Dominant Strategy : Buy

Time series to forecast n: 12 Jun 2023 for 4 Weeks

Methodology : Supervised Machine Learning (ML)

Abstract

LivePerson Inc. Common Stock prediction model is evaluated with Supervised Machine Learning (ML) and Paired T-Test1,2,3,4 and it is concluded that the LPSN stock is predictable in the short/long term. Supervised machine learning (ML) is a type of machine learning where a model is trained on labeled data. This means that the data has been tagged with the correct output for the input data. The model learns to predict the output for new input data based on the labeled data. Supervised ML is a powerful tool that can be used for a variety of tasks, including classification, regression, and forecasting. Classification tasks involve predicting the category of an input data, such as whether an email is spam or not. Regression tasks involve predicting a numerical value for an input data, such as the price of a house. Forecasting tasks involve predicting future values for a time series, such as the sales of a product. According to price forecasts for 4 Weeks period, the dominant strategy among neural network is: Buy

Key Points

- How useful are statistical predictions?

- What are main components of Markov decision process?

- What are the most successful trading algorithms?

LPSN Target Price Prediction Modeling Methodology

We consider LivePerson Inc. Common Stock Decision Process with Supervised Machine Learning (ML) where A is the set of discrete actions of LPSN stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Paired T-Test)5,6,7= X R(Supervised Machine Learning (ML)) X S(n):→ 4 Weeks

n:Time series to forecast

p:Price signals of LPSN stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Supervised Machine Learning (ML)

Supervised machine learning (ML) is a type of machine learning where a model is trained on labeled data. This means that the data has been tagged with the correct output for the input data. The model learns to predict the output for new input data based on the labeled data. Supervised ML is a powerful tool that can be used for a variety of tasks, including classification, regression, and forecasting. Classification tasks involve predicting the category of an input data, such as whether an email is spam or not. Regression tasks involve predicting a numerical value for an input data, such as the price of a house. Forecasting tasks involve predicting future values for a time series, such as the sales of a product.Paired T-Test

A paired t-test is a statistical test that compares the means of two paired samples. In a paired t-test, each data point in one sample is paired with a data point in the other sample. The pairs are typically related in some way, such as before and after measurements, or measurements from the same subject under different conditions. The paired t-test is a parametric test, which means that it assumes that the data is normally distributed. The paired t-test is also a dependent samples test, which means that the data points in each pair are correlated.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

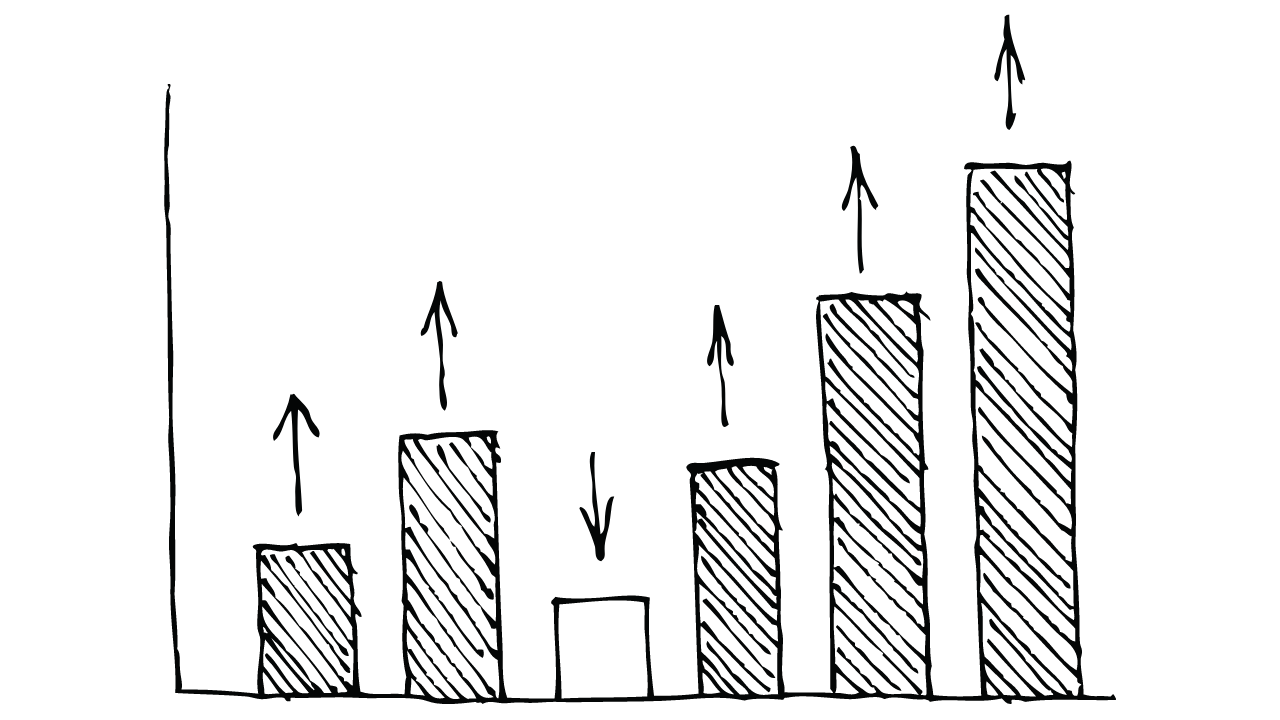

LPSN Stock Forecast (Buy or Sell) for 4 Weeks

Sample Set: Neural NetworkStock/Index: LPSN LivePerson Inc. Common Stock

Time series to forecast n: 12 Jun 2023 for 4 Weeks

According to price forecasts for 4 Weeks period, the dominant strategy among neural network is: Buy

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for LivePerson Inc. Common Stock

- When defining default for the purposes of determining the risk of a default occurring, an entity shall apply a default definition that is consistent with the definition used for internal credit risk management purposes for the relevant financial instrument and consider qualitative indicators (for example, financial covenants) when appropriate. However, there is a rebuttable presumption that default does not occur later than when a financial asset is 90 days past due unless an entity has reasonable and supportable information to demonstrate that a more lagging default criterion is more appropriate. The definition of default used for these purposes shall be applied consistently to all financial instruments unless information becomes available that demonstrates that another default definition is more appropriate for a particular financial instrument.

- An entity's documentation of the hedging relationship includes how it will assess the hedge effectiveness requirements, including the method or methods used. The documentation of the hedging relationship shall be updated for any changes to the methods (see paragraph B6.4.17).

- For the purposes of applying the requirement in paragraph 5.7.7(a), credit risk is different from asset-specific performance risk. Asset-specific performance risk is not related to the risk that an entity will fail to discharge a particular obligation but instead it is related to the risk that a single asset or a group of assets will perform poorly (or not at all).

- For hedges other than hedges of foreign currency risk, when an entity designates a non-derivative financial asset or a non-derivative financial liability measured at fair value through profit or loss as a hedging instrument, it may only designate the non-derivative financial instrument in its entirety or a proportion of it.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

LivePerson Inc. Common Stock is assigned short-term Ba1 & long-term Ba1 estimated rating. LivePerson Inc. Common Stock prediction model is evaluated with Supervised Machine Learning (ML) and Paired T-Test1,2,3,4 and it is concluded that the LPSN stock is predictable in the short/long term. According to price forecasts for 4 Weeks period, the dominant strategy among neural network is: Buy

LPSN LivePerson Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | C | C |

| Balance Sheet | B1 | Baa2 |

| Leverage Ratios | B2 | B1 |

| Cash Flow | Baa2 | Baa2 |

| Rates of Return and Profitability | Baa2 | B2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Zubizarreta JR. 2015. Stable weights that balance covariates for estimation with incomplete outcome data. J. Am. Stat. Assoc. 110:910–22

- V. Borkar. Q-learning for risk-sensitive control. Mathematics of Operations Research, 27:294–311, 2002.

- D. Bertsekas. Nonlinear programming. Athena Scientific, 1999.

- E. van der Pol and F. A. Oliehoek. Coordinated deep reinforcement learners for traffic light control. NIPS Workshop on Learning, Inference and Control of Multi-Agent Systems, 2016.

- Vilnis L, McCallum A. 2015. Word representations via Gaussian embedding. arXiv:1412.6623 [cs.CL]

- Vilnis L, McCallum A. 2015. Word representations via Gaussian embedding. arXiv:1412.6623 [cs.CL]

- Zeileis A, Hothorn T, Hornik K. 2008. Model-based recursive partitioning. J. Comput. Graph. Stat. 17:492–514 Zhou Z, Athey S, Wager S. 2018. Offline multi-action policy learning: generalization and optimization. arXiv:1810.04778 [stat.ML]

Frequently Asked Questions

Q: What is the prediction methodology for LPSN stock?A: LPSN stock prediction methodology: We evaluate the prediction models Supervised Machine Learning (ML) and Paired T-Test

Q: Is LPSN stock a buy or sell?

A: The dominant strategy among neural network is to Buy LPSN Stock.

Q: Is LivePerson Inc. Common Stock stock a good investment?

A: The consensus rating for LivePerson Inc. Common Stock is Buy and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of LPSN stock?

A: The consensus rating for LPSN is Buy.

Q: What is the prediction period for LPSN stock?

A: The prediction period for LPSN is 4 Weeks