Dominant Strategy : Sell

Time series to forecast n: 12 Jun 2023 for 3 Month

Methodology : Ensemble Learning (ML)

Abstract

NiSource Inc Series A Corporate Units prediction model is evaluated with Ensemble Learning (ML) and Paired T-Test1,2,3,4 and it is concluded that the NIMC stock is predictable in the short/long term. Ensemble learning is a machine learning (ML) technique that combines multiple models to create a single model that is more accurate than any of the individual models. This is done by combining the predictions of the individual models, typically using a voting scheme or a weighted average. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

Key Points

- What is a prediction confidence?

- Why do we need predictive models?

- What is prediction model?

NIMC Target Price Prediction Modeling Methodology

We consider NiSource Inc Series A Corporate Units Decision Process with Ensemble Learning (ML) where A is the set of discrete actions of NIMC stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Paired T-Test)5,6,7= X R(Ensemble Learning (ML)) X S(n):→ 3 Month

n:Time series to forecast

p:Price signals of NIMC stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Ensemble Learning (ML)

Ensemble learning is a machine learning (ML) technique that combines multiple models to create a single model that is more accurate than any of the individual models. This is done by combining the predictions of the individual models, typically using a voting scheme or a weighted average.Paired T-Test

A paired t-test is a statistical test that compares the means of two paired samples. In a paired t-test, each data point in one sample is paired with a data point in the other sample. The pairs are typically related in some way, such as before and after measurements, or measurements from the same subject under different conditions. The paired t-test is a parametric test, which means that it assumes that the data is normally distributed. The paired t-test is also a dependent samples test, which means that the data points in each pair are correlated.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

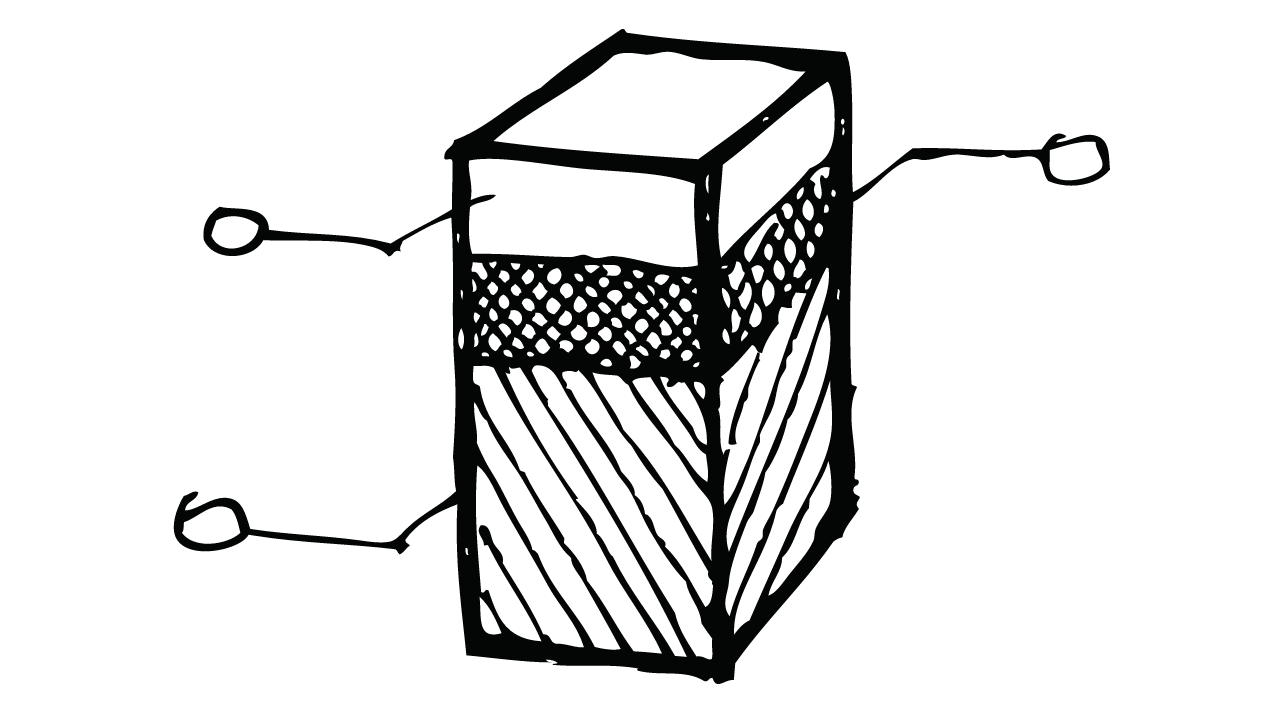

NIMC Stock Forecast (Buy or Sell) for 3 Month

Sample Set: Neural NetworkStock/Index: NIMC NiSource Inc Series A Corporate Units

Time series to forecast n: 12 Jun 2023 for 3 Month

According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for NiSource Inc Series A Corporate Units

- The underlying pool must contain one or more instruments that have contractual cash flows that are solely payments of principal and interest on the principal amount outstanding

- Paragraph 6.3.6 states that in consolidated financial statements the foreign currency risk of a highly probable forecast intragroup transaction may qualify as a hedged item in a cash flow hedge, provided that the transaction is denominated in a currency other than the functional currency of the entity entering into that transaction and that the foreign currency risk will affect consolidated profit or loss. For this purpose an entity can be a parent, subsidiary, associate, joint arrangement or branch. If the foreign currency risk of a forecast intragroup transaction does not affect consolidated profit or loss, the intragroup transaction cannot qualify as a hedged item. This is usually the case for royalty payments, interest payments or management charges between members of the same group, unless there is a related external transaction. However, when the foreign currency risk of a forecast intragroup transaction will affect consolidated profit or loss, the intragroup transaction can qualify as a hedged item. An example is forecast sales or purchases of inventories between members of the same group if there is an onward sale of the inventory to a party external to the group. Similarly, a forecast intragroup sale of plant and equipment from the group entity that manufactured it to a group entity that will use the plant and equipment in its operations may affect consolidated profit or loss. This could occur, for example, because the plant and equipment will be depreciated by the purchasing entity and the amount initially recognised for the plant and equipment may change if the forecast intragroup transaction is denominated in a currency other than the functional currency of the purchasing entity.

- If an entity previously accounted at cost (in accordance with IAS 39), for an investment in an equity instrument that does not have a quoted price in an active market for an identical instrument (ie a Level 1 input) (or for a derivative asset that is linked to and must be settled by delivery of such an equity instrument) it shall measure that instrument at fair value at the date of initial application. Any difference between the previous carrying amount and the fair value shall be recognised in the opening retained earnings (or other component of equity, as appropriate) of the reporting period that includes the date of initial application.

- In applying the effective interest method, an entity identifies fees that are an integral part of the effective interest rate of a financial instrument. The description of fees for financial services may not be indicative of the nature and substance of the services provided. Fees that are an integral part of the effective interest rate of a financial instrument are treated as an adjustment to the effective interest rate, unless the financial instrument is measured at fair value, with the change in fair value being recognised in profit or loss. In those cases, the fees are recognised as revenue or expense when the instrument is initially recognised.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

NiSource Inc Series A Corporate Units is assigned short-term Ba1 & long-term Ba1 estimated rating. NiSource Inc Series A Corporate Units prediction model is evaluated with Ensemble Learning (ML) and Paired T-Test1,2,3,4 and it is concluded that the NIMC stock is predictable in the short/long term. According to price forecasts for 3 Month period, the dominant strategy among neural network is: Sell

NIMC NiSource Inc Series A Corporate Units Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | C | Baa2 |

| Balance Sheet | C | B2 |

| Leverage Ratios | Caa2 | Caa2 |

| Cash Flow | C | B3 |

| Rates of Return and Profitability | C | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Çetinkaya, A., Zhang, Y.Z., Hao, Y.M. and Ma, X.Y., What are buy sell or hold recommendations?(AIRC Stock Forecast). AC Investment Research Journal, 101(3).

- Arjovsky M, Bottou L. 2017. Towards principled methods for training generative adversarial networks. arXiv:1701.04862 [stat.ML]

- Hastie T, Tibshirani R, Tibshirani RJ. 2017. Extended comparisons of best subset selection, forward stepwise selection, and the lasso. arXiv:1707.08692 [stat.ME]

- Chernozhukov V, Demirer M, Duflo E, Fernandez-Val I. 2018b. Generic machine learning inference on heteroge- nous treatment effects in randomized experiments. NBER Work. Pap. 24678

- M. Colby, T. Duchow-Pressley, J. J. Chung, and K. Tumer. Local approximation of difference evaluation functions. In Proceedings of the Fifteenth International Joint Conference on Autonomous Agents and Multiagent Systems, Singapore, May 2016

- Alexander, J. C. Jr. (1995), "Refining the degree of earnings surprise: A comparison of statistical and analysts' forecasts," Financial Review, 30, 469–506.

- D. S. Bernstein, S. Zilberstein, and N. Immerman. The complexity of decentralized control of Markov Decision Processes. In UAI '00: Proceedings of the 16th Conference in Uncertainty in Artificial Intelligence, Stanford University, Stanford, California, USA, June 30 - July 3, 2000, pages 32–37, 2000.

Frequently Asked Questions

Q: What is the prediction methodology for NIMC stock?A: NIMC stock prediction methodology: We evaluate the prediction models Ensemble Learning (ML) and Paired T-Test

Q: Is NIMC stock a buy or sell?

A: The dominant strategy among neural network is to Sell NIMC Stock.

Q: Is NiSource Inc Series A Corporate Units stock a good investment?

A: The consensus rating for NiSource Inc Series A Corporate Units is Sell and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of NIMC stock?

A: The consensus rating for NIMC is Sell.

Q: What is the prediction period for NIMC stock?

A: The prediction period for NIMC is 3 Month