Dominant Strategy : Speculative Trend

Time series to forecast n: 09 Jun 2023 for 16 Weeks

Methodology : Transfer Learning (ML)

Abstract

Hyzon Motors Inc. Class A Common Stock prediction model is evaluated with Transfer Learning (ML) and Pearson Correlation1,2,3,4 and it is concluded that the HYZN stock is predictable in the short/long term. Transfer learning is a machine learning (ML) method where a model developed for one task is reused as the starting point for a model on a second task. This can be useful when the second task is similar to the first task, or when there is limited data available for the second task. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Speculative Trend

Key Points

- Operational Risk

- Is it better to buy and sell or hold?

- Investment Risk

HYZN Target Price Prediction Modeling Methodology

We consider Hyzon Motors Inc. Class A Common Stock Decision Process with Transfer Learning (ML) where A is the set of discrete actions of HYZN stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Pearson Correlation)5,6,7= X R(Transfer Learning (ML)) X S(n):→ 16 Weeks

n:Time series to forecast

p:Price signals of HYZN stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Transfer Learning (ML)

Transfer learning is a machine learning (ML) method where a model developed for one task is reused as the starting point for a model on a second task. This can be useful when the second task is similar to the first task, or when there is limited data available for the second task.Pearson Correlation

Pearson correlation, also known as Pearson's product-moment correlation, is a measure of the linear relationship between two variables. It is a statistical measure that assesses the strength and direction of a linear relationship between two variables. The sign of the correlation coefficient indicates the direction of the relationship, while the magnitude of the correlation coefficient indicates the strength of the relationship. A correlation coefficient of 0.9 indicates a strong positive correlation, while a correlation coefficient of 0.2 indicates a weak positive correlation.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

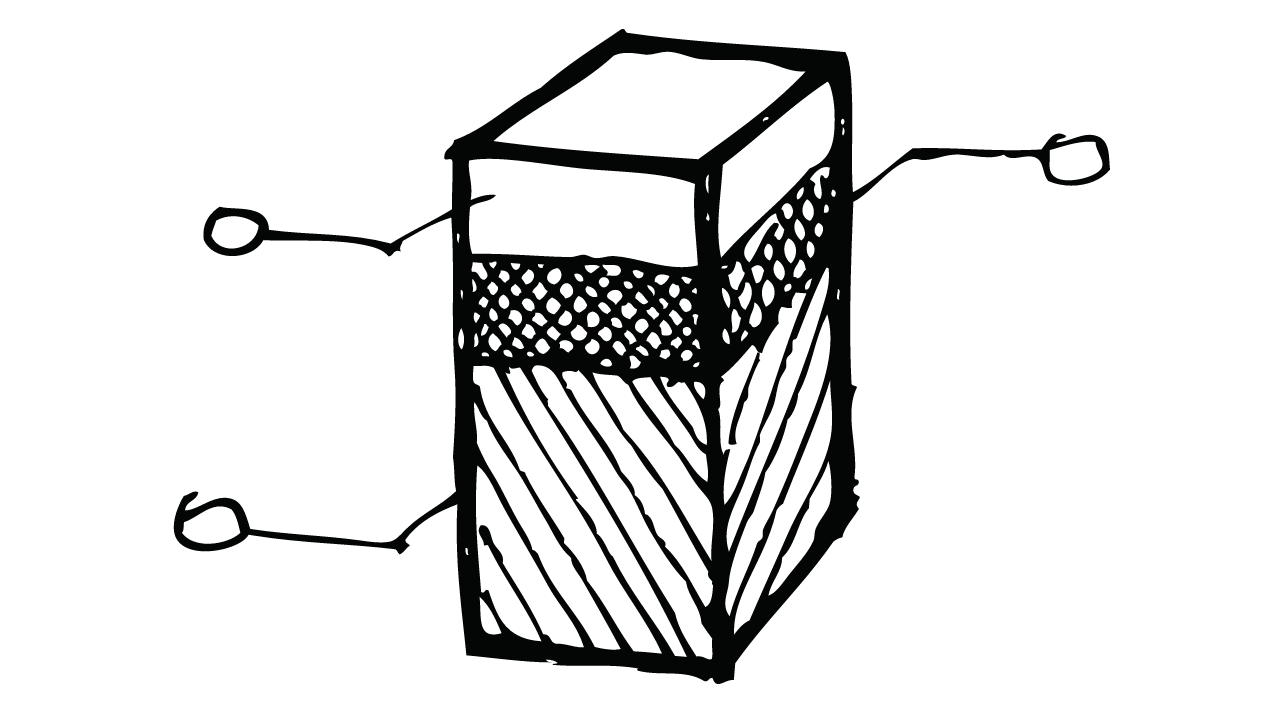

HYZN Stock Forecast (Buy or Sell) for 16 Weeks

Sample Set: Neural NetworkStock/Index: HYZN Hyzon Motors Inc. Class A Common Stock

Time series to forecast n: 09 Jun 2023 for 16 Weeks

According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Speculative Trend

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for Hyzon Motors Inc. Class A Common Stock

- In cases such as those described in the preceding paragraph, to designate, at initial recognition, the financial assets and financial liabilities not otherwise so measured as at fair value through profit or loss may eliminate or significantly reduce the measurement or recognition inconsistency and produce more relevant information. For practical purposes, the entity need not enter into all of the assets and liabilities giving rise to the measurement or recognition inconsistency at exactly the same time. A reasonable delay is permitted provided that each transaction is designated as at fair value through profit or loss at its initial recognition and, at that time, any remaining transactions are expected to occur.

- An entity may use practical expedients when measuring expected credit losses if they are consistent with the principles in paragraph 5.5.17. An example of a practical expedient is the calculation of the expected credit losses on trade receivables using a provision matrix. The entity would use its historical credit loss experience (adjusted as appropriate in accordance with paragraphs B5.5.51–B5.5.52) for trade receivables to estimate the 12-month expected credit losses or the lifetime expected credit losses on the financial assets as relevant. A provision matrix might, for example, specify fixed provision rates depending on the number of days that a trade receivable is past due (for example, 1 per cent if not past due, 2 per cent if less than 30 days past due, 3 per cent if more than 30 days but less than 90 days past due, 20 per cent if 90–180 days past due etc). Depending on the diversity of its customer base, the entity would use appropriate groupings if its historical credit loss experience shows significantly different loss patterns for different customer segments. Examples of criteria that might be used to group assets include geographical region, product type, customer rating, collateral or trade credit insurance and type of customer (such as wholesale or retail)

- If an entity measures a hybrid contract at fair value in accordance with paragraphs 4.1.2A, 4.1.4 or 4.1.5 but the fair value of the hybrid contract had not been measured in comparative reporting periods, the fair value of the hybrid contract in the comparative reporting periods shall be the sum of the fair values of the components (ie the non-derivative host and the embedded derivative) at the end of each comparative reporting period if the entity restates prior periods (see paragraph 7.2.15).

- Expected credit losses shall be discounted to the reporting date, not to the expected default or some other date, using the effective interest rate determined at initial recognition or an approximation thereof. If a financial instrument has a variable interest rate, expected credit losses shall be discounted using the current effective interest rate determined in accordance with paragraph B5.4.5.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

Hyzon Motors Inc. Class A Common Stock is assigned short-term Ba1 & long-term Ba1 estimated rating. Hyzon Motors Inc. Class A Common Stock prediction model is evaluated with Transfer Learning (ML) and Pearson Correlation1,2,3,4 and it is concluded that the HYZN stock is predictable in the short/long term. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Speculative Trend

HYZN Hyzon Motors Inc. Class A Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | Baa2 | Baa2 |

| Balance Sheet | Ba1 | Caa2 |

| Leverage Ratios | Baa2 | Baa2 |

| Cash Flow | B3 | C |

| Rates of Return and Profitability | Ba2 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Mikolov T, Chen K, Corrado GS, Dean J. 2013a. Efficient estimation of word representations in vector space. arXiv:1301.3781 [cs.CL]

- Li L, Chen S, Kleban J, Gupta A. 2014. Counterfactual estimation and optimization of click metrics for search engines: a case study. In Proceedings of the 24th International Conference on the World Wide Web, pp. 929–34. New York: ACM

- ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. How is the price of gold determined? (No. Stock Analysis). AC Investment Research.

- Hastie T, Tibshirani R, Tibshirani RJ. 2017. Extended comparisons of best subset selection, forward stepwise selection, and the lasso. arXiv:1707.08692 [stat.ME]

- J. Ott. A Markov decision model for a surveillance application and risk-sensitive Markov decision processes. PhD thesis, Karlsruhe Institute of Technology, 2010.

- B. Derfer, N. Goodyear, K. Hung, C. Matthews, G. Paoni, K. Rollins, R. Rose, M. Seaman, and J. Wiles. Online marketing platform, August 17 2007. US Patent App. 11/893,765

- Jiang N, Li L. 2016. Doubly robust off-policy value evaluation for reinforcement learning. In Proceedings of the 33rd International Conference on Machine Learning, pp. 652–61. La Jolla, CA: Int. Mach. Learn. Soc.

Frequently Asked Questions

Q: What is the prediction methodology for HYZN stock?A: HYZN stock prediction methodology: We evaluate the prediction models Transfer Learning (ML) and Pearson Correlation

Q: Is HYZN stock a buy or sell?

A: The dominant strategy among neural network is to Speculative Trend HYZN Stock.

Q: Is Hyzon Motors Inc. Class A Common Stock stock a good investment?

A: The consensus rating for Hyzon Motors Inc. Class A Common Stock is Speculative Trend and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of HYZN stock?

A: The consensus rating for HYZN is Speculative Trend.

Q: What is the prediction period for HYZN stock?

A: The prediction period for HYZN is 16 Weeks