Dominant Strategy : Hold

Time series to forecast n: 10 Jun 2023 for 8 Weeks

Methodology : Modular Neural Network (Speculative Sentiment Analysis)

Abstract

Blue Ocean Acquisition Corp Class A Ordinary Shares prediction model is evaluated with Modular Neural Network (Speculative Sentiment Analysis) and ElasticNet Regression1,2,3,4 and it is concluded that the BOCN stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for speculative sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of speculative sentiment analysis, MNNs can be used to identify the sentiment of people who are speculating about the future value of an asset, such as a stock or a cryptocurrency. This information can then be used to make investment decisions, to identify trends in the market, and to target investors with relevant advertising. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

Key Points

- Probability Distribution

- How do you know when a stock will go up or down?

- Can neural networks predict stock market?

BOCN Target Price Prediction Modeling Methodology

We consider Blue Ocean Acquisition Corp Class A Ordinary Shares Decision Process with Modular Neural Network (Speculative Sentiment Analysis) where A is the set of discrete actions of BOCN stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(ElasticNet Regression)5,6,7= X R(Modular Neural Network (Speculative Sentiment Analysis)) X S(n):→ 8 Weeks

n:Time series to forecast

p:Price signals of BOCN stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Speculative Sentiment Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for speculative sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of speculative sentiment analysis, MNNs can be used to identify the sentiment of people who are speculating about the future value of an asset, such as a stock or a cryptocurrency. This information can then be used to make investment decisions, to identify trends in the market, and to target investors with relevant advertising.ElasticNet Regression

Elastic net regression is a type of regression analysis that combines the benefits of ridge regression and lasso regression. It is a regularized regression method that adds a penalty to the least squares objective function in order to reduce the variance of the estimates, induce sparsity in the model, and reduce overfitting. This is done by adding a term to the objective function that is proportional to the sum of the squares of the coefficients and the sum of the absolute values of the coefficients. The penalty terms are controlled by two parameters, called the ridge constant and the lasso constant. Elastic net regression can be used to address the problems of multicollinearity, overfitting, and sensitivity to outliers. It is a more flexible method than ridge regression or lasso regression, and it can often achieve better results.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

BOCN Stock Forecast (Buy or Sell) for 8 Weeks

Sample Set: Neural NetworkStock/Index: BOCN Blue Ocean Acquisition Corp Class A Ordinary Shares

Time series to forecast n: 10 Jun 2023 for 8 Weeks

According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

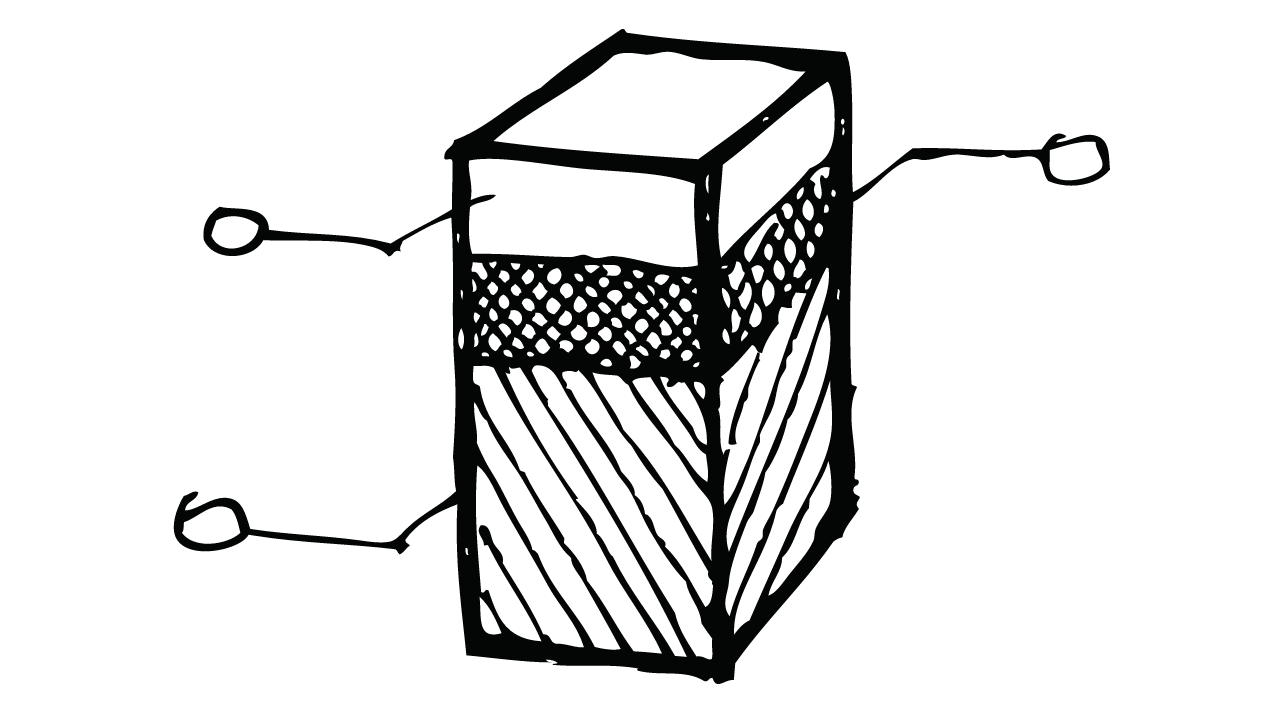

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for Blue Ocean Acquisition Corp Class A Ordinary Shares

- When rebalancing a hedging relationship, an entity shall update its analysis of the sources of hedge ineffectiveness that are expected to affect the hedging relationship during its (remaining) term (see paragraph B6.4.2). The documentation of the hedging relationship shall be updated accordingly.

- For a discontinued hedging relationship, when the interest rate benchmark on which the hedged future cash flows had been based is changed as required by interest rate benchmark reform, for the purpose of applying paragraph 6.5.12 in order to determine whether the hedged future cash flows are expected to occur, the amount accumulated in the cash flow hedge reserve for that hedging relationship shall be deemed to be based on the alternative benchmark rate on which the hedged future cash flows will be based.

- Amounts presented in other comprehensive income shall not be subsequently transferred to profit or loss. However, the entity may transfer the cumulative gain or loss within equity.

- An entity is not required to incorporate forecasts of future conditions over the entire expected life of a financial instrument. The degree of judgement that is required to estimate expected credit losses depends on the availability of detailed information. As the forecast horizon increases, the availability of detailed information decreases and the degree of judgement required to estimate expected credit losses increases. The estimate of expected credit losses does not require a detailed estimate for periods that are far in the future—for such periods, an entity may extrapolate projections from available, detailed information.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

Blue Ocean Acquisition Corp Class A Ordinary Shares is assigned short-term Ba1 & long-term Ba1 estimated rating. Blue Ocean Acquisition Corp Class A Ordinary Shares prediction model is evaluated with Modular Neural Network (Speculative Sentiment Analysis) and ElasticNet Regression1,2,3,4 and it is concluded that the BOCN stock is predictable in the short/long term. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Hold

BOCN Blue Ocean Acquisition Corp Class A Ordinary Shares Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | B2 | Caa2 |

| Balance Sheet | Baa2 | Ba3 |

| Leverage Ratios | B2 | Baa2 |

| Cash Flow | Baa2 | B1 |

| Rates of Return and Profitability | Ba3 | C |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Bai J. 2003. Inferential theory for factor models of large dimensions. Econometrica 71:135–71

- Mnih A, Kavukcuoglu K. 2013. Learning word embeddings efficiently with noise-contrastive estimation. In Advances in Neural Information Processing Systems, Vol. 26, ed. Z Ghahramani, M Welling, C Cortes, ND Lawrence, KQ Weinberger, pp. 2265–73. San Diego, CA: Neural Inf. Process. Syst. Found.

- Athey S, Tibshirani J, Wager S. 2016b. Generalized random forests. arXiv:1610.01271 [stat.ME]

- F. A. Oliehoek and C. Amato. A Concise Introduction to Decentralized POMDPs. SpringerBriefs in Intelligent Systems. Springer, 2016

- Dietterich TG. 2000. Ensemble methods in machine learning. In Multiple Classifier Systems: First International Workshop, Cagliari, Italy, June 21–23, pp. 1–15. Berlin: Springer

- Mullainathan S, Spiess J. 2017. Machine learning: an applied econometric approach. J. Econ. Perspect. 31:87–106

- Dimakopoulou M, Zhou Z, Athey S, Imbens G. 2018. Balanced linear contextual bandits. arXiv:1812.06227 [cs.LG]

Frequently Asked Questions

Q: What is the prediction methodology for BOCN stock?A: BOCN stock prediction methodology: We evaluate the prediction models Modular Neural Network (Speculative Sentiment Analysis) and ElasticNet Regression

Q: Is BOCN stock a buy or sell?

A: The dominant strategy among neural network is to Hold BOCN Stock.

Q: Is Blue Ocean Acquisition Corp Class A Ordinary Shares stock a good investment?

A: The consensus rating for Blue Ocean Acquisition Corp Class A Ordinary Shares is Hold and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of BOCN stock?

A: The consensus rating for BOCN is Hold.

Q: What is the prediction period for BOCN stock?

A: The prediction period for BOCN is 8 Weeks