Dominant Strategy : Hold

Time series to forecast n: 12 Jun 2023 for 8 Weeks

Methodology : Modular Neural Network (Market Volatility Analysis)

Abstract

ASEANA PROPERTIES LIMITED prediction model is evaluated with Modular Neural Network (Market Volatility Analysis) and Linear Regression1,2,3,4 and it is concluded that the LON:ASPL stock is predictable in the short/long term. Modular neural networks (MNNs) are a type of artificial neural network that can be used for market volatility analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying patterns in data or predicting future price movements. The modules are then combined to form a single neural network that can perform multiple tasks.In the context of market volatility analysis, MNNs can be used to identify patterns in market data that suggest that the market is becoming more or less volatile. This information can then be used to make predictions about future price movements. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

Key Points

- Dominated Move

- Short/Long Term Stocks

- Game Theory

LON:ASPL Target Price Prediction Modeling Methodology

We consider ASEANA PROPERTIES LIMITED Decision Process with Modular Neural Network (Market Volatility Analysis) where A is the set of discrete actions of LON:ASPL stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Linear Regression)5,6,7= X R(Modular Neural Network (Market Volatility Analysis)) X S(n):→ 8 Weeks

n:Time series to forecast

p:Price signals of LON:ASPL stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Market Volatility Analysis)

Modular neural networks (MNNs) are a type of artificial neural network that can be used for market volatility analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying patterns in data or predicting future price movements. The modules are then combined to form a single neural network that can perform multiple tasks.In the context of market volatility analysis, MNNs can be used to identify patterns in market data that suggest that the market is becoming more or less volatile. This information can then be used to make predictions about future price movements.Linear Regression

In statistics, linear regression is a method for estimating the relationship between a dependent variable and one or more independent variables. The dependent variable is the variable that is being predicted, and the independent variables are the variables that are used to predict the dependent variable. Linear regression assumes that the relationship between the dependent variable and the independent variables is linear. This means that the dependent variable can be represented as a straight line function of the independent variables.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

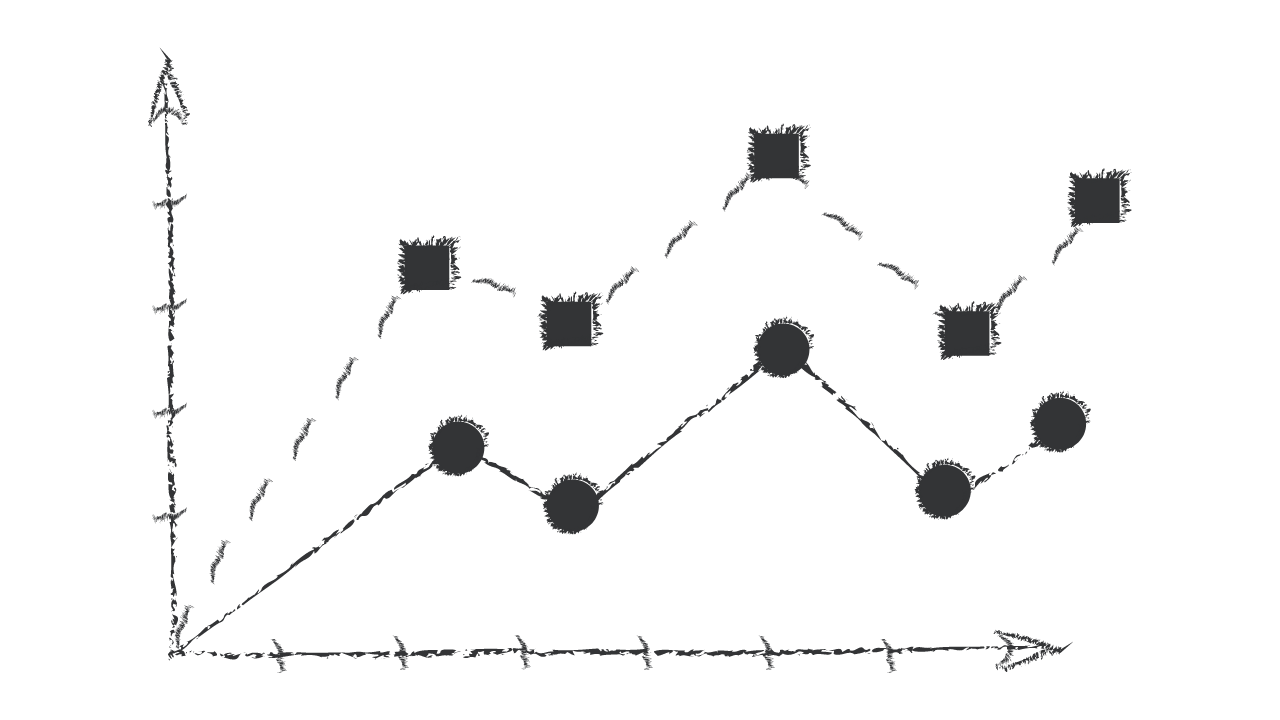

LON:ASPL Stock Forecast (Buy or Sell) for 8 Weeks

Sample Set: Neural NetworkStock/Index: LON:ASPL ASEANA PROPERTIES LIMITED

Time series to forecast n: 12 Jun 2023 for 8 Weeks

According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for ASEANA PROPERTIES LIMITED

- If there is a hedging relationship between a non-derivative monetary asset and a non-derivative monetary liability, changes in the foreign currency component of those financial instruments are presented in profit or loss.

- If there is a hedging relationship between a non-derivative monetary asset and a non-derivative monetary liability, changes in the foreign currency component of those financial instruments are presented in profit or loss.

- A portfolio of financial assets that is managed and whose performance is evaluated on a fair value basis (as described in paragraph 4.2.2(b)) is neither held to collect contractual cash flows nor held both to collect contractual cash flows and to sell financial assets. The entity is primarily focused on fair value information and uses that information to assess the assets' performance and to make decisions. In addition, a portfolio of financial assets that meets the definition of held for trading is not held to collect contractual cash flows or held both to collect contractual cash flows and to sell financial assets. For such portfolios, the collection of contractual cash flows is only incidental to achieving the business model's objective. Consequently, such portfolios of financial assets must be measured at fair value through profit or loss.

- For hedges other than hedges of foreign currency risk, when an entity designates a non-derivative financial asset or a non-derivative financial liability measured at fair value through profit or loss as a hedging instrument, it may only designate the non-derivative financial instrument in its entirety or a proportion of it.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

ASEANA PROPERTIES LIMITED is assigned short-term Ba1 & long-term Ba1 estimated rating. ASEANA PROPERTIES LIMITED prediction model is evaluated with Modular Neural Network (Market Volatility Analysis) and Linear Regression1,2,3,4 and it is concluded that the LON:ASPL stock is predictable in the short/long term. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

LON:ASPL ASEANA PROPERTIES LIMITED Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | C | B1 |

| Balance Sheet | C | C |

| Leverage Ratios | B1 | Caa2 |

| Cash Flow | C | Ba3 |

| Rates of Return and Profitability | Caa2 | B2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- V. Konda and J. Tsitsiklis. Actor-Critic algorithms. In Proceedings of Advances in Neural Information Processing Systems 12, pages 1008–1014, 2000

- C. Wu and Y. Lin. Minimizing risk models in Markov decision processes with policies depending on target values. Journal of Mathematical Analysis and Applications, 231(1):47–67, 1999

- J. Ott. A Markov decision model for a surveillance application and risk-sensitive Markov decision processes. PhD thesis, Karlsruhe Institute of Technology, 2010.

- R. Howard and J. Matheson. Risk sensitive Markov decision processes. Management Science, 18(7):356– 369, 1972

- Doudchenko N, Imbens GW. 2016. Balancing, regression, difference-in-differences and synthetic control methods: a synthesis. NBER Work. Pap. 22791

- Challen, D. W. A. J. Hagger (1983), Macroeconomic Systems: Construction, Validation and Applications. New York: St. Martin's Press.

- M. L. Littman. Friend-or-foe q-learning in general-sum games. In Proceedings of the Eighteenth International Conference on Machine Learning (ICML 2001), Williams College, Williamstown, MA, USA, June 28 - July 1, 2001, pages 322–328, 2001

Frequently Asked Questions

Q: What is the prediction methodology for LON:ASPL stock?A: LON:ASPL stock prediction methodology: We evaluate the prediction models Modular Neural Network (Market Volatility Analysis) and Linear Regression

Q: Is LON:ASPL stock a buy or sell?

A: The dominant strategy among neural network is to Hold LON:ASPL Stock.

Q: Is ASEANA PROPERTIES LIMITED stock a good investment?

A: The consensus rating for ASEANA PROPERTIES LIMITED is Hold and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of LON:ASPL stock?

A: The consensus rating for LON:ASPL is Hold.

Q: What is the prediction period for LON:ASPL stock?

A: The prediction period for LON:ASPL is 8 Weeks