Dominant Strategy : Speculative Trend

Time series to forecast n: 13 Jun 2023 for 6 Month

Methodology : Active Learning (ML)

Abstract

STARPHARMA HOLDINGS LIMITED prediction model is evaluated with Active Learning (ML) and Spearman Correlation1,2,3,4 and it is concluded that the SPL stock is predictable in the short/long term. Active learning (AL) is a machine learning (ML) method in which the model actively queries the user for labels on data points. This allows the model to learn more efficiently, as it is only learning about the data points that are most informative. According to price forecasts for 6 Month period, the dominant strategy among neural network is: Speculative Trend

Key Points

- Reaction Function

- Can machine learning predict?

- Market Outlook

SPL Target Price Prediction Modeling Methodology

We consider STARPHARMA HOLDINGS LIMITED Decision Process with Active Learning (ML) where A is the set of discrete actions of SPL stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

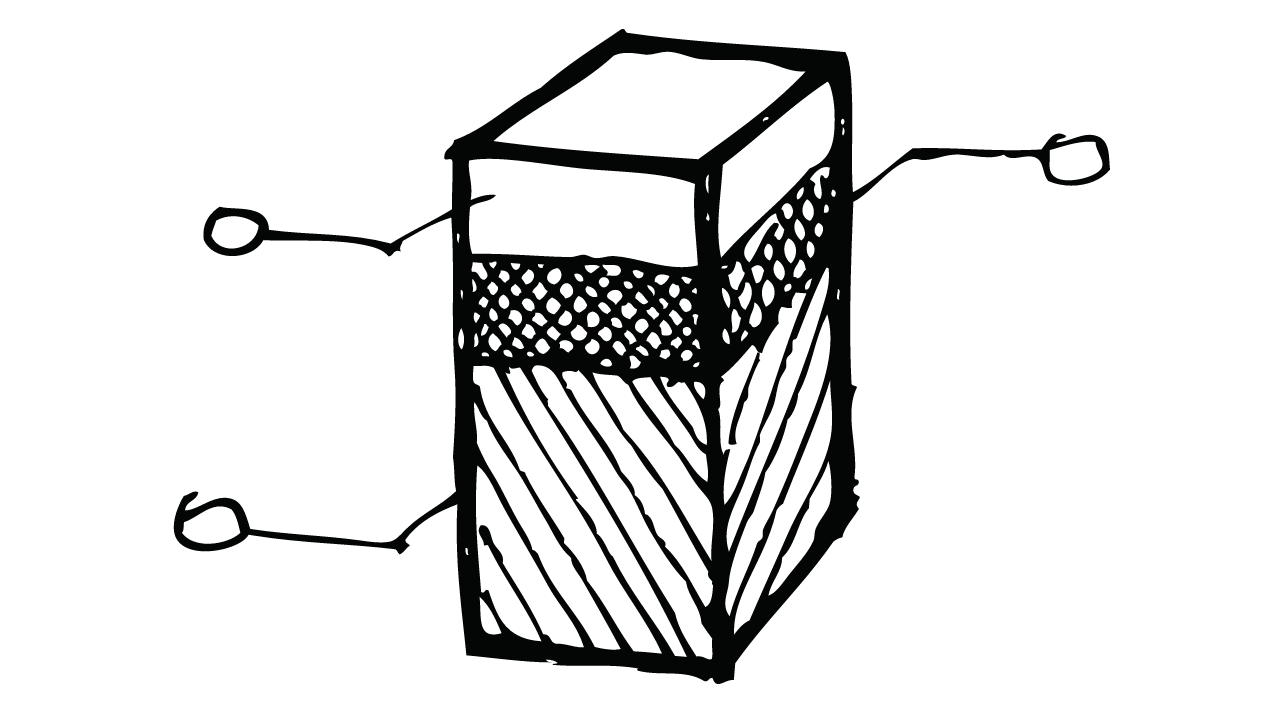

F(Spearman Correlation)5,6,7= X R(Active Learning (ML)) X S(n):→ 6 Month

n:Time series to forecast

p:Price signals of SPL stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Active Learning (ML)

Active learning (AL) is a machine learning (ML) method in which the model actively queries the user for labels on data points. This allows the model to learn more efficiently, as it is only learning about the data points that are most informative.Spearman Correlation

Spearman correlation is a nonparametric measure of the strength and direction of association between two variables. It is a rank-based correlation, which means that it does not assume that the data is normally distributed. Spearman correlation is calculated by first ranking the data for each variable, and then calculating the Pearson correlation between the ranks.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

SPL Stock Forecast (Buy or Sell) for 6 Month

Sample Set: Neural NetworkStock/Index: SPL STARPHARMA HOLDINGS LIMITED

Time series to forecast n: 13 Jun 2023 for 6 Month

According to price forecasts for 6 Month period, the dominant strategy among neural network is: Speculative Trend

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for STARPHARMA HOLDINGS LIMITED

- A contractually specified inflation risk component of the cash flows of a recognised inflation-linked bond (assuming that there is no requirement to account for an embedded derivative separately) is separately identifiable and reliably measurable, as long as other cash flows of the instrument are not affected by the inflation risk component.

- When rebalancing a hedging relationship, an entity shall update its analysis of the sources of hedge ineffectiveness that are expected to affect the hedging relationship during its (remaining) term (see paragraph B6.4.2). The documentation of the hedging relationship shall be updated accordingly.

- A net position is eligible for hedge accounting only if an entity hedges on a net basis for risk management purposes. Whether an entity hedges in this way is a matter of fact (not merely of assertion or documentation). Hence, an entity cannot apply hedge accounting on a net basis solely to achieve a particular accounting outcome if that would not reflect its risk management approach. Net position hedging must form part of an established risk management strategy. Normally this would be approved by key management personnel as defined in IAS 24.

- When an entity separates the foreign currency basis spread from a financial instrument and excludes it from the designation of that financial instrument as the hedging instrument (see paragraph 6.2.4(b)), the application guidance in paragraphs B6.5.34–B6.5.38 applies to the foreign currency basis spread in the same manner as it is applied to the forward element of a forward contract.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

STARPHARMA HOLDINGS LIMITED is assigned short-term Ba1 & long-term Ba1 estimated rating. STARPHARMA HOLDINGS LIMITED prediction model is evaluated with Active Learning (ML) and Spearman Correlation1,2,3,4 and it is concluded that the SPL stock is predictable in the short/long term. According to price forecasts for 6 Month period, the dominant strategy among neural network is: Speculative Trend

SPL STARPHARMA HOLDINGS LIMITED Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | C | B2 |

| Balance Sheet | B2 | Caa2 |

| Leverage Ratios | C | Caa2 |

| Cash Flow | Ba1 | Baa2 |

| Rates of Return and Profitability | B2 | Ba1 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Mnih A, Hinton GE. 2007. Three new graphical models for statistical language modelling. In International Conference on Machine Learning, pp. 641–48. La Jolla, CA: Int. Mach. Learn. Soc.

- Vapnik V. 2013. The Nature of Statistical Learning Theory. Berlin: Springer

- J. G. Schneider, W. Wong, A. W. Moore, and M. A. Riedmiller. Distributed value functions. In Proceedings of the Sixteenth International Conference on Machine Learning (ICML 1999), Bled, Slovenia, June 27 - 30, 1999, pages 371–378, 1999.

- C. Szepesvári. Algorithms for Reinforcement Learning. Synthesis Lectures on Artificial Intelligence and Machine Learning. Morgan & Claypool Publishers, 2010

- J. G. Schneider, W. Wong, A. W. Moore, and M. A. Riedmiller. Distributed value functions. In Proceedings of the Sixteenth International Conference on Machine Learning (ICML 1999), Bled, Slovenia, June 27 - 30, 1999, pages 371–378, 1999.

- C. Szepesvári. Algorithms for Reinforcement Learning. Synthesis Lectures on Artificial Intelligence and Machine Learning. Morgan & Claypool Publishers, 2010

- Keane MP. 2013. Panel data discrete choice models of consumer demand. In The Oxford Handbook of Panel Data, ed. BH Baltagi, pp. 54–102. Oxford, UK: Oxford Univ. Press

Frequently Asked Questions

Q: What is the prediction methodology for SPL stock?A: SPL stock prediction methodology: We evaluate the prediction models Active Learning (ML) and Spearman Correlation

Q: Is SPL stock a buy or sell?

A: The dominant strategy among neural network is to Speculative Trend SPL Stock.

Q: Is STARPHARMA HOLDINGS LIMITED stock a good investment?

A: The consensus rating for STARPHARMA HOLDINGS LIMITED is Speculative Trend and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of SPL stock?

A: The consensus rating for SPL is Speculative Trend.

Q: What is the prediction period for SPL stock?

A: The prediction period for SPL is 6 Month