Dominant Strategy : Sell

Time series to forecast n: 13 Jun 2023 for 3 Month

Methodology : Modular Neural Network (Emotional Trigger/Responses Analysis)

Abstract

SilverSPAC Inc. Class A Ordinary Share prediction model is evaluated with Modular Neural Network (Emotional Trigger/Responses Analysis) and Statistical Hypothesis Testing1,2,3,4 and it is concluded that the SLVR stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for emotional trigger/responses analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of emotional trigger/responses analysis, MNNs can be used to identify the emotional triggers that cause people to experience certain emotions, and to identify the responses that people typically exhibit when they experience those emotions. This information can then be used to develop more effective emotional support systems, to improve the accuracy of artificial intelligence systems, and to create more engaging and immersive entertainment experiences. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

Key Points

- Operational Risk

- Stock Forecast Based On a Predictive Algorithm

- What are main components of Markov decision process?

SLVR Target Price Prediction Modeling Methodology

We consider SilverSPAC Inc. Class A Ordinary Share Decision Process with Modular Neural Network (Emotional Trigger/Responses Analysis) where A is the set of discrete actions of SLVR stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Statistical Hypothesis Testing)5,6,7= X R(Modular Neural Network (Emotional Trigger/Responses Analysis)) X S(n):→ 3 Month

n:Time series to forecast

p:Price signals of SLVR stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Emotional Trigger/Responses Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for emotional trigger/responses analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of emotional trigger/responses analysis, MNNs can be used to identify the emotional triggers that cause people to experience certain emotions, and to identify the responses that people typically exhibit when they experience those emotions. This information can then be used to develop more effective emotional support systems, to improve the accuracy of artificial intelligence systems, and to create more engaging and immersive entertainment experiences.Statistical Hypothesis Testing

Statistical hypothesis testing is a process used to determine whether there is enough evidence to support a claim about a population based on a sample. The process involves making two hypotheses, a null hypothesis and an alternative hypothesis, and then collecting data and using statistical tests to determine which hypothesis is more likely to be true. The null hypothesis is the statement that there is no difference between the population and the sample. The alternative hypothesis is the statement that there is a difference between the population and the sample. The statistical test is used to calculate a p-value, which is the probability of obtaining the observed data or more extreme data if the null hypothesis is true. A p-value of less than 0.05 is typically considered to be statistically significant, which means that there is less than a 5% chance of obtaining the observed data or more extreme data if the null hypothesis is true.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

SLVR Stock Forecast (Buy or Sell) for 3 Month

Sample Set: Neural NetworkStock/Index: SLVR SilverSPAC Inc. Class A Ordinary Share

Time series to forecast n: 13 Jun 2023 for 3 Month

According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

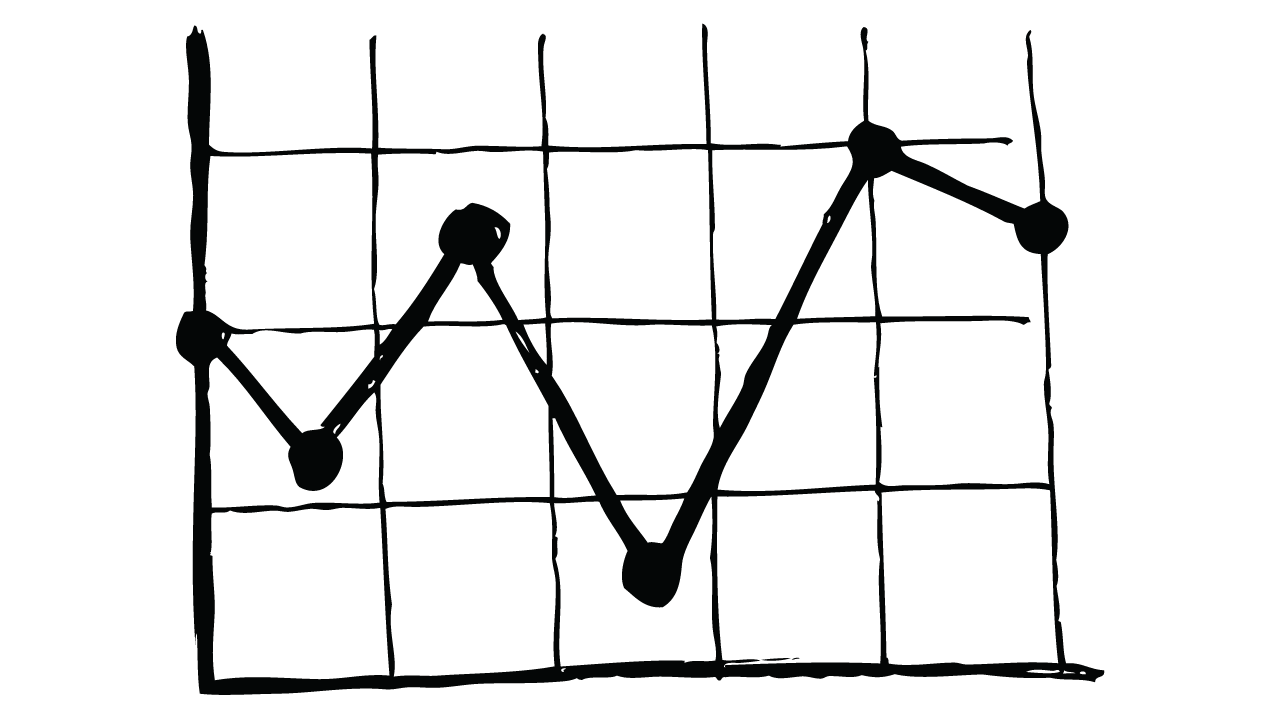

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for SilverSPAC Inc. Class A Ordinary Share

- Measurement of a financial asset or financial liability and classification of recognised changes in its value are determined by the item's classification and whether the item is part of a designated hedging relationship. Those requirements can create a measurement or recognition inconsistency (sometimes referred to as an 'accounting mismatch') when, for example, in the absence of designation as at fair value through profit or loss, a financial asset would be classified as subsequently measured at fair value through profit or loss and a liability the entity considers related would be subsequently measured at amortised cost (with changes in fair value not recognised). In such circumstances, an entity may conclude that its financial statements would provide more relevant information if both the asset and the liability were measured as at fair value through profit or loss.

- Measurement of a financial asset or financial liability and classification of recognised changes in its value are determined by the item's classification and whether the item is part of a designated hedging relationship. Those requirements can create a measurement or recognition inconsistency (sometimes referred to as an 'accounting mismatch') when, for example, in the absence of designation as at fair value through profit or loss, a financial asset would be classified as subsequently measured at fair value through profit or loss and a liability the entity considers related would be subsequently measured at amortised cost (with changes in fair value not recognised). In such circumstances, an entity may conclude that its financial statements would provide more relevant information if both the asset and the liability were measured as at fair value through profit or loss.

- Amounts presented in other comprehensive income shall not be subsequently transferred to profit or loss. However, the entity may transfer the cumulative gain or loss within equity.

- In addition to those hedging relationships specified in paragraph 6.9.1, an entity shall apply the requirements in paragraphs 6.9.11 and 6.9.12 to new hedging relationships in which an alternative benchmark rate is designated as a non-contractually specified risk component (see paragraphs 6.3.7(a) and B6.3.8) when, because of interest rate benchmark reform, that risk component is not separately identifiable at the date it is designated.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

SilverSPAC Inc. Class A Ordinary Share is assigned short-term Ba1 & long-term Ba1 estimated rating. SilverSPAC Inc. Class A Ordinary Share prediction model is evaluated with Modular Neural Network (Emotional Trigger/Responses Analysis) and Statistical Hypothesis Testing1,2,3,4 and it is concluded that the SLVR stock is predictable in the short/long term. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

SLVR SilverSPAC Inc. Class A Ordinary Share Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | Caa2 | Caa2 |

| Balance Sheet | B3 | B3 |

| Leverage Ratios | Ba1 | Baa2 |

| Cash Flow | C | Ba3 |

| Rates of Return and Profitability | Baa2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Friedberg R, Tibshirani J, Athey S, Wager S. 2018. Local linear forests. arXiv:1807.11408 [stat.ML]

- Abadir, K. M., K. Hadri E. Tzavalis (1999), "The influence of VAR dimensions on estimator biases," Econometrica, 67, 163–181.

- Athey S, Blei D, Donnelly R, Ruiz F. 2017b. Counterfactual inference for consumer choice across many prod- uct categories. AEA Pap. Proc. 108:64–67

- Blei DM, Lafferty JD. 2009. Topic models. In Text Mining: Classification, Clustering, and Applications, ed. A Srivastava, M Sahami, pp. 101–24. Boca Raton, FL: CRC Press

- Gentzkow M, Kelly BT, Taddy M. 2017. Text as data. NBER Work. Pap. 23276

- Hartford J, Lewis G, Taddy M. 2016. Counterfactual prediction with deep instrumental variables networks. arXiv:1612.09596 [stat.AP]

- M. Babes, E. M. de Cote, and M. L. Littman. Social reward shaping in the prisoner's dilemma. In 7th International Joint Conference on Autonomous Agents and Multiagent Systems (AAMAS 2008), Estoril, Portugal, May 12-16, 2008, Volume 3, pages 1389–1392, 2008.

Frequently Asked Questions

Q: What is the prediction methodology for SLVR stock?A: SLVR stock prediction methodology: We evaluate the prediction models Modular Neural Network (Emotional Trigger/Responses Analysis) and Statistical Hypothesis Testing

Q: Is SLVR stock a buy or sell?

A: The dominant strategy among neural network is to Sell SLVR Stock.

Q: Is SilverSPAC Inc. Class A Ordinary Share stock a good investment?

A: The consensus rating for SilverSPAC Inc. Class A Ordinary Share is Sell and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of SLVR stock?

A: The consensus rating for SLVR is Sell.

Q: What is the prediction period for SLVR stock?

A: The prediction period for SLVR is 3 Month