Dominant Strategy : Sell

Time series to forecast n: 10 Jun 2023 for 1 Year

Methodology : Modular Neural Network (Social Media Sentiment Analysis)

Abstract

CUSTODIAN REIT PLC prediction model is evaluated with Modular Neural Network (Social Media Sentiment Analysis) and Polynomial Regression1,2,3,4 and it is concluded that the LON:CREI stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for social media sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of social media sentiment analysis, MNNs can be used to identify the sentiment of social media posts, such as tweets, Facebook posts, and Instagram stories. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising. According to price forecasts for 1 Year period, the dominant strategy among neural network is: Sell

Key Points

- Stock Rating

- Stock Forecast Based On a Predictive Algorithm

- Trust metric by Neural Network

LON:CREI Target Price Prediction Modeling Methodology

We consider CUSTODIAN REIT PLC Decision Process with Modular Neural Network (Social Media Sentiment Analysis) where A is the set of discrete actions of LON:CREI stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Polynomial Regression)5,6,7= X R(Modular Neural Network (Social Media Sentiment Analysis)) X S(n):→ 1 Year

n:Time series to forecast

p:Price signals of LON:CREI stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Social Media Sentiment Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for social media sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of social media sentiment analysis, MNNs can be used to identify the sentiment of social media posts, such as tweets, Facebook posts, and Instagram stories. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising.Polynomial Regression

Polynomial regression is a type of regression analysis that uses a polynomial function to model the relationship between a dependent variable and one or more independent variables. Polynomial functions are mathematical functions that have a polynomial term, which is a term that is raised to a power greater than 1. In polynomial regression, the dependent variable is modeled as a polynomial function of the independent variables. The degree of the polynomial function is determined by the researcher. The higher the degree of the polynomial function, the more complex the model will be.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

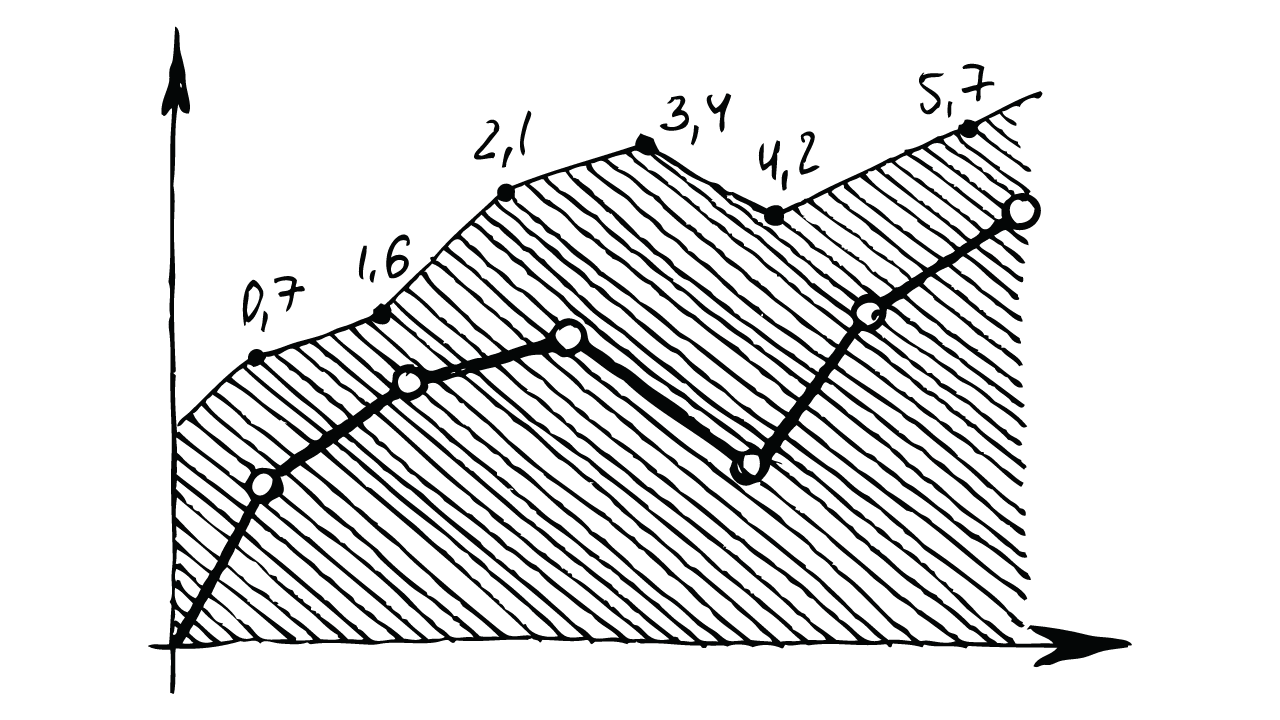

LON:CREI Stock Forecast (Buy or Sell) for 1 Year

Sample Set: Neural NetworkStock/Index: LON:CREI CUSTODIAN REIT PLC

Time series to forecast n: 10 Jun 2023 for 1 Year

According to price forecasts for 1 Year period, the dominant strategy among neural network is: Sell

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for CUSTODIAN REIT PLC

- An entity that first applies IFRS 17 as amended in June 2020 after it first applies this Standard shall apply paragraphs 7.2.39–7.2.42. The entity shall also apply the other transition requirements in this Standard necessary for applying these amendments. For that purpose, references to the date of initial application shall be read as referring to the beginning of the reporting period in which an entity first applies these amendments (date of initial application of these amendments).

- Rebalancing refers to the adjustments made to the designated quantities of the hedged item or the hedging instrument of an already existing hedging relationship for the purpose of maintaining a hedge ratio that complies with the hedge effectiveness requirements. Changes to designated quantities of a hedged item or of a hedging instrument for a different purpose do not constitute rebalancing for the purpose of this Standard

- As noted in paragraph B4.3.1, when an entity becomes a party to a hybrid contract with a host that is not an asset within the scope of this Standard and with one or more embedded derivatives, paragraph 4.3.3 requires the entity to identify any such embedded derivative, assess whether it is required to be separated from the host contract and, for those that are required to be separated, measure the derivatives at fair value at initial recognition and subsequently. These requirements can be more complex, or result in less reliable measures, than measuring the entire instrument at fair value through profit or loss. For that reason this Standard permits the entire hybrid contract to be designated as at fair value through profit or loss.

- For the purpose of recognising foreign exchange gains and losses under IAS 21, a financial asset measured at fair value through other comprehensive income in accordance with paragraph 4.1.2A is treated as a monetary item. Accordingly, such a financial asset is treated as an asset measured at amortised cost in the foreign currency. Exchange differences on the amortised cost are recognised in profit or loss and other changes in the carrying amount are recognised in accordance with paragraph 5.7.10.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

CUSTODIAN REIT PLC is assigned short-term Ba1 & long-term Ba1 estimated rating. CUSTODIAN REIT PLC prediction model is evaluated with Modular Neural Network (Social Media Sentiment Analysis) and Polynomial Regression1,2,3,4 and it is concluded that the LON:CREI stock is predictable in the short/long term. According to price forecasts for 1 Year period, the dominant strategy among neural network is: Sell

LON:CREI CUSTODIAN REIT PLC Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | Baa2 | Caa2 |

| Balance Sheet | Ba3 | Caa2 |

| Leverage Ratios | B3 | Caa2 |

| Cash Flow | Baa2 | C |

| Rates of Return and Profitability | C | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Mikolov T, Chen K, Corrado GS, Dean J. 2013a. Efficient estimation of word representations in vector space. arXiv:1301.3781 [cs.CL]

- S. Devlin, L. Yliniemi, D. Kudenko, and K. Tumer. Potential-based difference rewards for multiagent reinforcement learning. In Proceedings of the Thirteenth International Joint Conference on Autonomous Agents and Multiagent Systems, May 2014

- A. Tamar, Y. Glassner, and S. Mannor. Policy gradients beyond expectations: Conditional value-at-risk. In AAAI, 2015

- D. Bertsekas. Nonlinear programming. Athena Scientific, 1999.

- Athey S, Bayati M, Imbens G, Zhaonan Q. 2019. Ensemble methods for causal effects in panel data settings. NBER Work. Pap. 25675

- C. Szepesvári. Algorithms for Reinforcement Learning. Synthesis Lectures on Artificial Intelligence and Machine Learning. Morgan & Claypool Publishers, 2010

- K. Boda, J. Filar, Y. Lin, and L. Spanjers. Stochastic target hitting time and the problem of early retirement. Automatic Control, IEEE Transactions on, 49(3):409–419, 2004

Frequently Asked Questions

Q: What is the prediction methodology for LON:CREI stock?A: LON:CREI stock prediction methodology: We evaluate the prediction models Modular Neural Network (Social Media Sentiment Analysis) and Polynomial Regression

Q: Is LON:CREI stock a buy or sell?

A: The dominant strategy among neural network is to Sell LON:CREI Stock.

Q: Is CUSTODIAN REIT PLC stock a good investment?

A: The consensus rating for CUSTODIAN REIT PLC is Sell and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of LON:CREI stock?

A: The consensus rating for LON:CREI is Sell.

Q: What is the prediction period for LON:CREI stock?

A: The prediction period for LON:CREI is 1 Year