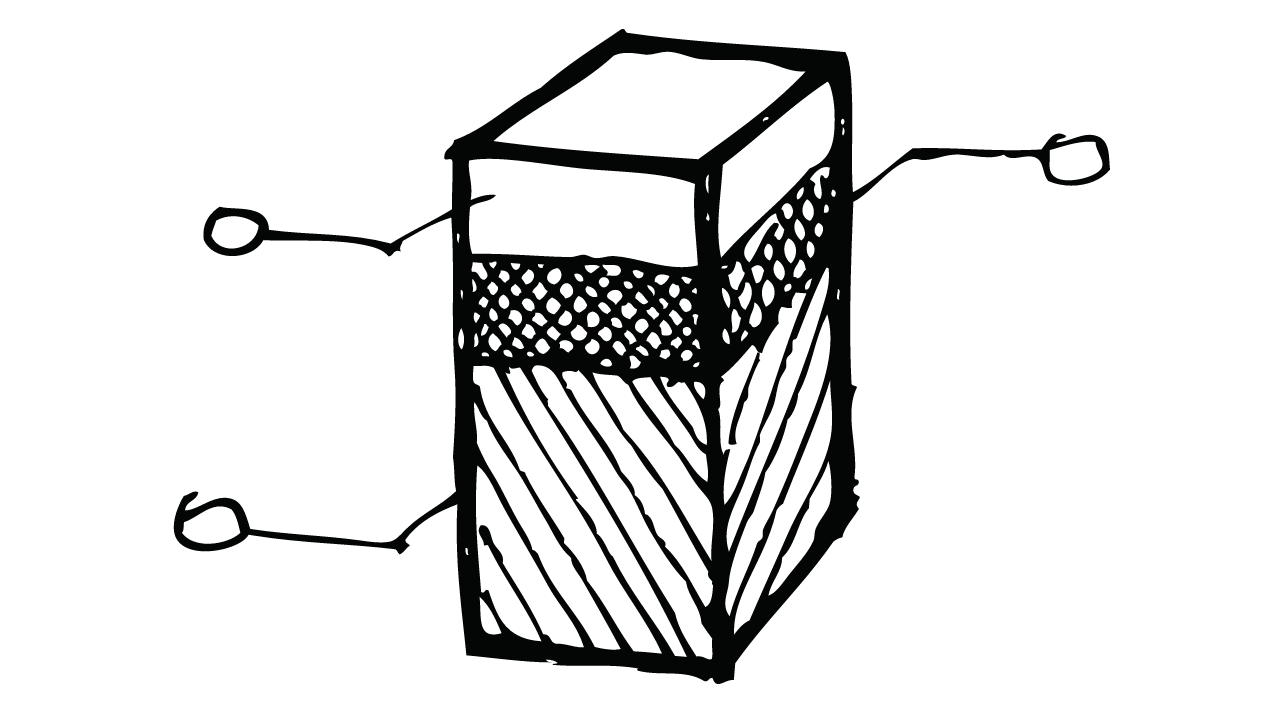

F(Polynomial Regression)5,6,7= X R(Transductive Learning (ML)) X S(n):→ 8 Weeks

n:Time series to forecast

p:Price signals of WINT stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Transductive Learning (ML)

Transductive learning is a supervised machine learning (ML) method in which the model is trained on both labeled and unlabeled data. The goal of transductive learning is to predict the labels of the unlabeled data. Transductive learning is a hybrid of inductive and semi-supervised learning. Inductive learning algorithms are trained on labeled data only, while semi-supervised learning algorithms are trained on a combination of labeled and unlabeled data. Transductive learning algorithms can achieve better performance than inductive learning algorithms on tasks where there is a small amount of labeled data. This is because transductive learning algorithms can use the unlabeled data to help them learn the relationships between the features and the labels.Polynomial Regression

Polynomial regression is a type of regression analysis that uses a polynomial function to model the relationship between a dependent variable and one or more independent variables. Polynomial functions are mathematical functions that have a polynomial term, which is a term that is raised to a power greater than 1. In polynomial regression, the dependent variable is modeled as a polynomial function of the independent variables. The degree of the polynomial function is determined by the researcher. The higher the degree of the polynomial function, the more complex the model will be.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

WINT Stock Forecast (Buy or Sell) for 8 Weeks

Sample Set: Neural NetworkStock/Index: WINT Windtree Therapeutics Inc. Common Stock

Time series to forecast n: 13 Jun 2023 for 8 Weeks

According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Buy

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for Windtree Therapeutics Inc. Common Stock

- When measuring a loss allowance for a lease receivable, the cash flows used for determining the expected credit losses should be consistent with the cash flows used in measuring the lease receivable in accordance with IFRS 16 Leases.

- The following example describes a situation in which an accounting mismatch would be created in profit or loss if the effects of changes in the credit risk of the liability were presented in other comprehensive income. A mortgage bank provides loans to customers and funds those loans by selling bonds with matching characteristics (eg amount outstanding, repayment profile, term and currency) in the market. The contractual terms of the loan permit the mortgage customer to prepay its loan (ie satisfy its obligation to the bank) by buying the corresponding bond at fair value in the market and delivering that bond to the mortgage bank. As a result of that contractual prepayment right, if the credit quality of the bond worsens (and, thus, the fair value of the mortgage bank's liability decreases), the fair value of the mortgage bank's loan asset also decreases. The change in the fair value of the asset reflects the mortgage customer's contractual right to prepay the mortgage loan by buying the underlying bond at fair value (which, in this example, has decreased) and delivering the bond to the mortgage bank. Consequently, the effects of changes in the credit risk of the liability (the bond) will be offset in profit or loss by a corresponding change in the fair value of a financial asset (the loan). If the effects of changes in the liability's credit risk were presented in other comprehensive income there would be an accounting mismatch in profit or loss. Consequently, the mortgage bank is required to present all changes in fair value of the liability (including the effects of changes in the liability's credit risk) in profit or loss.

- The expected credit losses on a loan commitment shall be discounted using the effective interest rate, or an approximation thereof, that will be applied when recognising the financial asset resulting from the loan commitment. This is because for the purpose of applying the impairment requirements, a financial asset that is recognised following a draw down on a loan commitment shall be treated as a continuation of that commitment instead of as a new financial instrument. The expected credit losses on the financial asset shall therefore be measured considering the initial credit risk of the loan commitment from the date that the entity became a party to the irrevocable commitment.

- If such a mismatch would be created or enlarged, the entity is required to present all changes in fair value (including the effects of changes in the credit risk of the liability) in profit or loss. If such a mismatch would not be created or enlarged, the entity is required to present the effects of changes in the liability's credit risk in other comprehensive income.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

Windtree Therapeutics Inc. Common Stock is assigned short-term Ba1 & long-term Ba1 estimated rating. Windtree Therapeutics Inc. Common Stock prediction model is evaluated with Transductive Learning (ML) and Polynomial Regression1,2,3,4 and it is concluded that the WINT stock is predictable in the short/long term. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Buy

WINT Windtree Therapeutics Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | B1 | Caa2 |

| Balance Sheet | Baa2 | Baa2 |

| Leverage Ratios | B1 | Ba3 |

| Cash Flow | Caa2 | B2 |

| Rates of Return and Profitability | Baa2 | C |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- V. Borkar. Stochastic approximation: a dynamical systems viewpoint. Cambridge University Press, 2008

- Van der Vaart AW. 2000. Asymptotic Statistics. Cambridge, UK: Cambridge Univ. Press

- Breiman L. 2001b. Statistical modeling: the two cultures (with comments and a rejoinder by the author). Stat. Sci. 16:199–231

- P. Marbach. Simulated-Based Methods for Markov Decision Processes. PhD thesis, Massachusetts Institute of Technology, 1998

- Dudik M, Langford J, Li L. 2011. Doubly robust policy evaluation and learning. In Proceedings of the 28th International Conference on Machine Learning, pp. 1097–104. La Jolla, CA: Int. Mach. Learn. Soc.

- Chernozhukov V, Newey W, Robins J. 2018c. Double/de-biased machine learning using regularized Riesz representers. arXiv:1802.08667 [stat.ML]

- D. Bertsekas and J. Tsitsiklis. Neuro-dynamic programming. Athena Scientific, 1996.

Frequently Asked Questions

Q: What is the prediction methodology for WINT stock?A: WINT stock prediction methodology: We evaluate the prediction models Transductive Learning (ML) and Polynomial Regression

Q: Is WINT stock a buy or sell?

A: The dominant strategy among neural network is to Buy WINT Stock.

Q: Is Windtree Therapeutics Inc. Common Stock stock a good investment?

A: The consensus rating for Windtree Therapeutics Inc. Common Stock is Buy and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of WINT stock?

A: The consensus rating for WINT is Buy.

Q: What is the prediction period for WINT stock?

A: The prediction period for WINT is 8 Weeks