Dominant Strategy : Hold

Time series to forecast n: 11 Jun 2023 for 8 Weeks

Methodology : Inductive Learning (ML)

Abstract

Lion One Metals Limited prediction model is evaluated with Inductive Learning (ML) and Multiple Regression1,2,3,4 and it is concluded that the LIO:TSXV stock is predictable in the short/long term. Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

Key Points

- What is prediction in deep learning?

- Can machine learning predict?

- What statistical methods are used to analyze data?

LIO:TSXV Target Price Prediction Modeling Methodology

We consider Lion One Metals Limited Decision Process with Inductive Learning (ML) where A is the set of discrete actions of LIO:TSXV stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Multiple Regression)5,6,7= X R(Inductive Learning (ML)) X S(n):→ 8 Weeks

n:Time series to forecast

p:Price signals of LIO:TSXV stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Inductive Learning (ML)

Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses.Multiple Regression

Multiple regression is a statistical method that analyzes the relationship between a dependent variable and multiple independent variables. The dependent variable is the variable that is being predicted, and the independent variables are the variables that are used to predict the dependent variable. Multiple regression is a more complex statistical method than simple linear regression, which only analyzes the relationship between a dependent variable and one independent variable. Multiple regression can be used to analyze more complex relationships between variables, and it can also be used to control for confounding variables. A confounding variable is a variable that is correlated with both the dependent variable and one or more of the independent variables. Confounding variables can distort the relationship between the dependent variable and the independent variables. Multiple regression can be used to control for confounding variables by including them in the model.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

LIO:TSXV Stock Forecast (Buy or Sell) for 8 Weeks

Sample Set: Neural NetworkStock/Index: LIO:TSXV Lion One Metals Limited

Time series to forecast n: 11 Jun 2023 for 8 Weeks

According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

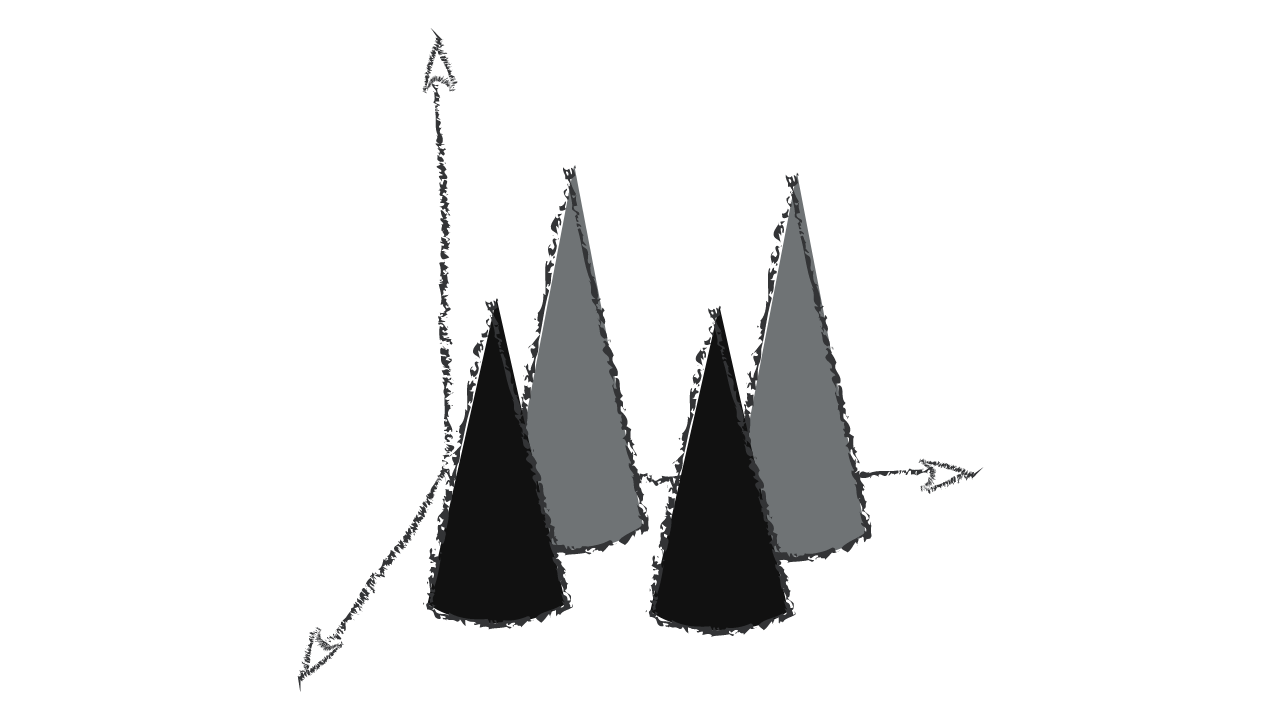

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for Lion One Metals Limited

- The fact that a derivative is in or out of the money when it is designated as a hedging instrument does not in itself mean that a qualitative assessment is inappropriate. It depends on the circumstances whether hedge ineffectiveness arising from that fact could have a magnitude that a qualitative assessment would not adequately capture.

- A contractual cash flow characteristic does not affect the classification of the financial asset if it could have only a de minimis effect on the contractual cash flows of the financial asset. To make this determination, an entity must consider the possible effect of the contractual cash flow characteristic in each reporting period and cumulatively over the life of the financial instrument. In addition, if a contractual cash flow characteristic could have an effect on the contractual cash flows that is more than de minimis (either in a single reporting period or cumulatively) but that cash flow characteristic is not genuine, it does not affect the classification of a financial asset. A cash flow characteristic is not genuine if it affects the instrument's contractual cash flows only on the occurrence of an event that is extremely rare, highly abnormal and very unlikely to occur.

- For the purpose of this Standard, reasonable and supportable information is that which is reasonably available at the reporting date without undue cost or effort, including information about past events, current conditions and forecasts of future economic conditions. Information that is available for financial reporting purposes is considered to be available without undue cost or effort.

- Adjusting the hedge ratio by increasing the volume of the hedging instrument does not affect how the changes in the value of the hedged item are measured. The measurement of the changes in the fair value of the hedging instrument related to the previously designated volume also remains unaffected. However, from the date of rebalancing, the changes in the fair value of the hedging instrument also include the changes in the value of the additional volume of the hedging instrument. The changes are measured starting from, and by reference to, the date of rebalancing instead of the date on which the hedging relationship was designated. For example, if an entity originally hedged the price risk of a commodity using a derivative volume of 100 tonnes as the hedging instrument and added a volume of 10 tonnes on rebalancing, the hedging instrument after rebalancing would comprise a total derivative volume of 110 tonnes. The change in the fair value of the hedging instrument is the total change in the fair value of the derivatives that make up the total volume of 110 tonnes. These derivatives could (and probably would) have different critical terms, such as their forward rates, because they were entered into at different points in time (including the possibility of designating derivatives into hedging relationships after their initial recognition).

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

Lion One Metals Limited is assigned short-term Ba1 & long-term Ba1 estimated rating. Lion One Metals Limited prediction model is evaluated with Inductive Learning (ML) and Multiple Regression1,2,3,4 and it is concluded that the LIO:TSXV stock is predictable in the short/long term. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

LIO:TSXV Lion One Metals Limited Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | B1 | Caa2 |

| Balance Sheet | Ba3 | B1 |

| Leverage Ratios | B3 | Baa2 |

| Cash Flow | B3 | Baa2 |

| Rates of Return and Profitability | Caa2 | C |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Akgiray, V. (1989), "Conditional heteroscedasticity in time series of stock returns: Evidence and forecasts," Journal of Business, 62, 55–80.

- Andrews, D. W. K. (1993), "Tests for parameter instability and structural change with unknown change point," Econometrica, 61, 821–856.

- M. Ono, M. Pavone, Y. Kuwata, and J. Balaram. Chance-constrained dynamic programming with application to risk-aware robotic space exploration. Autonomous Robots, 39(4):555–571, 2015

- uyer, S. Whiteson, B. Bakker, and N. A. Vlassis. Multiagent reinforcement learning for urban traffic control using coordination graphs. In Machine Learning and Knowledge Discovery in Databases, European Conference, ECML/PKDD 2008, Antwerp, Belgium, September 15-19, 2008, Proceedings, Part I, pages 656–671, 2008.

- Hastie T, Tibshirani R, Tibshirani RJ. 2017. Extended comparisons of best subset selection, forward stepwise selection, and the lasso. arXiv:1707.08692 [stat.ME]

- M. Ono, M. Pavone, Y. Kuwata, and J. Balaram. Chance-constrained dynamic programming with application to risk-aware robotic space exploration. Autonomous Robots, 39(4):555–571, 2015

- Hastie T, Tibshirani R, Wainwright M. 2015. Statistical Learning with Sparsity: The Lasso and Generalizations. New York: CRC Press

Frequently Asked Questions

Q: What is the prediction methodology for LIO:TSXV stock?A: LIO:TSXV stock prediction methodology: We evaluate the prediction models Inductive Learning (ML) and Multiple Regression

Q: Is LIO:TSXV stock a buy or sell?

A: The dominant strategy among neural network is to Hold LIO:TSXV Stock.

Q: Is Lion One Metals Limited stock a good investment?

A: The consensus rating for Lion One Metals Limited is Hold and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of LIO:TSXV stock?

A: The consensus rating for LIO:TSXV is Hold.

Q: What is the prediction period for LIO:TSXV stock?

A: The prediction period for LIO:TSXV is 8 Weeks