Dominant Strategy : Sell

Time series to forecast n: 21 Jun 2023 for 8 Weeks

Methodology : Modular Neural Network (DNN Layer)

Summary

HANSARD GLOBAL PLC prediction model is evaluated with Modular Neural Network (DNN Layer) and Independent T-Test1,2,3,4 and it is concluded that the LON:HSD stock is predictable in the short/long term. In a modular neural network (MNN), a DNN layer is a type of module that is used to learn complex relationships between input and output data. DNN layers are made up of a series of artificial neurons, which are connected to each other by weighted edges. The weights of the edges are adjusted during training to minimize the error between the network's predictions and the desired output. DNN layers are used in a variety of MNN applications, including natural language processing, speech recognition, and machine translation. In natural language processing, DNN layers are used to extract features from text data, such as the sentiment of a sentence or the topic of a conversation. In speech recognition, DNN layers are used to convert audio data into text data. In machine translation, DNN layers are used to translate text from one language to another. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Sell

Key Points

- Dominated Move

- Stock Forecast Based On a Predictive Algorithm

- Should I buy stocks now or wait amid such uncertainty?

LON:HSD Target Price Prediction Modeling Methodology

We consider HANSARD GLOBAL PLC Decision Process with Modular Neural Network (DNN Layer) where A is the set of discrete actions of LON:HSD stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Independent T-Test)5,6,7= X R(Modular Neural Network (DNN Layer)) X S(n):→ 8 Weeks

n:Time series to forecast

p:Price signals of LON:HSD stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (DNN Layer)

In a modular neural network (MNN), a DNN layer is a type of module that is used to learn complex relationships between input and output data. DNN layers are made up of a series of artificial neurons, which are connected to each other by weighted edges. The weights of the edges are adjusted during training to minimize the error between the network's predictions and the desired output. DNN layers are used in a variety of MNN applications, including natural language processing, speech recognition, and machine translation. In natural language processing, DNN layers are used to extract features from text data, such as the sentiment of a sentence or the topic of a conversation. In speech recognition, DNN layers are used to convert audio data into text data. In machine translation, DNN layers are used to translate text from one language to another.Independent T-Test

An independent t-test is a statistical test that compares the means of two independent samples. In an independent t-test, the data points in each sample are not related to each other. The independent t-test is a parametric test, which means that it assumes that the data is normally distributed. The independent t-test is also a two-sample test, which means that it compares the means of two independent samples.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

LON:HSD Stock Forecast (Buy or Sell) for 8 Weeks

Sample Set: Neural NetworkStock/Index: LON:HSD HANSARD GLOBAL PLC

Time series to forecast n: 21 Jun 2023 for 8 Weeks

According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Sell

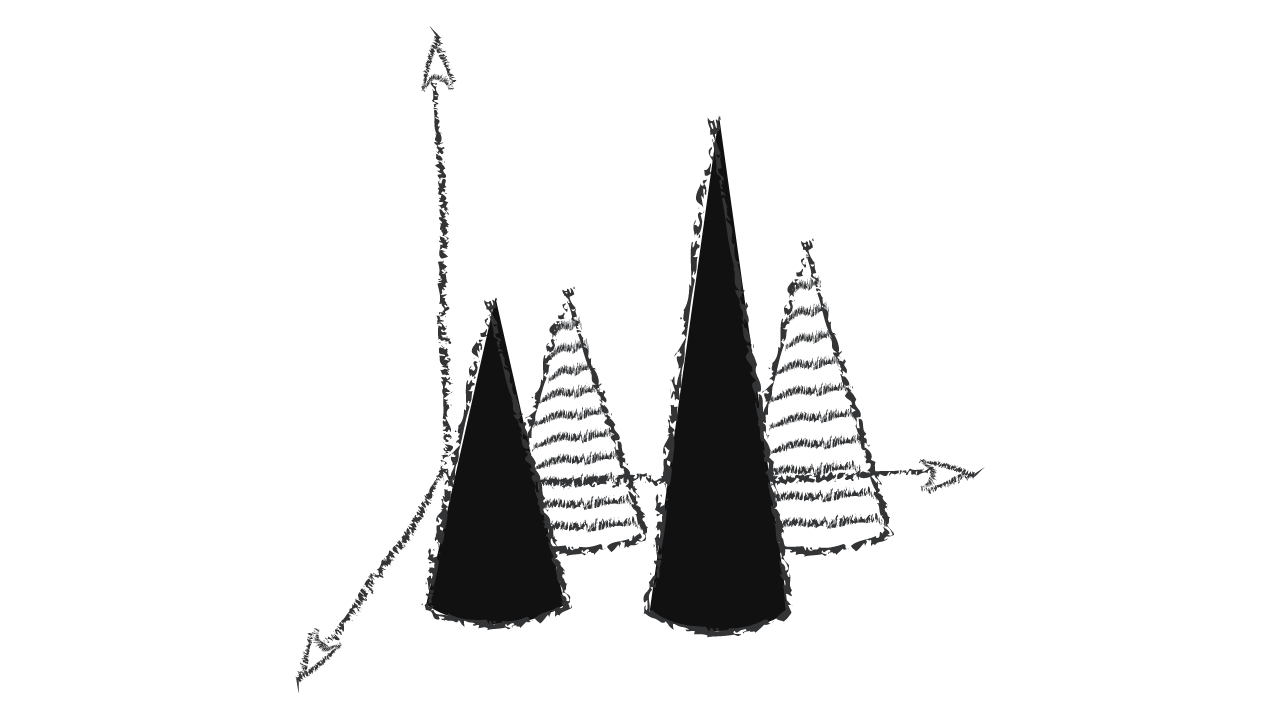

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for HANSARD GLOBAL PLC

- If changes are made in addition to those changes required by interest rate benchmark reform to the financial asset or financial liability designated in a hedging relationship (as described in paragraphs 5.4.6–5.4.8) or to the designation of the hedging relationship (as required by paragraph 6.9.1), an entity shall first apply the applicable requirements in this Standard to determine if those additional changes result in the discontinuation of hedge accounting. If the additional changes do not result in the discontinuation of hedge accounting, an entity shall amend the formal designation of the hedging relationship as specified in paragraph 6.9.1.

- When determining whether the recognition of lifetime expected credit losses is required, an entity shall consider reasonable and supportable information that is available without undue cost or effort and that may affect the credit risk on a financial instrument in accordance with paragraph 5.5.17(c). An entity need not undertake an exhaustive search for information when determining whether credit risk has increased significantly since initial recognition.

- When assessing a modified time value of money element, an entity must consider factors that could affect future contractual cash flows. For example, if an entity is assessing a bond with a five-year term and the variable interest rate is reset every six months to a five-year rate, the entity cannot conclude that the contractual cash flows are solely payments of principal and interest on the principal amount outstanding simply because the interest rate curve at the time of the assessment is such that the difference between a five-year interest rate and a six-month interest rate is not significant. Instead, the entity must also consider whether the relationship between the five-year interest rate and the six-month interest rate could change over the life of the instrument such that the contractual (undiscounted) cash flows over the life of the instrument could be significantly different from the (undiscounted) benchmark cash flows. However, an entity must consider only reasonably possible scenarios instead of every possible scenario. If an entity concludes that the contractual (undiscounted) cash flows could be significantly different from the (undiscounted) benchmark cash flows, the financial asset does not meet the condition in paragraphs 4.1.2(b) and 4.1.2A(b) and therefore cannot be measured at amortised cost or fair value through other comprehensive income.

- An entity must look through until it can identify the underlying pool of instruments that are creating (instead of passing through) the cash flows. This is the underlying pool of financial instruments.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

HANSARD GLOBAL PLC is assigned short-term Ba3 & long-term Ba3 estimated rating. HANSARD GLOBAL PLC prediction model is evaluated with Modular Neural Network (DNN Layer) and Independent T-Test1,2,3,4 and it is concluded that the LON:HSD stock is predictable in the short/long term. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Sell

LON:HSD HANSARD GLOBAL PLC Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | Ba3 |

| Income Statement | C | C |

| Balance Sheet | Ba1 | Baa2 |

| Leverage Ratios | B1 | Baa2 |

| Cash Flow | Baa2 | Baa2 |

| Rates of Return and Profitability | Baa2 | B2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Abadie A, Diamond A, Hainmueller J. 2015. Comparative politics and the synthetic control method. Am. J. Political Sci. 59:495–510

- L. Panait and S. Luke. Cooperative multi-agent learning: The state of the art. Autonomous Agents and Multi-Agent Systems, 11(3):387–434, 2005.

- Abadie A, Diamond A, Hainmueller J. 2010. Synthetic control methods for comparative case studies: estimat- ing the effect of California's tobacco control program. J. Am. Stat. Assoc. 105:493–505

- Bottomley, P. R. Fildes (1998), "The role of prices in models of innovation diffusion," Journal of Forecasting, 17, 539–555.

- F. A. Oliehoek, M. T. J. Spaan, and N. A. Vlassis. Optimal and approximate q-value functions for decentralized pomdps. J. Artif. Intell. Res. (JAIR), 32:289–353, 2008

- S. Bhatnagar, H. Prasad, and L. Prashanth. Stochastic recursive algorithms for optimization, volume 434. Springer, 2013

- Çetinkaya, A., Zhang, Y.Z., Hao, Y.M. and Ma, X.Y., GXO Options & Futures Prediction. AC Investment Research Journal, 101(3).

Frequently Asked Questions

Q: What is the prediction methodology for LON:HSD stock?A: LON:HSD stock prediction methodology: We evaluate the prediction models Modular Neural Network (DNN Layer) and Independent T-Test

Q: Is LON:HSD stock a buy or sell?

A: The dominant strategy among neural network is to Sell LON:HSD Stock.

Q: Is HANSARD GLOBAL PLC stock a good investment?

A: The consensus rating for HANSARD GLOBAL PLC is Sell and is assigned short-term Ba3 & long-term Ba3 estimated rating.

Q: What is the consensus rating of LON:HSD stock?

A: The consensus rating for LON:HSD is Sell.

Q: What is the prediction period for LON:HSD stock?

A: The prediction period for LON:HSD is 8 Weeks