Dominant Strategy : Sell

Time series to forecast n: 11 Jun 2023 for 3 Month

Methodology : Inductive Learning (ML)

Abstract

BYOTROL PLC prediction model is evaluated with Inductive Learning (ML) and Factor1,2,3,4 and it is concluded that the LON:BYOT stock is predictable in the short/long term. Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

Key Points

- What is statistical models in machine learning?

- Investment Risk

- What is a prediction confidence?

LON:BYOT Target Price Prediction Modeling Methodology

We consider BYOTROL PLC Decision Process with Inductive Learning (ML) where A is the set of discrete actions of LON:BYOT stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Factor)5,6,7= X R(Inductive Learning (ML)) X S(n):→ 3 Month

n:Time series to forecast

p:Price signals of LON:BYOT stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Inductive Learning (ML)

Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses.Factor

In statistics, a factor is a variable that can influence the value of another variable. Factors can be categorical or continuous. Categorical factors have a limited number of possible values, such as gender (male or female) or blood type (A, B, AB, or O). Continuous factors can have an infinite number of possible values, such as height or weight. Factors can be used to explain the variation in a dependent variable. For example, a study might find that there is a relationship between gender and height. In this case, gender would be the independent variable, height would be the dependent variable, and the factor would be gender.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

LON:BYOT Stock Forecast (Buy or Sell) for 3 Month

Sample Set: Neural NetworkStock/Index: LON:BYOT BYOTROL PLC

Time series to forecast n: 11 Jun 2023 for 3 Month

According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

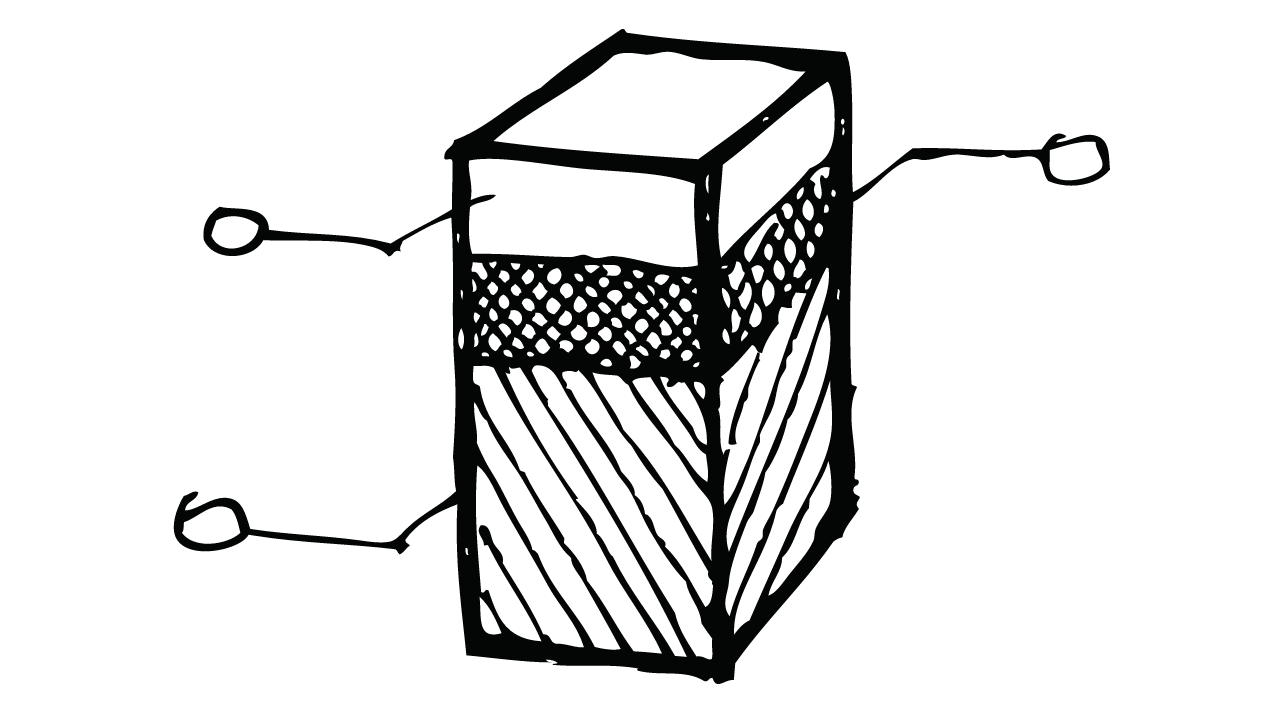

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for BYOTROL PLC

- At the date of initial application, an entity is permitted to make the designation in paragraph 2.5 for contracts that already exist on the date but only if it designates all similar contracts. The change in the net assets resulting from such designations shall be recognised in retained earnings at the date of initial application.

- If a financial instrument is designated in accordance with paragraph 6.7.1 as measured at fair value through profit or loss after its initial recognition, or was previously not recognised, the difference at the time of designation between the carrying amount, if any, and the fair value shall immediately be recognised in profit or loss. For financial assets measured at fair value through other comprehensive income in accordance with paragraph 4.1.2A, the cumulative gain or loss previously recognised in other comprehensive income shall immediately be reclassified from equity to profit or loss as a reclassification adjustment.

- IFRS 16, issued in January 2016, amended paragraphs 2.1, 5.5.15, B4.3.8, B5.5.34 and B5.5.46. An entity shall apply those amendments when it applies IFRS 16.

- An entity that first applies IFRS 17 as amended in June 2020 after it first applies this Standard shall apply paragraphs 7.2.39–7.2.42. The entity shall also apply the other transition requirements in this Standard necessary for applying these amendments. For that purpose, references to the date of initial application shall be read as referring to the beginning of the reporting period in which an entity first applies these amendments (date of initial application of these amendments).

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

BYOTROL PLC is assigned short-term Ba1 & long-term Ba1 estimated rating. BYOTROL PLC prediction model is evaluated with Inductive Learning (ML) and Factor1,2,3,4 and it is concluded that the LON:BYOT stock is predictable in the short/long term. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

LON:BYOT BYOTROL PLC Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | Caa2 | Ba2 |

| Balance Sheet | B3 | Baa2 |

| Leverage Ratios | C | Baa2 |

| Cash Flow | Baa2 | Caa2 |

| Rates of Return and Profitability | Baa2 | B3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Chow, G. C. (1960), "Tests of equality between sets of coefficients in two linear regressions," Econometrica, 28, 591–605.

- Tibshirani R, Hastie T. 1987. Local likelihood estimation. J. Am. Stat. Assoc. 82:559–67

- Candès EJ, Recht B. 2009. Exact matrix completion via convex optimization. Found. Comput. Math. 9:717

- K. Boda, J. Filar, Y. Lin, and L. Spanjers. Stochastic target hitting time and the problem of early retirement. Automatic Control, IEEE Transactions on, 49(3):409–419, 2004

- Athey S, Bayati M, Imbens G, Zhaonan Q. 2019. Ensemble methods for causal effects in panel data settings. NBER Work. Pap. 25675

- Abadie A, Imbens GW. 2011. Bias-corrected matching estimators for average treatment effects. J. Bus. Econ. Stat. 29:1–11

- Wan M, Wang D, Goldman M, Taddy M, Rao J, et al. 2017. Modeling consumer preferences and price sensitiv- ities from large-scale grocery shopping transaction logs. In Proceedings of the 26th International Conference on the World Wide Web, pp. 1103–12. New York: ACM

Frequently Asked Questions

Q: What is the prediction methodology for LON:BYOT stock?A: LON:BYOT stock prediction methodology: We evaluate the prediction models Inductive Learning (ML) and Factor

Q: Is LON:BYOT stock a buy or sell?

A: The dominant strategy among neural network is to Sell LON:BYOT Stock.

Q: Is BYOTROL PLC stock a good investment?

A: The consensus rating for BYOTROL PLC is Sell and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of LON:BYOT stock?

A: The consensus rating for LON:BYOT is Sell.

Q: What is the prediction period for LON:BYOT stock?

A: The prediction period for LON:BYOT is 3 Month